- India

- /

- Auto Components

- /

- NSEI:ASAHIINDIA

Here's Why Shareholders Will Not Be Complaining About Asahi India Glass Limited's (NSE:ASAHIINDIA) CEO Pay Packet

Key Insights

- Asahi India Glass will host its Annual General Meeting on 18th of September

- CEO Sanjay Labroo's total compensation includes salary of ₹31.3m

- The overall pay is comparable to the industry average

- Over the past three years, Asahi India Glass' EPS grew by 94% and over the past three years, the total shareholder return was 158%

We have been pretty impressed with the performance at Asahi India Glass Limited (NSE:ASAHIINDIA) recently and CEO Sanjay Labroo deserves a mention for their role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 18th of September. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

View our latest analysis for Asahi India Glass

How Does Total Compensation For Sanjay Labroo Compare With Other Companies In The Industry?

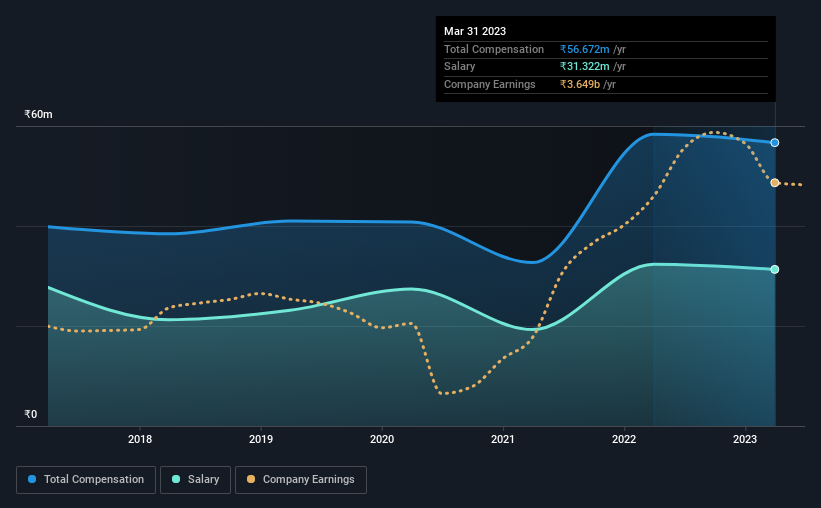

At the time of writing, our data shows that Asahi India Glass Limited has a market capitalization of ₹140b, and reported total annual CEO compensation of ₹57m for the year to March 2023. That is, the compensation was roughly the same as last year. Notably, the salary which is ₹31.3m, represents a considerable chunk of the total compensation being paid.

In comparison with other companies in the Indian Auto Components industry with market capitalizations ranging from ₹83b to ₹266b, the reported median CEO total compensation was ₹57m. This suggests that Asahi India Glass remunerates its CEO largely in line with the industry average. Furthermore, Sanjay Labroo directly owns ₹18b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹31m | ₹32m | 55% |

| Other | ₹25m | ₹26m | 45% |

| Total Compensation | ₹57m | ₹58m | 100% |

On an industry level, around 76% of total compensation represents salary and 24% is other remuneration. Asahi India Glass sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Asahi India Glass Limited's Growth Numbers

Asahi India Glass Limited has seen its earnings per share (EPS) increase by 94% a year over the past three years. Its revenue is up 20% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Asahi India Glass Limited Been A Good Investment?

We think that the total shareholder return of 158%, over three years, would leave most Asahi India Glass Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 2 warning signs for Asahi India Glass that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ASAHIINDIA

Asahi India Glass

An integrated glass and windows solutions company, manufactures and supplies various glass products in India and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives