Wanguo Gold Group And 2 Other Undiscovered Gems With Solid Potential

Reviewed by Simply Wall St

In recent weeks, global markets have shown a mixed performance with major indexes like the S&P 500 and Nasdaq hitting record highs, while small-cap stocks represented by the Russell 2000 have faced some challenges. Amidst this backdrop of diverging market trends and economic indicators such as job growth rebounding in November, investors are increasingly on the lookout for undiscovered gems that may offer solid potential despite broader market volatility. Identifying promising stocks often involves looking beyond current headlines to assess fundamental strengths and growth opportunities within companies that may not yet be widely recognized.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Wanguo Gold Group (SEHK:3939)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wanguo Gold Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in China and the Solomon Islands, with a market cap of HK$12.49 billion.

Operations: The company generates revenue primarily from its Yifeng and Solomon projects, with the Solomon Project contributing CN¥912.63 million and the Yifeng Project CN¥749.25 million.

Wanguo Gold Group, a player in the mining sector, has showcased impressive earnings growth of 89.9% over the past year, significantly outpacing the industry average of 22.8%. Despite this growth, shareholders experienced dilution due to recent equity offerings totaling HK$1.38 billion at HK$8.33 per share. The company's debt-to-equity ratio rose from 13.9% to 16.3% over five years, indicating increased leverage but with interest payments well-covered by EBIT at a multiple of 91.7x. Recent board changes include Ms. Gao Jinzhu's appointment as an executive director, bringing extensive industry experience back into leadership roles.

- Delve into the full analysis health report here for a deeper understanding of Wanguo Gold Group.

Examine Wanguo Gold Group's past performance report to understand how it has performed in the past.

Inspur Digital Enterprise Technology (SEHK:596)

Simply Wall St Value Rating: ★★★★★☆

Overview: Inspur Digital Enterprise Technology Limited is an investment holding company that offers software development, other software services, and cloud services in the People’s Republic of China, with a market cap of approximately HK$4.18 billion.

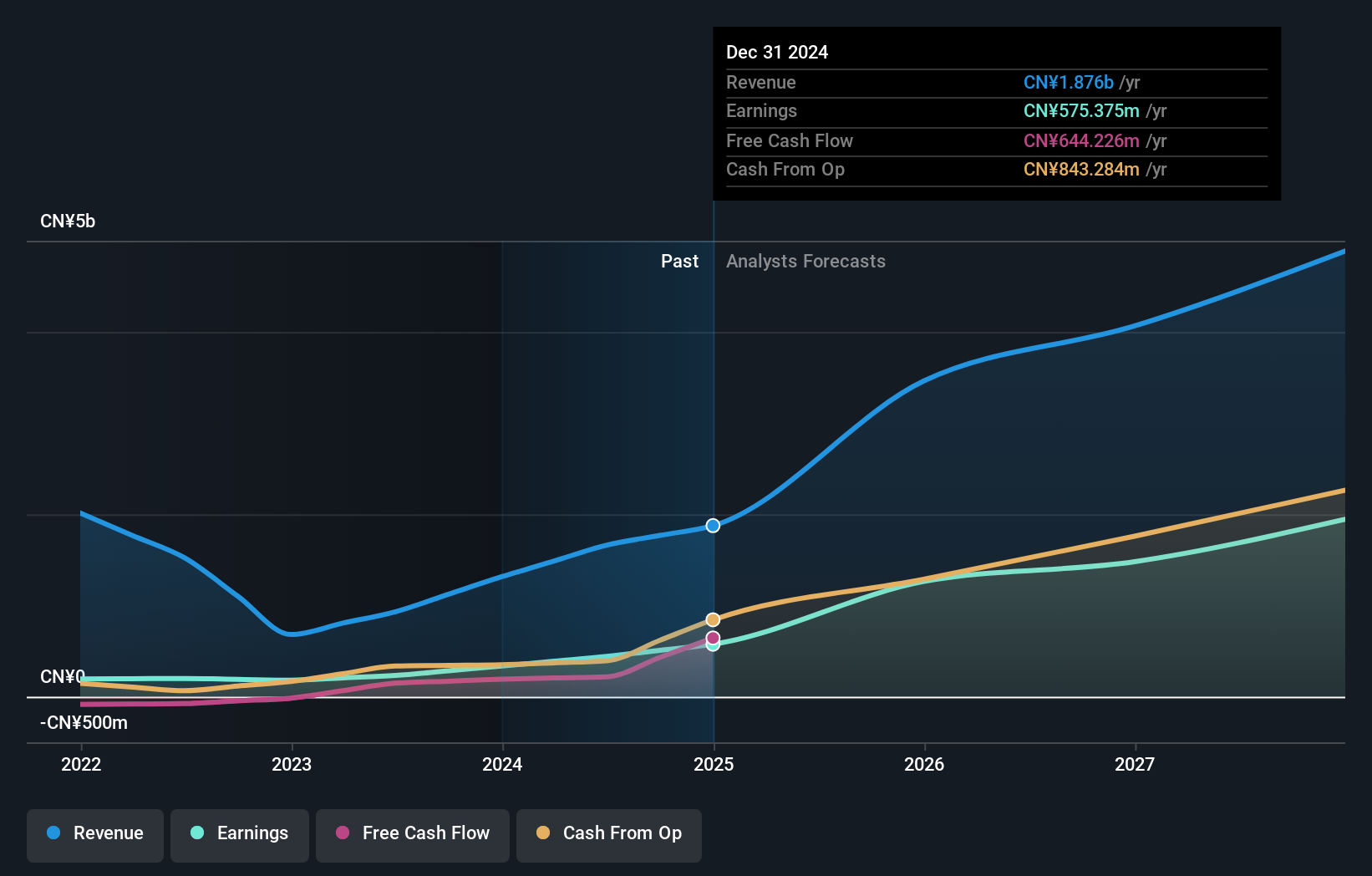

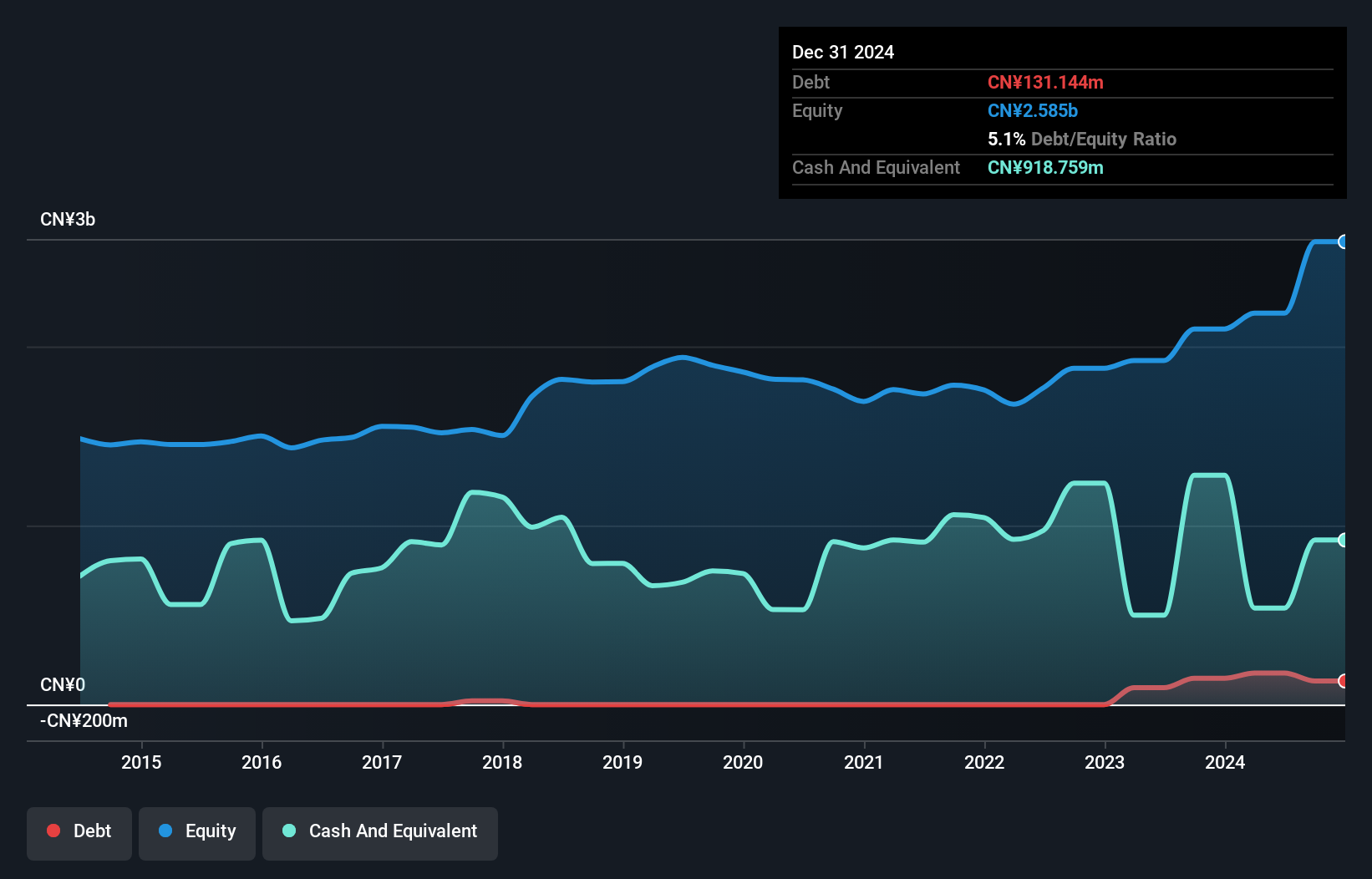

Operations: Inspur Digital Enterprise Technology derives its revenue primarily from three segments: Internet of Things (IoT) Solutions at CN¥3.53 billion, Management Software at CN¥2.55 billion, and Cloud Services at CN¥2.26 billion. The company's net profit margin is a key indicator to consider when evaluating financial performance trends over time.

Inspur Digital Enterprise Technology, a promising player in the tech space, is trading at 80.4% below its estimated fair value, suggesting potential undervaluation. The company's earnings grew by an impressive 84.5% over the past year, outpacing the broader software industry growth of 16.9%. Despite a rise in its debt-to-equity ratio from 0% to 8% over five years, Inspur's interest payments are comfortably covered by EBIT at a multiple of 251x. With more cash than total debt and high-quality earnings, Inspur seems well-positioned for continued profitability and growth in the competitive tech landscape.

Partner Communications (TASE:PTNR)

Simply Wall St Value Rating: ★★★★★★

Overview: Partner Communications Company Ltd. offers a range of communication services in Israel and has a market capitalization of ₪4.22 billion.

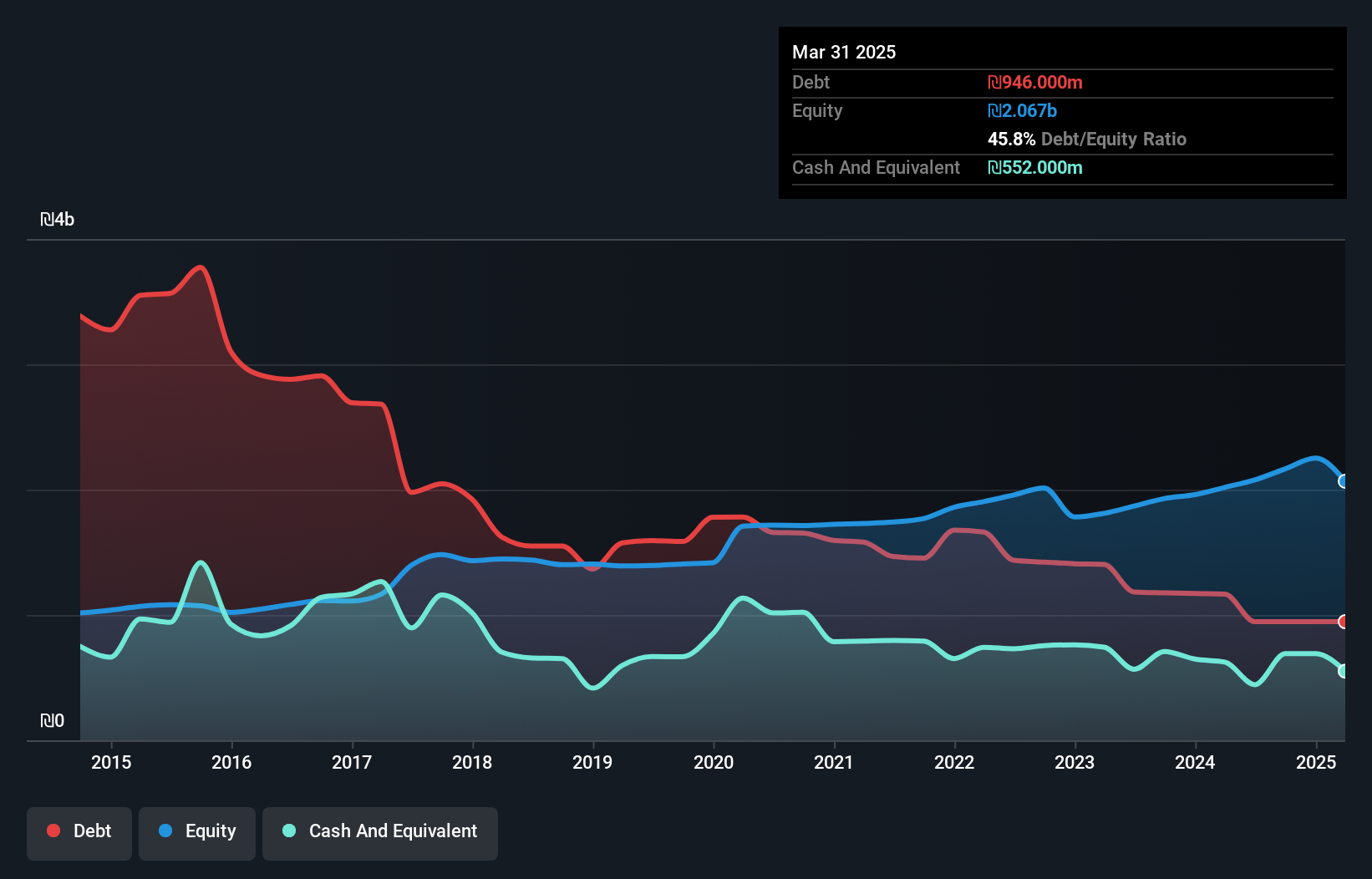

Operations: Partner Communications generates revenue primarily from its Cellular Segment, accounting for ₪2.09 billion, and its Stationary Segment, contributing ₪1.33 billion.

Partner Communications, a modestly sized player in the telecom sector, has shown notable financial resilience. This year marked its transition to profitability, with net income for Q3 reaching ILS 85 million compared to ILS 56 million last year. The company trades at an attractive 40.5% below its estimated fair value and demonstrates high-quality earnings. Its debt management is commendable; the net debt to equity ratio improved from 112.7% five years ago to a satisfactory 43.7%. Despite recent share price volatility, Partner's EBIT covers interest payments comfortably at 15.3 times, indicating robust financial health amidst industry challenges.

- Get an in-depth perspective on Partner Communications' performance by reading our health report here.

Understand Partner Communications' track record by examining our Past report.

Where To Now?

- Click through to start exploring the rest of the 4625 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:596

Inspur Digital Enterprise Technology

An investment holding company, engages in management software development, cloud services, and sale of Internet of Things (IoT) solutions in the People’s Republic of China.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives