- India

- /

- Auto Components

- /

- NSEI:FMGOETZE

Federal-Mogul Goetze (India)'s (NSE:FMGOETZE) Shareholders Are Down 44% On Their Shares

Federal-Mogul Goetze (India) Limited (NSE:FMGOETZE) shareholders should be happy to see the share price up 29% in the last month. But in truth the last year hasn't been good for the share price. In fact the stock is down 44% in the last year, well below the market return.

Check out our latest analysis for Federal-Mogul Goetze (India)

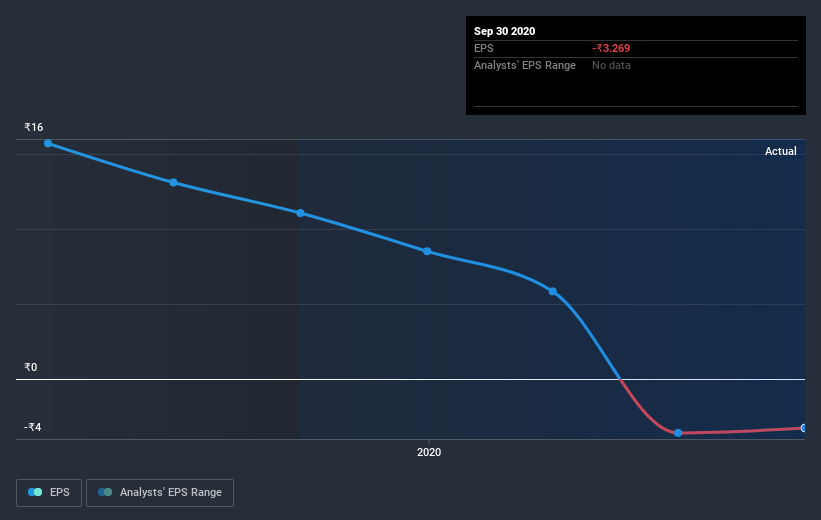

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Federal-Mogul Goetze (India) fell to a loss making position during the year. Some investors no doubt dumped the stock as a result. However, there may be an opportunity for investors if the company can recover.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Investors in Federal-Mogul Goetze (India) had a tough year, with a total loss of 44%, against a market gain of about 12%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.3% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with Federal-Mogul Goetze (India) (including 1 which is is significant) .

We will like Federal-Mogul Goetze (India) better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade Federal-Mogul Goetze (India), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:FMGOETZE

Federal-Mogul Goetze (India)

Engages in the manufacture, supply, and distribution of automotive components for two/three/four-wheeler automobiles in India and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives