- India

- /

- Auto Components

- /

- NSEI:IGARASHI

Is Igarashi Motors India Limited's (NSE:IGARASHI) 0.3% Dividend Worth Your Time?

Dividend paying stocks like Igarashi Motors India Limited (NSE:IGARASHI) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

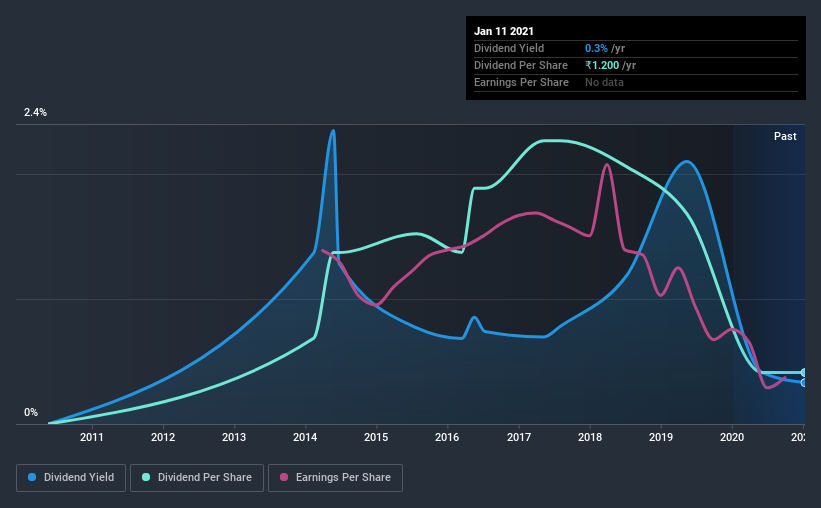

Investors might not know much about Igarashi Motors India's dividend prospects, even though it has been paying dividends for the last seven years and offers a 0.3% yield. A low yield is generally a turn-off, but if the prospects for earnings growth were strong, investors might be pleasantly surprised by the long-term results. Some simple research can reduce the risk of buying Igarashi Motors India for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 22% of Igarashi Motors India's profits were paid out as dividends in the last 12 months. We'd say its dividends are thoroughly covered by earnings.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. The company paid out 52% of its free cash flow, which is not bad per se, but does start to limit the amount of cash Igarashi Motors India has available to meet other needs. It's positive to see that Igarashi Motors India's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Consider getting our latest analysis on Igarashi Motors India's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Igarashi Motors India has been paying a dividend for the past seven years. It's good to see that Igarashi Motors India has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past seven-year period, the first annual payment was ₹2.0 in 2014, compared to ₹1.2 last year. The dividend has shrunk at around 7.0% a year during that period. Igarashi Motors India's dividend has been cut sharply at least once, so it hasn't fallen by 7.0% every year, but this is a decent approximation of the long term change.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Igarashi Motors India's EPS have fallen by approximately 23% per year during the past five years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Igarashi Motors India's earnings per share, which support the dividend, have been anything but stable.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Firstly, we like that Igarashi Motors India pays out a low fraction of earnings. It pays out a higher percentage of its cashflow, although this is within acceptable bounds. Earnings per share are down, and Igarashi Motors India's dividend has been cut at least once in the past, which is disappointing. In sum, we find it hard to get excited about Igarashi Motors India from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 2 warning signs for Igarashi Motors India (of which 1 is significant!) you should know about.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you decide to trade Igarashi Motors India, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:IGARASHI

Igarashi Motors India

Manufactures and sells electric micro motors and motor components in India, the United States, Japan, Germany, Hong Kong, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives