Balu Forge Industries Limited (NSE:BALUFORGE) Stocks Shoot Up 29% But Its P/E Still Looks Reasonable

Despite an already strong run, Balu Forge Industries Limited (NSE:BALUFORGE) shares have been powering on, with a gain of 29% in the last thirty days. The annual gain comes to 142% following the latest surge, making investors sit up and take notice.

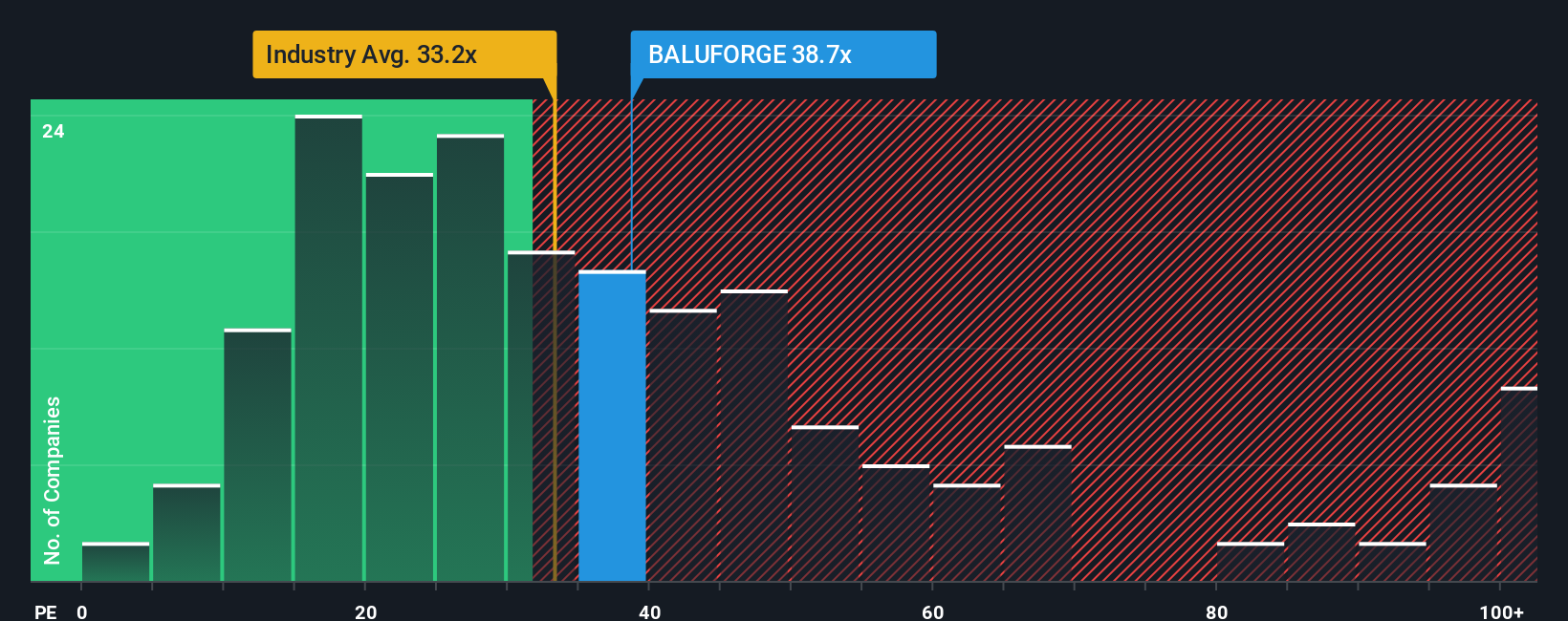

Following the firm bounce in price, Balu Forge Industries' price-to-earnings (or "P/E") ratio of 38.7x might make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 27x and even P/E's below 16x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been quite advantageous for Balu Forge Industries as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Balu Forge Industries

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Balu Forge Industries' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 96% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 346% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Balu Forge Industries is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Balu Forge Industries' P/E

The large bounce in Balu Forge Industries' shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Balu Forge Industries maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Balu Forge Industries that you should be aware of.

If you're unsure about the strength of Balu Forge Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Balu Forge Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BALUFORGE

Balu Forge Industries

Manufactures and sells crankshafts in India and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026