- Israel

- /

- Electric Utilities

- /

- TASE:GPGB-M

Investors Who Bought G.P. Global Power (TLV:GPGB) Shares A Year Ago Are Now Up 15%

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if you choose that path, you're going to buy some stocks that fall short of the market. Unfortunately for shareholders, while the G.P. Global Power Ltd (TLV:GPGB) share price is up 15% in the last year, that falls short of the market return. G.P. Global Power hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for G.P. Global Power

G.P. Global Power wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

G.P. Global Power actually shrunk its revenue over the last year, with a reduction of 63%. The lacklustre gain of 15% over twelve months, is not a bad result given the falling revenue. We'd want to see progress to profitability before getting too interested in this stock.

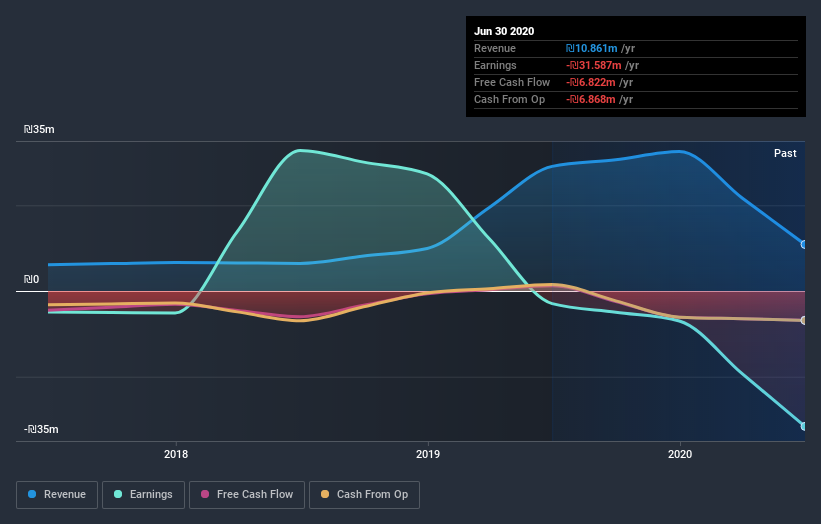

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

G.P. Global Power shareholders have gained 15% for the year. While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 51%. The last three months haven't been so kind to G.P. Global Power, with the share price gaining just 1.4%. It's not uncommon to see a company's share price between updates to shareholders. It's always interesting to track share price performance over the longer term. But to understand G.P. Global Power better, we need to consider many other factors. Take risks, for example - G.P. Global Power has 5 warning signs (and 2 which shouldn't be ignored) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

If you decide to trade G.P. Global Power, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:GPGB-M

G.P. Global Power

Engages in the design, development, and construction of infrastructure and energy projects in Israel.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026