- India

- /

- Auto Components

- /

- NSEI:JBMA

Market Participants Recognise JBM Auto Limited's (NSE:JBMA) Revenues Pushing Shares 27% Higher

JBM Auto Limited (NSE:JBMA) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days were the cherry on top of the stock's 310% gain in the last year, which is nothing short of spectacular.

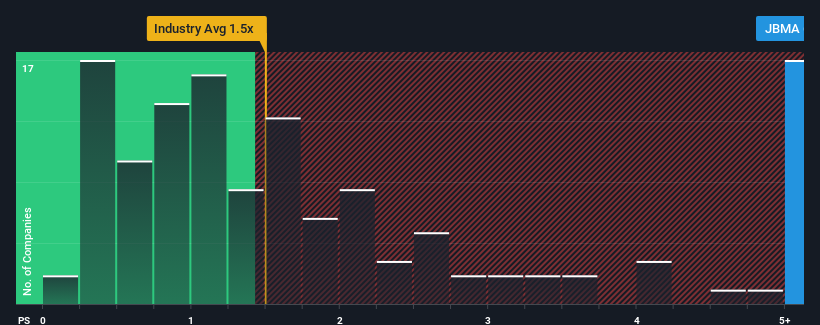

Following the firm bounce in price, when almost half of the companies in India's Auto Components industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider JBM Auto as a stock not worth researching with its 6.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for JBM Auto

How Has JBM Auto Performed Recently?

With revenue growth that's superior to most other companies of late, JBM Auto has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think JBM Auto's future stacks up against the industry? In that case, our free report is a great place to start.How Is JBM Auto's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as JBM Auto's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 165% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 56% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 10%, which is noticeably less attractive.

With this information, we can see why JBM Auto is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On JBM Auto's P/S

Shares in JBM Auto have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of JBM Auto's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about this 1 warning sign we've spotted with JBM Auto.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JBMA

JBM Auto

Engages in the manufacture and sale sheet metal components, tools, dies and moulds, and buses in India and internationally.

Proven track record with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026