Should You Be Adding BEML (NSE:BEML) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like BEML (NSE:BEML). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for BEML

BEML's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. It certainly is nice to see that BEML has managed to grow EPS by 35% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

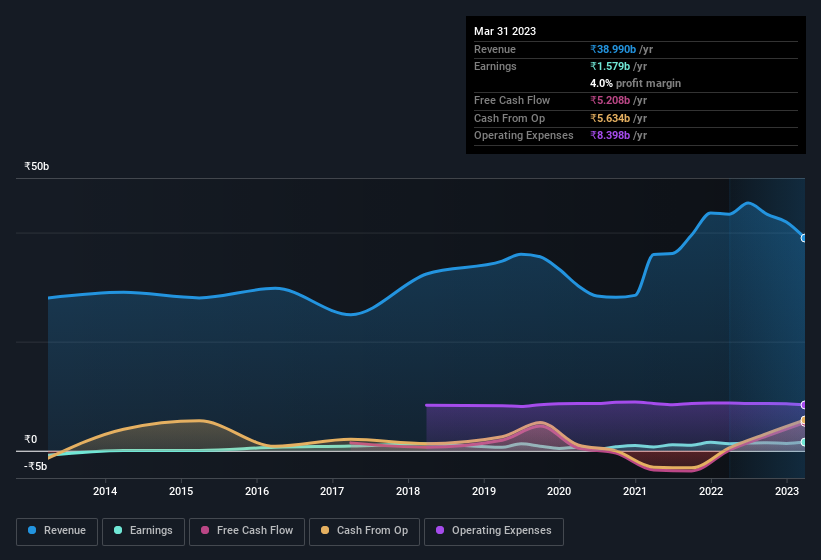

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Despite consistency in EBIT margins year on year, BEML has actually recorded a dip in revenue. Suffice it to say that is not a great sign of growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for BEML.

Are BEML Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations between ₹33b and ₹131b, like BEML, the median CEO pay is around ₹35m.

BEML's CEO only received compensation totalling ₹4.7m in the year to March 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add BEML To Your Watchlist?

You can't deny that BEML has grown its earnings per share at a very impressive rate. That's attractive. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. So this stock is well worth an addition to your watchlist as it has the potential to provide great value to shareholders. What about risks? Every company has them, and we've spotted 1 warning sign for BEML you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if BEML might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BEML

BEML

Provides products and services to the mining and construction, rail and metro, power, and defense and aerospace sectors in India.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives