- India

- /

- Auto Components

- /

- NSEI:TALBROAUTO

Is Talbros Automotive Components (NSE:TALBROAUTO) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Talbros Automotive Components Limited (NSE:TALBROAUTO) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Talbros Automotive Components

What Is Talbros Automotive Components's Net Debt?

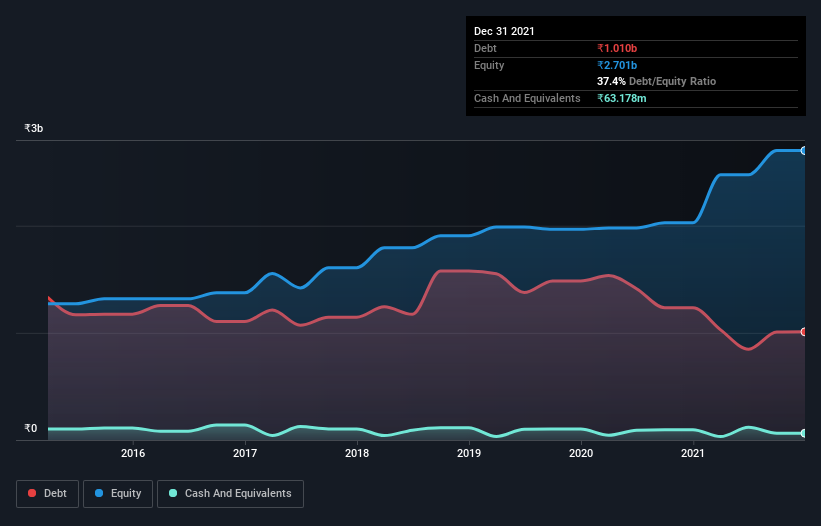

As you can see below, Talbros Automotive Components had ₹1.01b of debt at September 2021, down from ₹1.23b a year prior. However, it also had ₹63.2m in cash, and so its net debt is ₹946.6m.

A Look At Talbros Automotive Components' Liabilities

We can see from the most recent balance sheet that Talbros Automotive Components had liabilities of ₹2.53b falling due within a year, and liabilities of ₹169.2m due beyond that. On the other hand, it had cash of ₹63.2m and ₹1.53b worth of receivables due within a year. So its liabilities total ₹1.11b more than the combination of its cash and short-term receivables.

Of course, Talbros Automotive Components has a market capitalization of ₹5.95b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Looking at its net debt to EBITDA of 1.2 and interest cover of 5.1 times, it seems to us that Talbros Automotive Components is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Notably, Talbros Automotive Components's EBIT launched higher than Elon Musk, gaining a whopping 130% on last year. There's no doubt that we learn most about debt from the balance sheet. But it is Talbros Automotive Components's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Talbros Automotive Components recorded free cash flow worth a fulsome 80% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

The good news is that Talbros Automotive Components's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its EBIT growth rate is also very heartening. Zooming out, Talbros Automotive Components seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Talbros Automotive Components is showing 4 warning signs in our investment analysis , you should know about...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Talbros Automotive Components might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TALBROAUTO

Talbros Automotive Components

Engages in the manufacture and sale of auto components in India.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives