Mahindra & Mahindra (NSE:M&M) Has A Somewhat Strained Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Mahindra & Mahindra Limited (NSE:M&M) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Mahindra & Mahindra

What Is Mahindra & Mahindra's Net Debt?

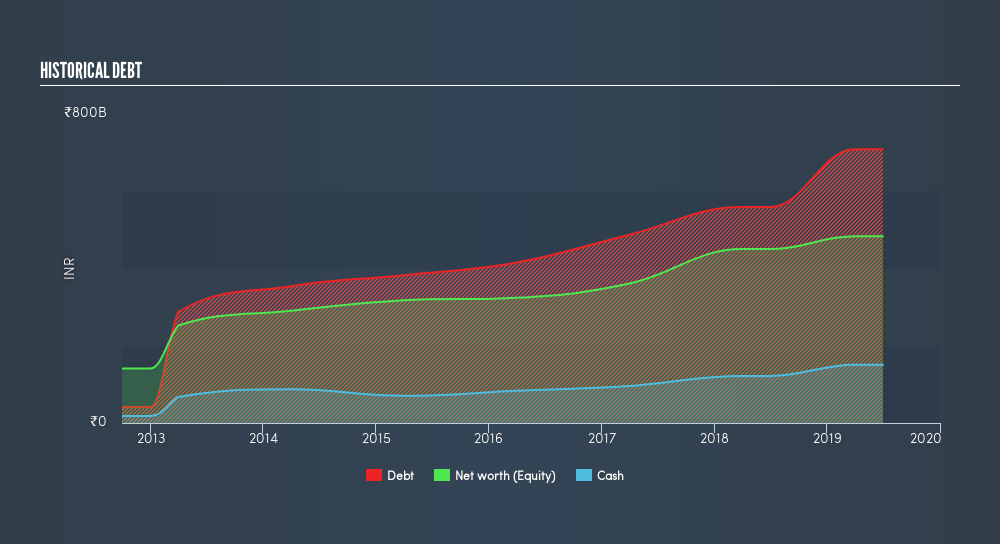

You can click the graphic below for the historical numbers, but it shows that as of March 2019 Mahindra & Mahindra had ₹708.5b of debt, an increase on ₹559.0b, over one year. However, it also had ₹150.9b in cash, and so its net debt is ₹557.5b.

How Strong Is Mahindra & Mahindra's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Mahindra & Mahindra had liabilities of ₹587.4b due within 12 months and liabilities of ₹563.0b due beyond that. Offsetting these obligations, it had cash of ₹150.9b as well as receivables valued at ₹384.0b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹615.6b.

Given this deficit is actually higher than the company's market capitalization of ₹569.6b, we think shareholders really should watch Mahindra & Mahindra's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about Mahindra & Mahindra's net debt to EBITDA ratio of 3.9, we think its super-low interest cover of 2.2 times is a sign of high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. More concerning, Mahindra & Mahindra saw its EBIT drop by 7.4% in the last twelve months. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Mahindra & Mahindra's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Mahindra & Mahindra burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Mahindra & Mahindra's interest cover and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. And even its net debt to EBITDA fails to inspire much confidence. Taking into account all the aforementioned factors, it looks like Mahindra & Mahindra has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Mahindra & Mahindra's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:M&M

Mahindra & Mahindra

Provides mobility products and farm solutions in India and internationally.

Mediocre balance sheet second-rate dividend payer.