- India

- /

- Auto Components

- /

- NSEI:RML

Positive Sentiment Still Eludes Rane (Madras) Limited (NSE:RML) Following 27% Share Price Slump

Rane (Madras) Limited (NSE:RML) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The last month has meant the stock is now only up 3.1% during the last year.

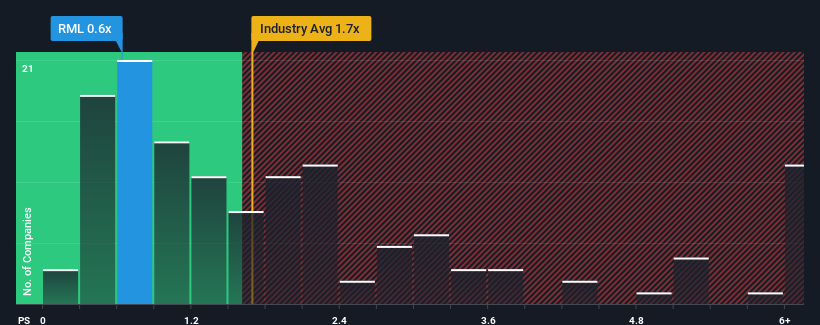

In spite of the heavy fall in price, when close to half the companies operating in India's Auto Components industry have price-to-sales ratios (or "P/S") above 1.7x, you may still consider Rane (Madras) as an enticing stock to check out with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Rane (Madras)

How Rane (Madras) Has Been Performing

For example, consider that Rane (Madras)'s financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Rane (Madras) will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Rane (Madras)'s earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Rane (Madras)'s P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 28% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.8% shows it's about the same on an annualised basis.

In light of this, it's peculiar that Rane (Madras)'s P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

What Does Rane (Madras)'s P/S Mean For Investors?

The southerly movements of Rane (Madras)'s shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Rane (Madras) revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. While recent

And what about other risks? Every company has them, and we've spotted 3 warning signs for Rane (Madras) (of which 2 are concerning!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RML

Rane (Madras)

Engages in the manufacture and marketing of auto components for transportation industry in India and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives