- India

- /

- Auto Components

- /

- NSEI:STERTOOLS

Keep An Eye On Sterling Tools As Insider Stock Selling Hits ₹100m

Even though Sterling Tools Limited (NSE:STERTOOLS) stock gained 11% last week, insiders who sold ₹100m worth of stock over the past year are probably better off. Selling at an average price of ₹690, which is higher than the current price, may have been the wisest decision for these insiders as their investment would have been worth less now than when they sold.

While insider transactions are not the most important thing when it comes to long-term investing, we would consider it foolish to ignore insider transactions altogether.

Our free stock report includes 1 warning sign investors should be aware of before investing in Sterling Tools. Read for free now.The Last 12 Months Of Insider Transactions At Sterling Tools

The Managing Director, Atul Aggarwal, made the biggest insider sale in the last 12 months. That single transaction was for ₹59m worth of shares at a price of ₹681 each. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. The good news is that this large sale was at well above current price of ₹317. So it may not tell us anything about how insiders feel about the current share price. The only individual insider seller over the last year was Atul Aggarwal.

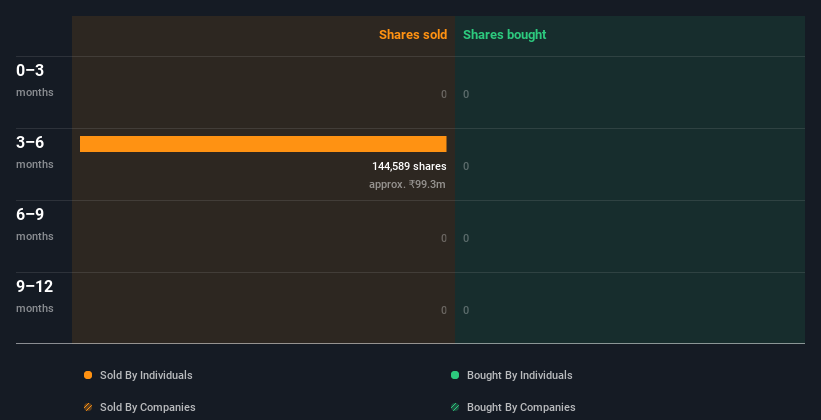

Atul Aggarwal sold a total of 144.59k shares over the year at an average price of ₹690. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

View our latest analysis for Sterling Tools

I will like Sterling Tools better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

Does Sterling Tools Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Sterling Tools insiders own 73% of the company, currently worth about ₹8.4b based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About Sterling Tools Insiders?

There haven't been any insider transactions in the last three months -- that doesn't mean much. While we feel good about high insider ownership of Sterling Tools, we can't say the same about the selling of shares. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. To assist with this, we've discovered 1 warning sign that you should run your eye over to get a better picture of Sterling Tools.

But note: Sterling Tools may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:STERTOOLS

Sterling Tools

Manufactures and sells high tensile cold forged fasteners to original equipment manufacturers in India.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives