JBM Auto Limited (NSE:JBMA) defied analyst predictions to release its quarterly results, which were ahead of market expectations. JBM Auto delivered a significant beat to revenue and earnings per share (EPS) expectations, with sales hitting ₹7.5b and statutory EPS reaching ₹5.35, both beating estimates by more than 10%. The analyst typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. With this in mind, we've gathered the latest statutory forecasts to see what the analyst is expecting for next year.

View our latest analysis for JBM Auto

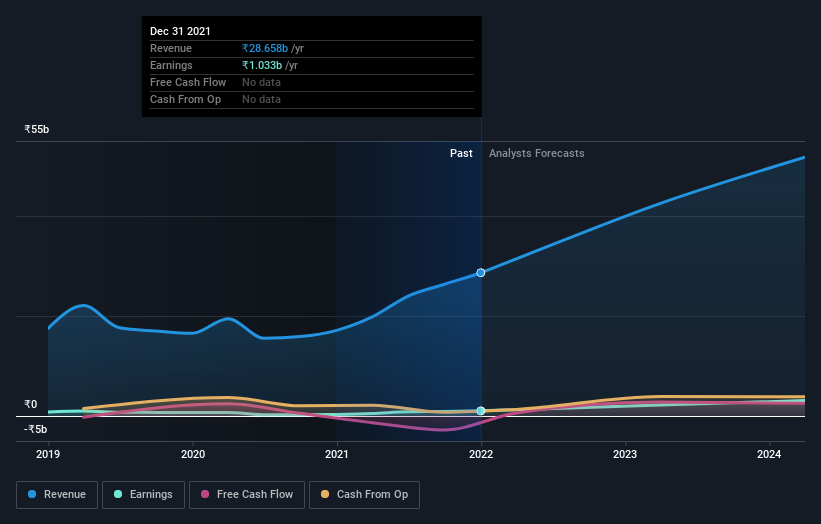

Taking into account the latest results, the most recent consensus for JBM Auto from sole analyst is for revenues of ₹31.4b in 2022 which, if met, would be a decent 9.7% increase on its sales over the past 12 months. Statutory earnings per share are predicted to swell 18% to ₹25.70. Yet prior to the latest earnings, the analyst had been anticipated revenues of ₹29.5b and earnings per share (EPS) of ₹22.60 in 2022. So it seems there's been a definite increase in optimism about JBM Auto's future following the latest results, with a solid gain to the earnings per share forecasts in particular.

With these upgrades, we're not surprised to see that the analyst has lifted their price target 62% to ₹1,931per share.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analyst is definitely expecting JBM Auto's growth to accelerate, with the forecast 20% annualised growth to the end of 2022 ranking favourably alongside historical growth of 7.1% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 14% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analyst also expect JBM Auto to grow faster than the wider industry.

The Bottom Line

The most important thing here is that the analyst upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards JBM Auto following these results. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analyst believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for JBM Auto going out as far as 2024, and you can see them free on our platform here.

You still need to take note of risks, for example - JBM Auto has 2 warning signs (and 1 which can't be ignored) we think you should know about.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JBMA

JBM Auto

Engages in the manufacture and sale sheet metal components, tools, dies and moulds, and buses in India and internationally.

Proven track record with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026