- India

- /

- Auto Components

- /

- NSEI:FIEMIND

Here's Why We Think Fiem Industries (NSE:FIEMIND) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Fiem Industries (NSE:FIEMIND). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Fiem Industries

How Quickly Is Fiem Industries Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Fiem Industries has grown EPS by 19% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

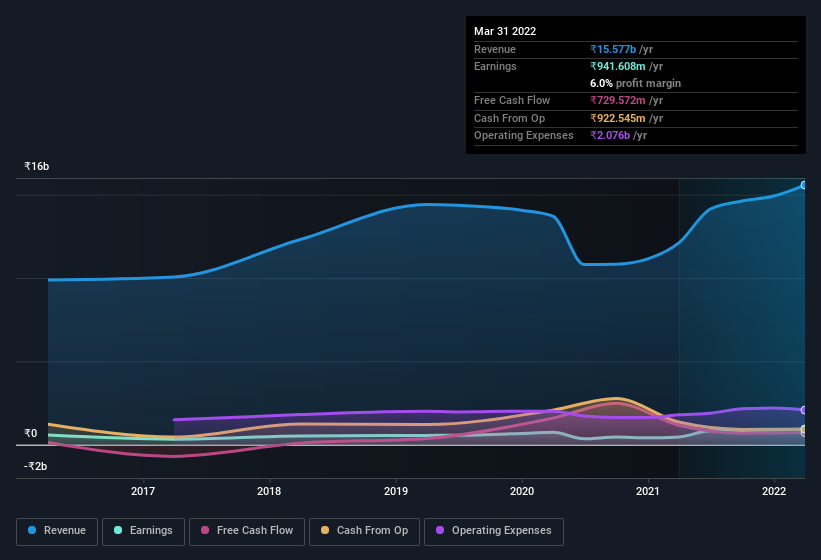

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Fiem Industries is growing revenues, and EBIT margins improved by 2.4 percentage points to 8.7%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fiem Industries isn't a huge company, given its market capitalisation of ₹20b. That makes it extra important to check on its balance sheet strength.

Are Fiem Industries Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Fiem Industries insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 66%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. To give you an idea, the value of insiders' holdings in the business are valued at ₹13b at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations between ₹7.9b and ₹32b, like Fiem Industries, the median CEO pay is around ₹15m.

Fiem Industries' CEO took home a total compensation package worth ₹9.4m in the year leading up to March 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Fiem Industries Worth Keeping An Eye On?

You can't deny that Fiem Industries has grown its earnings per share at a very impressive rate. That's attractive. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Everyone has their own preferences when it comes to investing but it definitely makes Fiem Industries look rather interesting indeed. What about risks? Every company has them, and we've spotted 2 warning signs for Fiem Industries you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FIEMIND

Fiem Industries

Manufactures and supplies automotive lighting and signaling equipment, rear view mirrors, prismatic mirror, plastic moulded parts, bank angle sensor, canister, and sheet metal components for motorized vehicles in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives