- India

- /

- Auto Components

- /

- NSEI:HINDCOMPOS

Investors Who Bought Hindustan Composites (NSE:HINDCOMPOS) Shares A Year Ago Are Now Up 47%

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Hindustan Composites Limited (NSE:HINDCOMPOS) share price is 47% higher than it was a year ago, much better than the market return of around 14% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! In contrast, the longer term returns are negative, since the share price is 31% lower than it was three years ago.

Check out our latest analysis for Hindustan Composites

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year, Hindustan Composites actually saw its earnings per share drop 1.7%.

Sometimes companies will sacrifice EPS in the short term for longer term gains; and in that case we may be able to find other positives. It makes sense to check some of the other fundamental data for an explanation of the share price rise.

We are skeptical of the suggestion that the 0.6% dividend yield would entice buyers to the stock. Hindustan Composites' revenue actually dropped 17% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

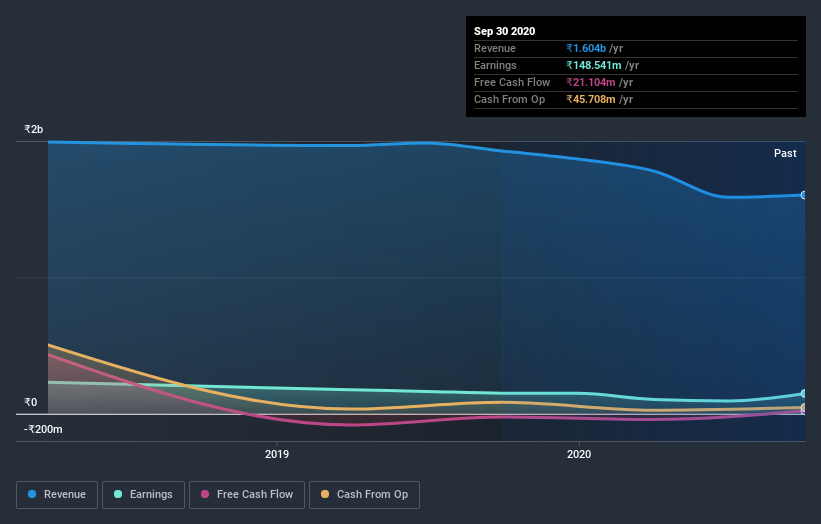

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Hindustan Composites has rewarded shareholders with a total shareholder return of 49% in the last twelve months. And that does include the dividend. That certainly beats the loss of about 1.0% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Hindustan Composites better, we need to consider many other factors. For example, we've discovered 5 warning signs for Hindustan Composites (1 is concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Hindustan Composites, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Composites might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:HINDCOMPOS

Hindustan Composites

Develops, manufactures, and markets fibre-based friction materials in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026