- Israel

- /

- Renewable Energy

- /

- TASE:SNFL

Market Might Still Lack Some Conviction On Sunflower Sustainable Investments Ltd (TLV:SNFL) Even After 31% Share Price Boost

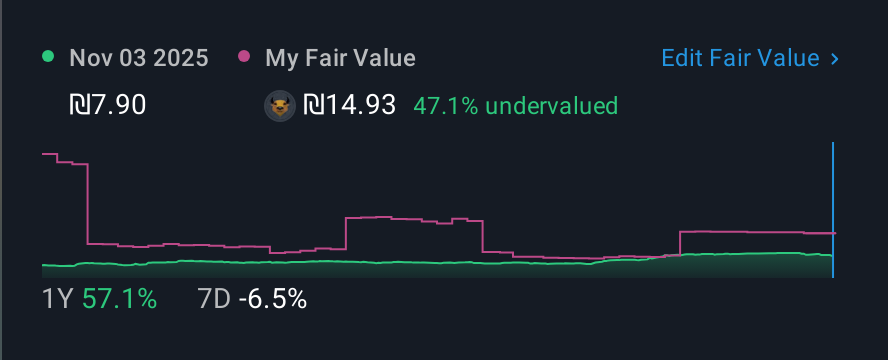

The Sunflower Sustainable Investments Ltd (TLV:SNFL) share price has done very well over the last month, posting an excellent gain of 31%. The last 30 days bring the annual gain to a very sharp 26%.

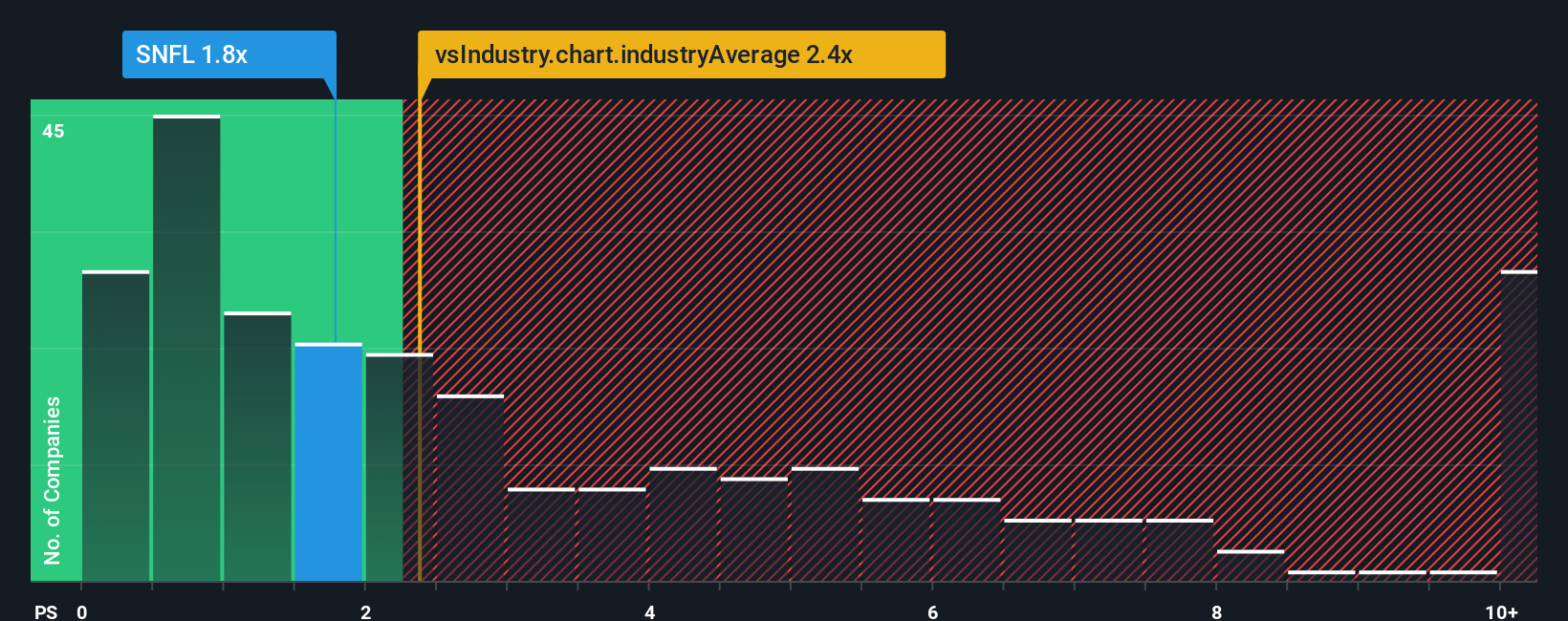

In spite of the firm bounce in price, considering about half the companies operating in Israel's Renewable Energy industry have price-to-sales ratios (or "P/S") above 6.8x, you may still consider Sunflower Sustainable Investments as an great investment opportunity with its 1.8x P/S ratio. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Sunflower Sustainable Investments

How Has Sunflower Sustainable Investments Performed Recently?

As an illustration, revenue has deteriorated at Sunflower Sustainable Investments over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Sunflower Sustainable Investments will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sunflower Sustainable Investments' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Sunflower Sustainable Investments' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. Even so, admirably revenue has lifted 115% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 11% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Sunflower Sustainable Investments' P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Sunflower Sustainable Investments' P/S?

Even after such a strong price move, Sunflower Sustainable Investments' P/S still trails the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Sunflower Sustainable Investments revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Sunflower Sustainable Investments that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SNFL

Sunflower Sustainable Investments

Engages in the initiation, development, establishment, financing, operation, and management of renewable energy and energy storage projects in Israel, Poland, and the United States.

Good value with mediocre balance sheet.

Market Insights

Community Narratives