- India

- /

- Auto Components

- /

- NSEI:TIINDIA

Tube Investments of India Limited's (NSE:TIINDIA) Business Is Trailing The Industry But Its Shares Aren't

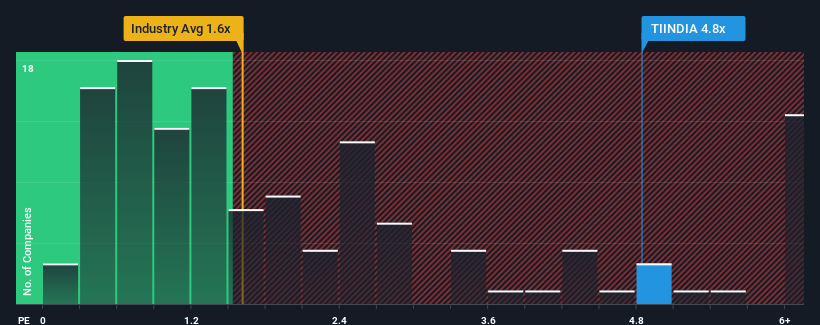

Tube Investments of India Limited's (NSE:TIINDIA) price-to-sales (or "P/S") ratio of 4.8x may look like a poor investment opportunity when you consider close to half the companies in the Auto Components industry in India have P/S ratios below 1.6x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Tube Investments of India

What Does Tube Investments of India's Recent Performance Look Like?

Tube Investments of India's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tube Investments of India.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Tube Investments of India's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. The latest three year period has also seen an excellent 180% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 12% per annum during the coming three years according to the four analysts following the company. With the industry predicted to deliver 11% growth each year, that's a disappointing outcome.

With this in mind, we find it intriguing that Tube Investments of India's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Tube Investments of India's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

For a company with revenues that are set to decline in the context of a growing industry, Tube Investments of India's P/S is much higher than we would've anticipated. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Tube Investments of India with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tube Investments of India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TIINDIA

Tube Investments of India

Engages in the manufacture and sale of precision engineered and metal formed products to automotive, railway, construction, agriculture, etc.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives