- India

- /

- Auto Components

- /

- NSEI:JKTYRE

JK Tyre & Industries' (NSE:JKTYRE) Shareholders Have More To Worry About Than Only Soft Earnings

The market rallied behind JK Tyre & Industries Limited's (NSE:JKTYRE) stock, leading do a rise in the share price after its recent weak earnings report. We think that shareholders might be missing some concerning factors that our analysis found.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, JK Tyre & Industries issued 5.1% more new shares over the last year. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of JK Tyre & Industries' EPS by clicking here.

A Look At The Impact Of JK Tyre & Industries' Dilution On Its Earnings Per Share (EPS)

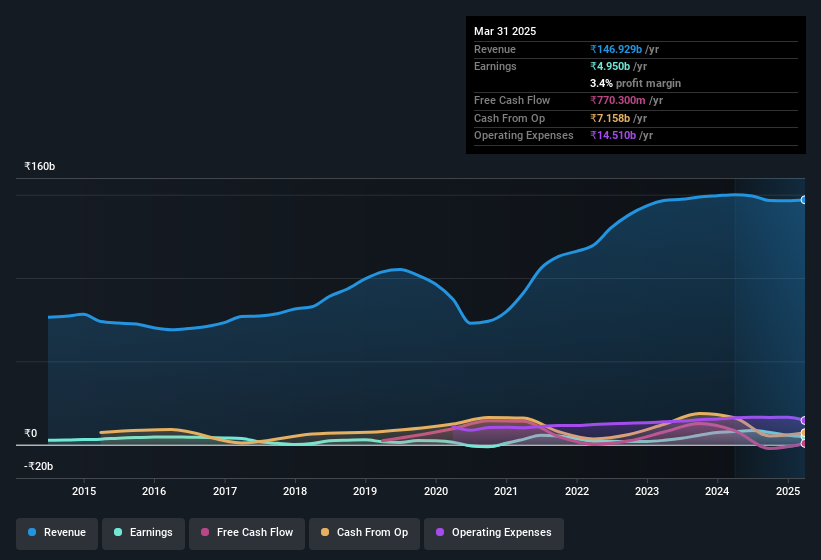

As you can see above, JK Tyre & Industries has been growing its net income over the last few years, with an annualized gain of 136% over three years. In comparison, earnings per share only gained 112% over the same period. Net profit actually dropped by 37% in the last year. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 39%. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, if JK Tyre & Industries' earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On JK Tyre & Industries' Profit Performance

Over the last year JK Tyre & Industries issued new shares and so, there's a noteworthy divergence between EPS and net income growth. Because of this, we think that it may be that JK Tyre & Industries' statutory profits are better than its underlying earnings power. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you want to do dive deeper into JK Tyre & Industries, you'd also look into what risks it is currently facing. Every company has risks, and we've spotted 3 warning signs for JK Tyre & Industries (of which 1 can't be ignored!) you should know about.

Today we've zoomed in on a single data point to better understand the nature of JK Tyre & Industries' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JKTYRE

JK Tyre & Industries

Develops, manufactures, markets and distributes automotive tyres, tubes, flaps, and retreads in India, Mexico, and Internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026