- India

- /

- Interactive Media and Services

- /

- NSEI:NAUKRI

Insider-Owned Growth Companies To Watch On The Indian Exchange In July 2024

Reviewed by Simply Wall St

The Indian stock market has shown robust growth, rising by 1.2% over the past week and an impressive 45% over the last year, with earnings expected to grow by 16% annually. In this thriving environment, companies with high insider ownership can be particularly intriguing, as such stakes often align leadership's interests with those of shareholders, potentially enhancing long-term value.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 30.3% | 28.0% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 29.8% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 34.5% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Aether Industries (NSEI:AETHER) | 31.1% | 40.9% |

We'll examine a selection from our screener results.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

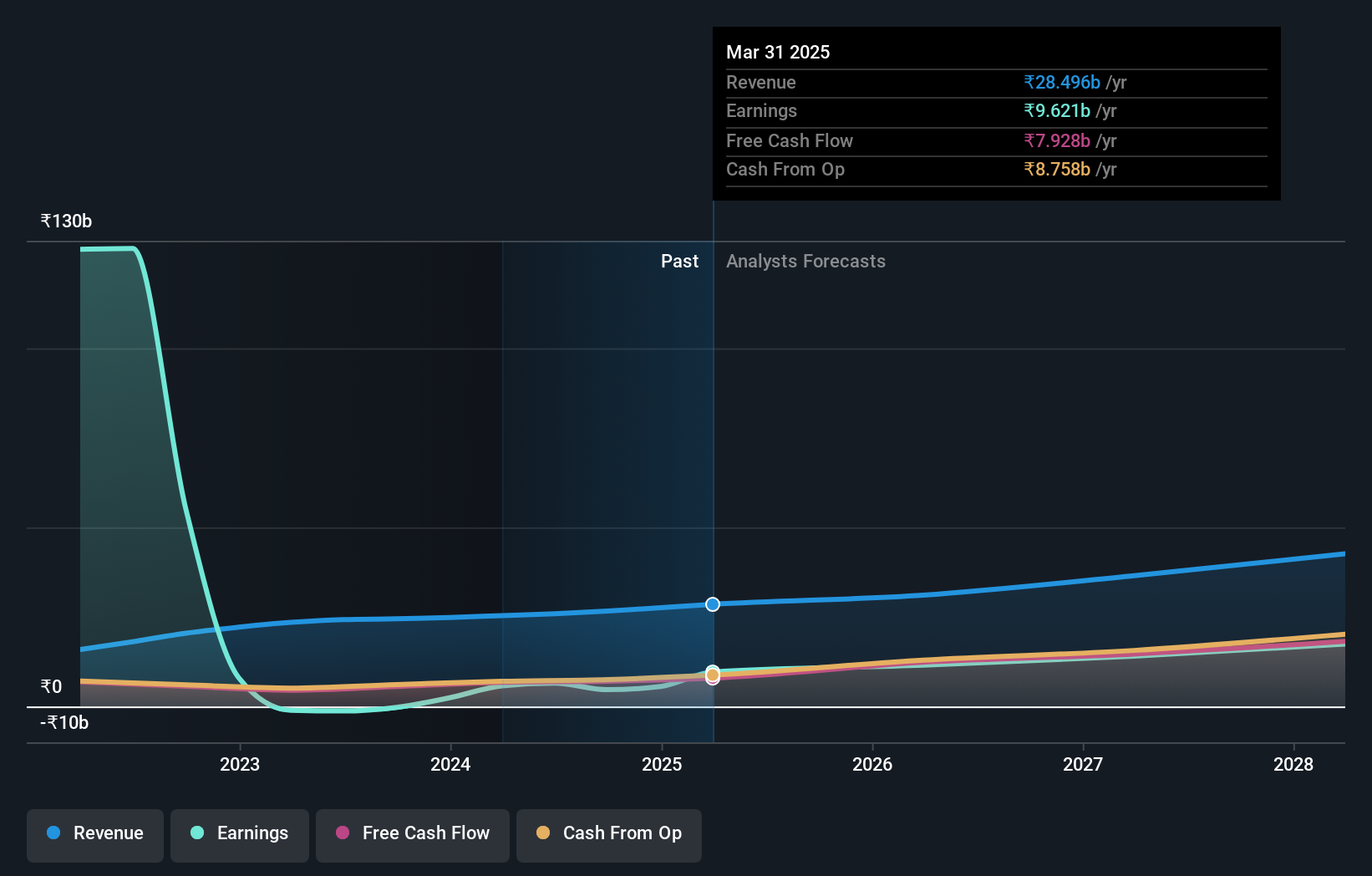

Overview: Info Edge (India) Limited, with a market cap of approximately ₹894.35 billion, operates as an online classifieds company in India and internationally, focusing on recruitment, matrimony, real estate, and education sectors.

Operations: The company generates revenue primarily through recruitment solutions (₹18.80 billion) and real estate classifieds (₹3.51 billion).

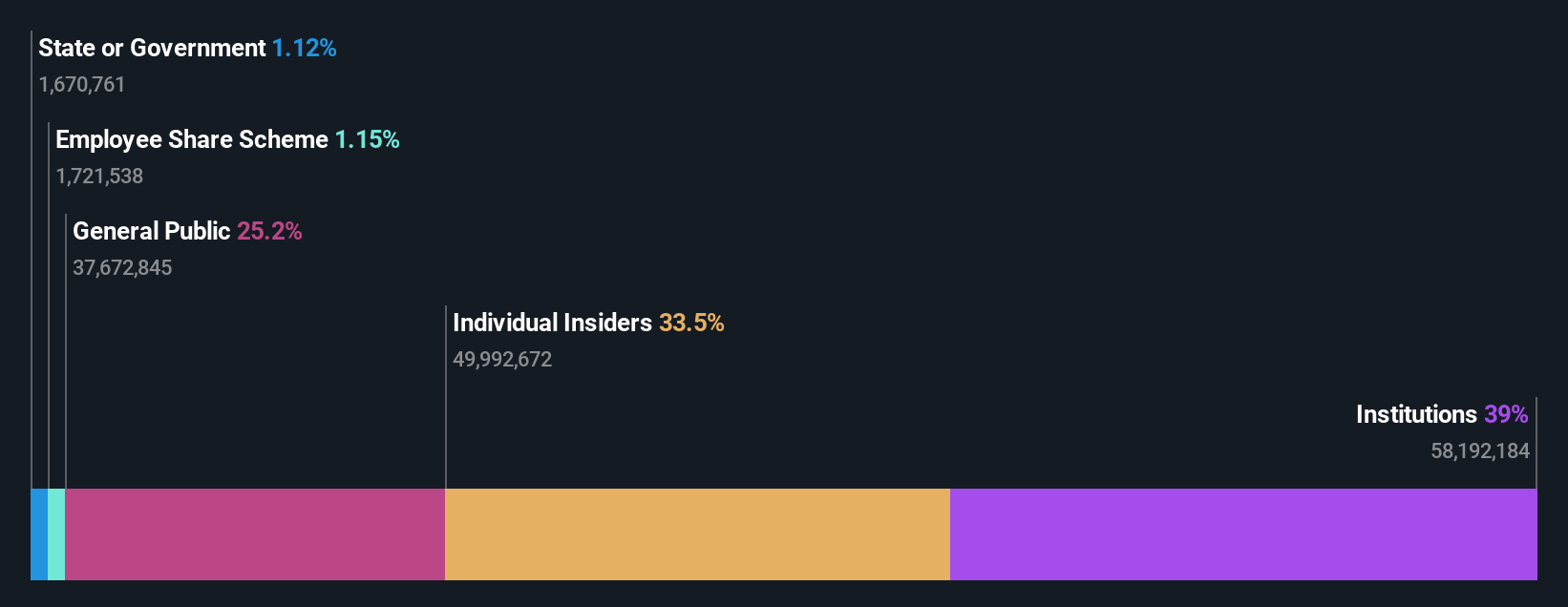

Insider Ownership: 37.9%

Revenue Growth Forecast: 12.1% p.a.

Info Edge (India) Limited, a company with substantial insider transactions recently, has shown mixed financial dynamics. While its revenue growth at 12.1% per year is expected to outpace the Indian market's 9.6%, it remains below the high-growth benchmark of 20%. However, earnings are projected to increase significantly by 24.1% annually, surpassing the market average of 15.9%. Despite this promising profit outlook and a recent dividend announcement, concerns include a low forecasted return on equity at 5.6% and unstable dividend records alongside significant insider selling over the past three months.

- Get an in-depth perspective on Info Edge (India)'s performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Info Edge (India)'s shares may be trading at a premium.

Persistent Systems (NSEI:PERSISTENT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Persistent Systems Limited operates globally, offering software products, services, and technology solutions with a market capitalization of approximately ₹71.92 billion.

Operations: The company generates revenue from three primary segments: Healthcare & Life Sciences (₹20.88 billion), Software, Hi-Tech and Emerging Industries (₹45.95 billion), and Banking, Financial Services and Insurance (BFSI) at ₹31.39 billion.

Insider Ownership: 34.3%

Revenue Growth Forecast: 13.5% p.a.

Persistent Systems, a key entity in India's tech sector, reported robust earnings growth of 18.7% last year with forecasts suggesting a continued 18.1% annual increase, outpacing the Indian market's average. Despite its promising profit trajectory and reliable dividends (0.53%), its revenue growth forecast at 13.5% annually lags behind the high-growth benchmark of 20%, though it still exceeds the market expectation of 9.6%. The firm recently announced quarterly sales of INR 27.37 billion and net income of INR 3.06 billion, reflecting strong operational performance but no substantial insider buying was reported over the past three months.

- Delve into the full analysis future growth report here for a deeper understanding of Persistent Systems.

- According our valuation report, there's an indication that Persistent Systems' share price might be on the expensive side.

S.J.S. Enterprises (NSEI:SJS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: S.J.S. Enterprises Limited specializes in designing, developing, manufacturing, selling, and exporting decorative aesthetics for the automotive and consumer appliance sectors globally, with a market capitalization of ₹24.92 billion.

Operations: The primary revenue stream is generated from the manufacturing and selling of self-adhesive labels, totaling ₹6.28 billion.

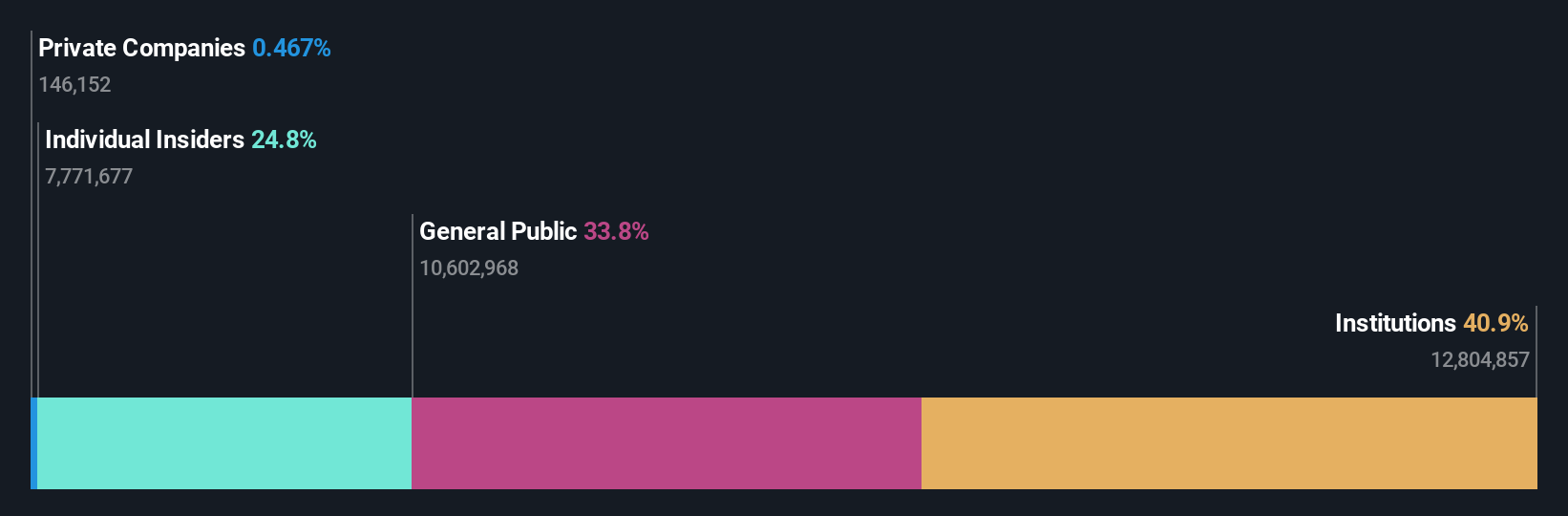

Insider Ownership: 24.8%

Revenue Growth Forecast: 17.3% p.a.

S.J.S. Enterprises has demonstrated strong financial performance with significant year-over-year earnings growth and robust revenue increases, notably outpacing the Indian market averages. The company's price-to-earnings ratio stands below the market average, indicating potential value at its current price. Noteworthy is the high insider buying over recent months, reflecting confidence from those closest to the company's operations. However, its forecasted Return on Equity is relatively low, suggesting some challenges in efficiency or profitability ahead.

- Click here to discover the nuances of S.J.S. Enterprises with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of S.J.S. Enterprises shares in the market.

Where To Now?

- Take a closer look at our Fast Growing Indian Companies With High Insider Ownership list of 83 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NAUKRI

Info Edge (India)

Operates as an online classifieds company in the areas of recruitment, matrimony, real estate, and education and related services in India and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026