Knafaim Holdings' (TLV:KNFM) Returns On Capital Not Reflecting Well On The Business

To avoid investing in a business that's in decline, there's a few financial metrics that can provide early indications of aging. More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. Having said that, after a brief look, Knafaim Holdings (TLV:KNFM) we aren't filled with optimism, but let's investigate further.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Knafaim Holdings:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.057 = US$13m ÷ (US$254m - US$33m) (Based on the trailing twelve months to September 2021).

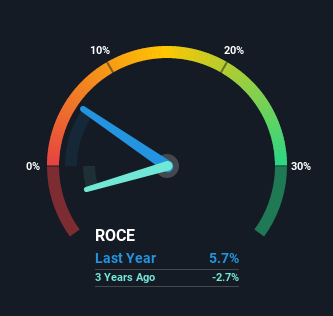

Therefore, Knafaim Holdings has an ROCE of 5.7%. On its own that's a low return, but compared to the average of 3.9% generated by the Airlines industry, it's much better.

View our latest analysis for Knafaim Holdings

Historical performance is a great place to start when researching a stock so above you can see the gauge for Knafaim Holdings' ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Knafaim Holdings, check out these free graphs here.

What Can We Tell From Knafaim Holdings' ROCE Trend?

The trend of returns that Knafaim Holdings is generating are raising some concerns. The company used to generate 13% on its capital five years ago but it has since fallen noticeably. In addition to that, Knafaim Holdings is now employing 83% less capital than it was five years ago. When you see both ROCE and capital employed diminishing, it can often be a sign of a mature and shrinking business that might be in structural decline. If these underlying trends continue, we wouldn't be too optimistic going forward.

On a related note, Knafaim Holdings has decreased its current liabilities to 13% of total assets. That could partly explain why the ROCE has dropped. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

What We Can Learn From Knafaim Holdings' ROCE

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. It should come as no surprise then that the stock has fallen 68% over the last five years, so it looks like investors are recognizing these changes. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

If you want to know some of the risks facing Knafaim Holdings we've found 3 warning signs (1 can't be ignored!) that you should be aware of before investing here.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Knafaim Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:KNFM

Knafaim Holdings

Through its subsidiaries, operates in the aviation industry worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026