Acrysil (NSE:ACRYSIL) stock performs better than its underlying earnings growth over last year

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Acrysil Limited (NSE:ACRYSIL) share price had more than doubled in just one year - up 152%. In more good news, the share price has risen 12% in thirty days. We'll need to follow Acrysil for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Check out our latest analysis for Acrysil

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

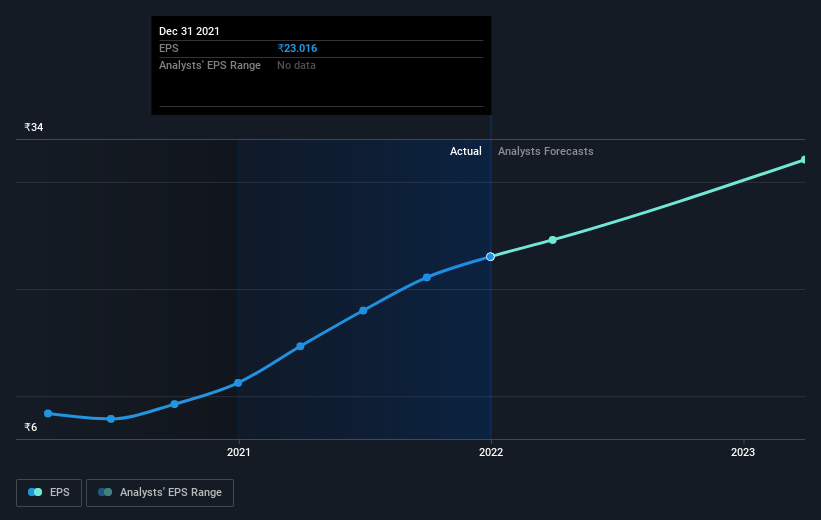

During the last year Acrysil grew its earnings per share (EPS) by 105%. The share price gain of 152% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Acrysil has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Acrysil shareholders have gained 153% over the last year, including dividends. We regret to report that the share price is down 6.8% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Acrysil that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CARYSIL

Carysil

Manufactures and trades in quartz kitchen and stainless steel kitchen sinks, bath products, tiles, kitchen appliances, and accessories in India.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026