- India

- /

- Auto Components

- /

- NSEI:IGARASHI

Does Igarashi Motors India (NSE:IGARASHI) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Igarashi Motors India Limited (NSE:IGARASHI) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Igarashi Motors India

What Is Igarashi Motors India's Debt?

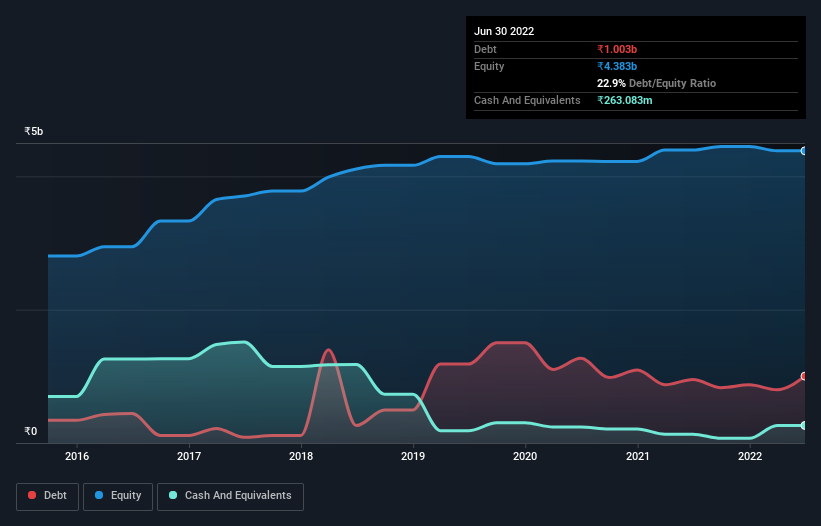

The image below, which you can click on for greater detail, shows that at March 2022 Igarashi Motors India had debt of ₹1.00b, up from ₹951.2m in one year. However, it does have ₹263.1m in cash offsetting this, leading to net debt of about ₹740.0m.

How Healthy Is Igarashi Motors India's Balance Sheet?

According to the last reported balance sheet, Igarashi Motors India had liabilities of ₹1.81b due within 12 months, and liabilities of ₹570.1m due beyond 12 months. Offsetting this, it had ₹263.1m in cash and ₹1.41b in receivables that were due within 12 months. So it has liabilities totalling ₹710.9m more than its cash and near-term receivables, combined.

Of course, Igarashi Motors India has a market capitalization of ₹14.8b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Igarashi Motors India's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Igarashi Motors India made a loss at the EBIT level, and saw its revenue drop to ₹5.5b, which is a fall of 14%. That's not what we would hope to see.

Caveat Emptor

Not only did Igarashi Motors India's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). To be specific the EBIT loss came in at ₹64m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. We would feel better if it turned its trailing twelve month loss of ₹68m into a profit. So we do think this stock is quite risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 2 warning signs we've spotted with Igarashi Motors India .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking to trade Igarashi Motors India, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IGARASHI

Igarashi Motors India

Manufactures and sells electric micro motors and motor components in India, the United States, Japan, Germany, Hong Kong, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives