Market Still Lacking Some Conviction On Ashok Leyland Limited (NSE:ASHOKLEY)

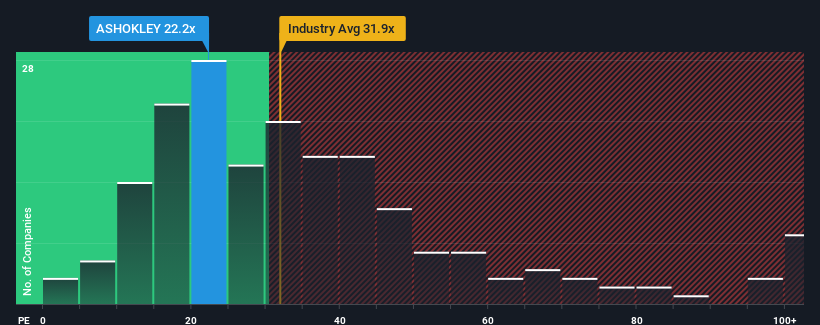

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 27x, you may consider Ashok Leyland Limited (NSE:ASHOKLEY) as an attractive investment with its 22.2x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 2 warning signs investors should be aware of before investing in Ashok Leyland. Read for free now.There hasn't been much to differentiate Ashok Leyland's and the market's earnings growth lately. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Check out our latest analysis for Ashok Leyland

How Is Ashok Leyland's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Ashok Leyland's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 19% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 16% per annum over the next three years. That's shaping up to be similar to the 18% each year growth forecast for the broader market.

With this information, we find it odd that Ashok Leyland is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Ashok Leyland's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 2 warning signs for Ashok Leyland (1 is potentially serious!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ASHOKLEY

Ashok Leyland

Engages in the manufacture and sale of commercial vehicles in India and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives