- Israel

- /

- Renewable Energy

- /

- TASE:OPCE

OPC Energy (TASE:OPCE): Assessing Valuation After Notable Share Price Momentum

Reviewed by Simply Wall St

OPC Energy (TASE:OPCE) Stock Draws Investor Curiosity Following Recent Moves

If you are following OPC Energy (TASE:OPCE), you might have noticed the stock has been making some interesting moves lately. While there is no single event driving recent activity, the shifts in OPC Energy’s price action naturally spark questions. Is something new brewing beneath the surface, or is this just standard market churn?

Looking at the bigger picture, OPC Energy’s shares have delivered a strong climb of 83% over the past year, with momentum particularly accelerating over the past three months. The past month saw a more modest gain, but that comes on the heels of a multi-month rally, with shorter-term dips quickly giving way to renewed buying interest. There haven’t been major headlines lately, yet the performance signals that investors have been warming up to the stock throughout the year.

So, after this impressive run, is OPC Energy’s growth potential still flying under the radar, or has the market already priced in future gains?

Price-to-Earnings of 86.3x: Is it justified?

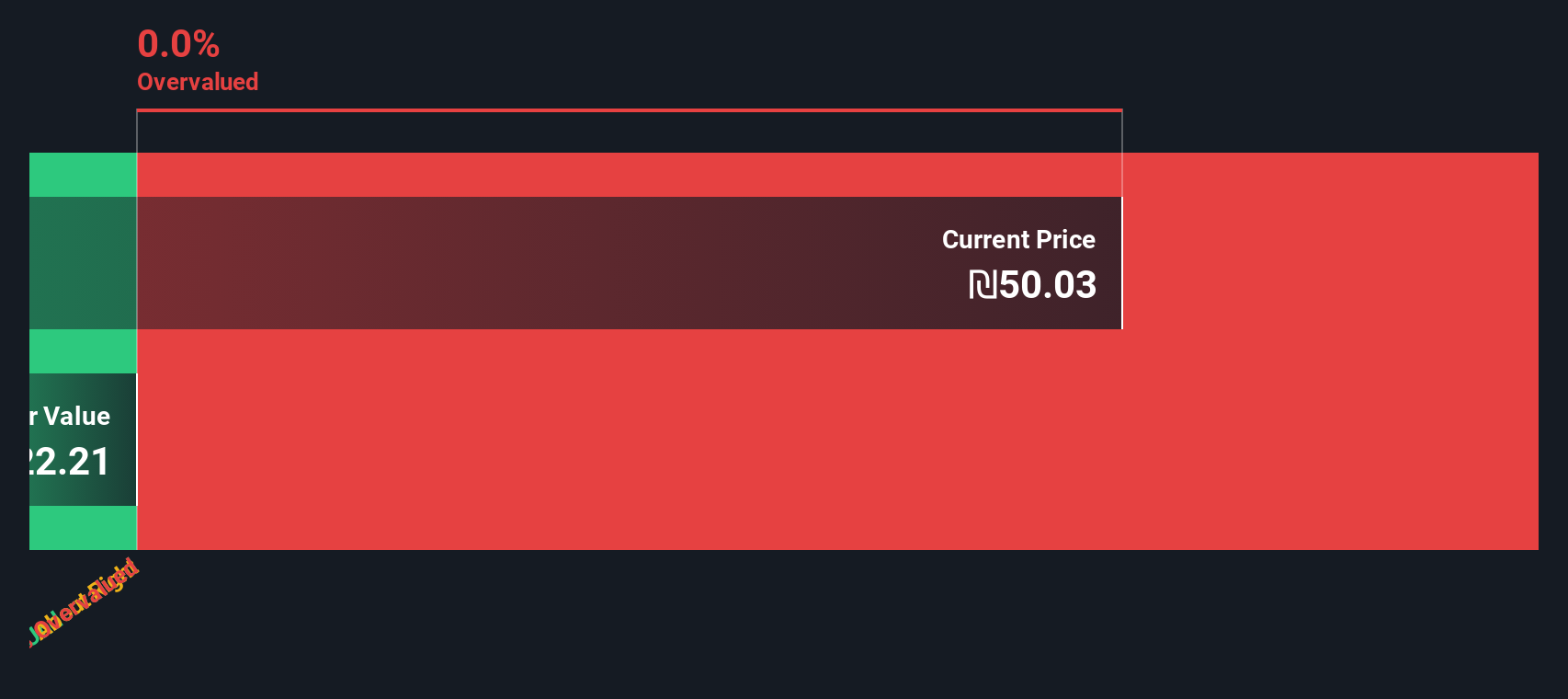

OPC Energy currently trades at a Price-To-Earnings (P/E) ratio of 86.3x, which is significantly higher than both the Asian Renewable Energy industry average of 16.2x and the peer average of 21.1x. This indicates that investors are paying a premium for each shekel of earnings generated by the company compared to similar firms in the industry.

The P/E ratio measures how much the market is willing to pay today for a company’s earnings. In the context of renewable energy, a higher multiple can signal expectations of rapid growth or market leadership. It may also reflect a level of optimism that is not rooted in fundamentals.

Given these multiples, the market appears to be pricing in strong future growth for OPC Energy. However, such a premium demands exceptional performance to be justified and may leave little room for error if expectations are not met.

Result: Fair Value of ₪52.42 (OVERVALUED)

See our latest analysis for OPC Energy.However, investors should be wary of profit margin pressure or sudden changes in sector sentiment. Both of these factors could dampen recent optimism around OPC Energy.

Find out about the key risks to this OPC Energy narrative.Another View: What Does the SWS DCF Model Say?

While the price-to-earnings ratio makes OPC Energy look expensive for its sector, our DCF model cannot offer more insight, as there is insufficient data to estimate a fair value through this lens. Could the real story hide between the lines of these approaches?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own OPC Energy Narrative

If this perspective does not match your own or you would like to dive deeper into the numbers yourself, starting a custom analysis takes only a few minutes, so you can Do it your way.

A great starting point for your OPC Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not let your search stop here. Broaden your strategy by tapping into other standout opportunities that can elevate your portfolio. There is a world of innovation and value waiting for smart investors like you.

- Uncover value plays by targeting companies trading below their cash flow potential through our undervalued stocks based on cash flows for opportunities others might miss.

- Ride the wave of healthcare’s digital transformation by surfacing cutting-edge medical technology firms with healthcare AI stocks.

- Tap into the rise of digital assets with direct access to the pioneers in blockchain and cryptocurrency via cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:OPCE

OPC Energy

Engages in the development, construction, operation, generation, and supply of electricity in Israel.

Solid track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives