- India

- /

- Construction

- /

- NSEI:ASHOKA

I Ran A Stock Scan For Earnings Growth And Ashoka Buildcon (NSE:ASHOKA) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Ashoka Buildcon (NSE:ASHOKA). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Ashoka Buildcon

How Fast Is Ashoka Buildcon Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. You can imagine, then, that it almost knocked my socks off when I realized that Ashoka Buildcon grew its EPS from ₹0.79 to ₹9.52, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Ashoka Buildcon's EBIT margins have actually improved by 2.8 percentage points in the last year, to reach 26%, but, on the flip side, revenue was down 4.8%. That's not ideal.

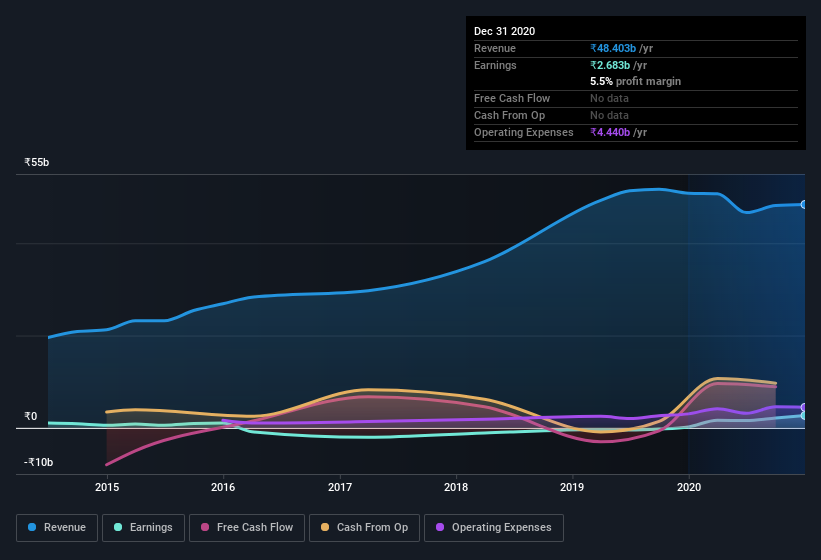

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Ashoka Buildcon EPS 100% free.

Are Ashoka Buildcon Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We do note that Ashoka Buildcon insiders netted -₹1.5m worth of shares over the last year. But the silver lining to that cloud is that Ashish Kataria, the Non-Executive & Non-Independent Director, spent ₹2.1m buying shares at an average price of ₹97.20. So, on balance, that's positive.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Ashoka Buildcon insiders own more than a third of the company. In fact, they own 53% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have ₹12b invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Ashoka Buildcon To Your Watchlist?

Ashoka Buildcon's earnings per share have taken off like a rocket aimed right at the moon. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Ashoka Buildcon belongs on the top of your watchlist. What about risks? Every company has them, and we've spotted 3 warning signs for Ashoka Buildcon (of which 2 are significant!) you should know about.

As a growth investor I do like to see insider buying. But Ashoka Buildcon isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Ashoka Buildcon, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ASHOKA

Ashoka Buildcon

Engages in the infrastructure development business in India.

Solid track record with adequate balance sheet.