Some Bank of Baroda (NSE:BANKBARODA) Shareholders Have Copped A Big 54% Share Price Drop

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. Zooming in on an example, the Bank of Baroda (NSE:BANKBARODA) share price dropped 54% in the last half decade. We certainly feel for shareholders who bought near the top. On top of that, the share price is down 5.3% in the last week. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

See our latest analysis for Bank of Baroda

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Bank of Baroda became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

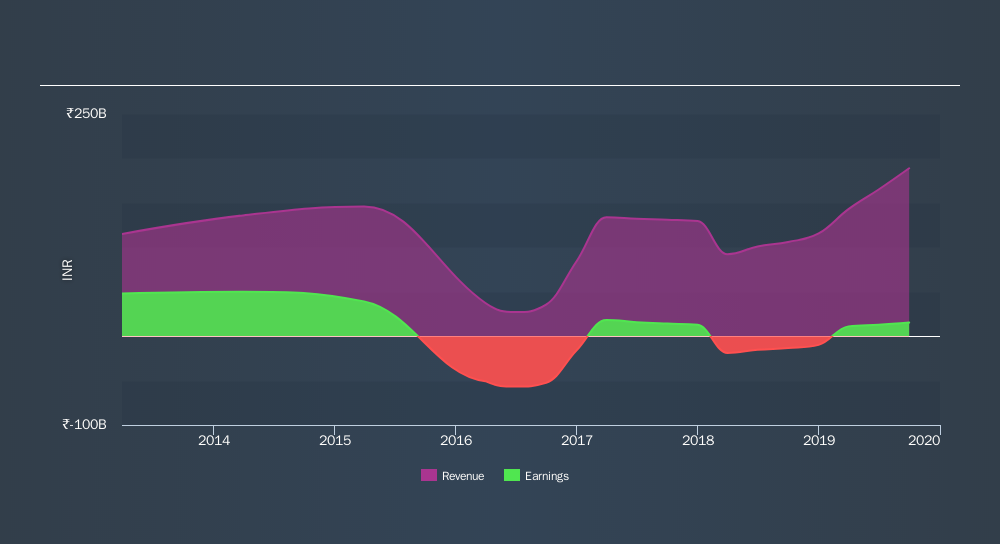

In contrast to the share price, revenue has actually increased by a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

The graphic below depicts how revenue has changed over time.

Bank of Baroda is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market gained around 7.6% in the last year, Bank of Baroda shareholders lost 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 14% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Before forming an opinion on Bank of Baroda you might want to consider these 3 valuation metrics.

But note: Bank of Baroda may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:BANKBARODA

Bank of Baroda

Provides various banking products and services to individuals, government departments, and corporate customers in India and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives