- India

- /

- Auto Components

- /

- NSEI:HITECHGEAR

The Market Lifts The Hi-Tech Gears Limited (NSE:HITECHGEAR) Shares 36% But It Can Do More

The The Hi-Tech Gears Limited (NSE:HITECHGEAR) share price has done very well over the last month, posting an excellent gain of 36%. The last month tops off a massive increase of 123% in the last year.

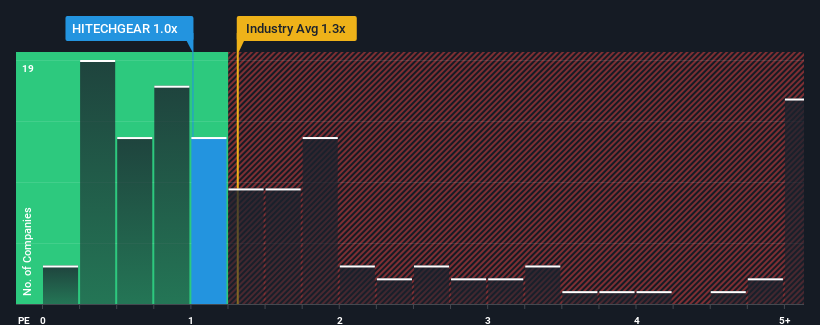

Although its price has surged higher, it's still not a stretch to say that Hi-Tech Gears' price-to-sales (or "P/S") ratio of 1x right now seems quite "middle-of-the-road" compared to the Auto Components industry in India, where the median P/S ratio is around 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Hi-Tech Gears

How Hi-Tech Gears Has Been Performing

For instance, Hi-Tech Gears' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Hi-Tech Gears, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Hi-Tech Gears would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 5.5% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 69% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 10%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Hi-Tech Gears' P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now Hi-Tech Gears' P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We didn't quite envision Hi-Tech Gears' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Having said that, be aware Hi-Tech Gears is showing 4 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hi-Tech Gears might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HITECHGEAR

Hi-Tech Gears

Manufactures and sells auto components for automobile manufacturers in India, the United States, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026