Maman-Cargo Terminals & Handling (TLV:MMAN) Takes On Some Risk With Its Use Of Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Maman-Cargo Terminals & Handling Ltd. (TLV:MMAN) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Maman-Cargo Terminals & Handling

How Much Debt Does Maman-Cargo Terminals & Handling Carry?

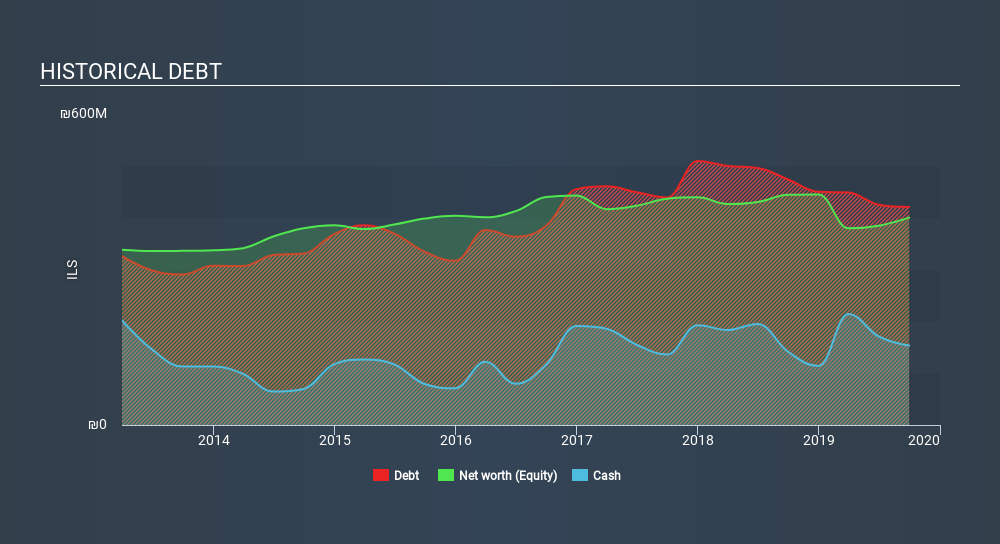

You can click the graphic below for the historical numbers, but it shows that as of September 2019 Maman-Cargo Terminals & Handling had ₪420.7m of debt, an increase on ₪474, over one year. However, it does have ₪153.3m in cash offsetting this, leading to net debt of about ₪267.4m.

A Look At Maman-Cargo Terminals & Handling's Liabilities

According to the last reported balance sheet, Maman-Cargo Terminals & Handling had liabilities of ₪381.1m due within 12 months, and liabilities of ₪917.2m due beyond 12 months. Offsetting this, it had ₪153.3m in cash and ₪264.5m in receivables that were due within 12 months. So it has liabilities totalling ₪880.4m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the ₪260.6m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Maman-Cargo Terminals & Handling would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Maman-Cargo Terminals & Handling has a quite reasonable net debt to EBITDA multiple of 1.9, its interest cover seems weak, at 1.6. The main reason for this is that it has such high depreciation and amortisation. While companies often boast that these charges are non-cash, most such businesses will therefore require ongoing investment (that is not expensed.) In any case, it's safe to say the company has meaningful debt. It is well worth noting that Maman-Cargo Terminals & Handling's EBIT shot up like bamboo after rain, gaining 59% in the last twelve months. That'll make it easier to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Maman-Cargo Terminals & Handling will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Maman-Cargo Terminals & Handling's free cash flow amounted to 32% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

On the face of it, Maman-Cargo Terminals & Handling's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. It's also worth noting that Maman-Cargo Terminals & Handling is in the Infrastructure industry, which is often considered to be quite defensive. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Maman-Cargo Terminals & Handling stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for Maman-Cargo Terminals & Handling (2 are concerning) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TASE:MMAN

Maman- Cargo Terminals & Handling

Maman- Cargo Terminals & Handling Ltd, together with its subsidiaries, engages in the provision of a range of cargo handling services for international air cargo imported or exported from Israel.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026