- India

- /

- Auto Components

- /

- NSEI:TIINDIA

Revenues Not Telling The Story For Tube Investments of India Limited (NSE:TIINDIA)

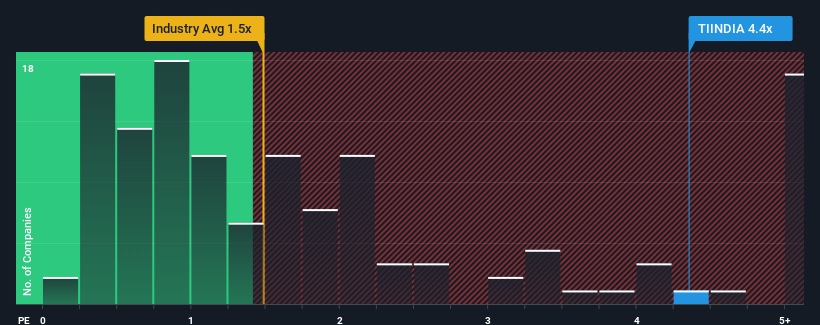

When close to half the companies in the Auto Components industry in India have price-to-sales ratios (or "P/S") below 1.5x, you may consider Tube Investments of India Limited (NSE:TIINDIA) as a stock to avoid entirely with its 4.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Tube Investments of India

How Has Tube Investments of India Performed Recently?

Tube Investments of India could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Tube Investments of India will help you uncover what's on the horizon.How Is Tube Investments of India's Revenue Growth Trending?

Tube Investments of India's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. This was backed up an excellent period prior to see revenue up by 273% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 12% per year as estimated by the four analysts watching the company. Meanwhile, the broader industry is forecast to expand by 12% each year, which paints a poor picture.

With this in mind, we find it intriguing that Tube Investments of India's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

For a company with revenues that are set to decline in the context of a growing industry, Tube Investments of India's P/S is much higher than we would've anticipated. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Tube Investments of India that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tube Investments of India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TIINDIA

Tube Investments of India

Engages in the manufacture and sale of precision engineered and metal formed products to automotive, railway, construction, agriculture, etc.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives