- India

- /

- Auto Components

- /

- NSEI:HINDCOMPOS

Hindustan Composites' (NSE:HINDCOMPOS) five-year earnings growth trails the 20% YoY shareholder returns

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on a lighter note, a good company can see its share price rise well over 100%. One great example is Hindustan Composites Limited (NSE:HINDCOMPOS) which saw its share price drive 140% higher over five years. Better yet, the share price has risen 10% in the last week.

Since it's been a strong week for Hindustan Composites shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Hindustan Composites

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

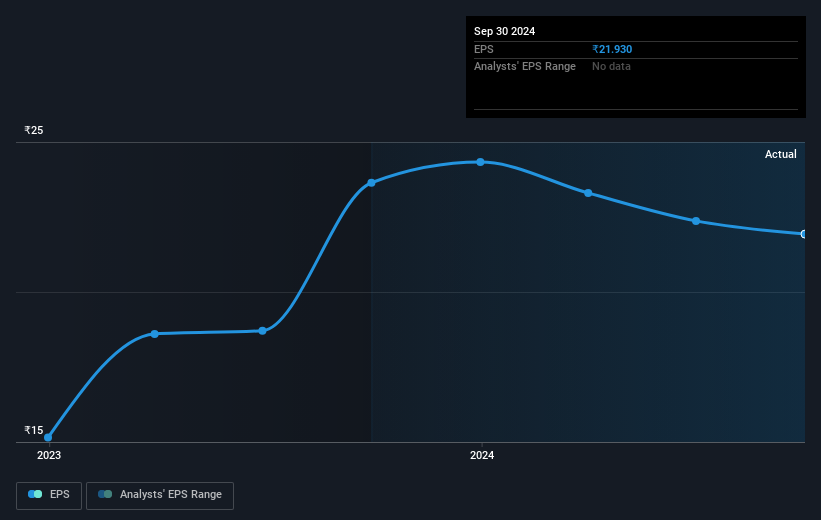

Over half a decade, Hindustan Composites managed to grow its earnings per share at 16% a year. So the EPS growth rate is rather close to the annualized share price gain of 19% per year. That suggests that the market sentiment around the company hasn't changed much over that time. In fact, the share price seems to largely reflect the EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Hindustan Composites' key metrics by checking this interactive graph of Hindustan Composites's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Hindustan Composites the TSR over the last 5 years was 147%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Hindustan Composites provided a TSR of 11% over the year (including dividends). That's fairly close to the broader market return. We should note here that the five-year TSR is more impressive, at 20% per year. More recently, the share price growth has slowed. But it has to be said the overall picture is one of good long term and short term performance. Arguably that makes Hindustan Composites a stock worth watching. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Hindustan Composites has 2 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Composites might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HINDCOMPOS

Hindustan Composites

Develops, manufactures, and markets fibre-based friction materials in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success