- Israel

- /

- Wireless Telecom

- /

- TASE:PTNR

Partner Communications (TASE:PTNR): Assessing Valuation After Q3 2025 Earnings Show Profit Growth but Lower Revenue

Reviewed by Simply Wall St

Partner Communications (TASE:PTNR) just reported third quarter 2025 earnings, and the headline is a classic trade off: revenue slipped, but profits and earnings per share moved higher versus last year.

See our latest analysis for Partner Communications.

The market seems to be rewarding that profitability shift, with a 1 month share price return of 15.5 percent and a 46.1 percent year to date share price gain. The 1 year total shareholder return of 89.8 percent suggests momentum has been building rather than fading.

If these results have you rethinking where growth could come from next, it might be worth scanning fast growing stocks with high insider ownership for other under the radar ideas with aligned leadership incentives.

Yet with earnings rising, revenue slipping, and the share price sitting slightly above analyst targets but below some intrinsic estimates, is the recent rally a genuine buying opportunity, or is the market already pricing in future growth?

Price to earnings of 23.6x: Is it justified?

On a price to earnings basis, Partner Communications trades on 23.6 times earnings, which looks expensive versus both local and regional peers at the current ₪38.63 share price.

The price to earnings ratio compares what investors are paying today for each unit of current profit. It is a common yardstick for mature, consistently profitable telecom operators like Partner Communications.

With earnings having grown at a rapid clip in recent years and margins improving, the market appears willing to ascribe a richer multiple, effectively pricing in a continuation of that strong profitability trend rather than a slowdown.

However, compared with the Asian Wireless Telecom industry average of 20.1 times and a peer group average of 17.1 times, the stock carries a noticeably higher valuation that suggests investors are paying a premium for its recent performance.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to earnings of 23.6x (OVERVALUED)

However, investors still face risks if revenue decline persists or competitive pressure on pricing and fiber investments squeezes margins faster than expected.

Find out about the key risks to this Partner Communications narrative.

Another View: DCF points the other way

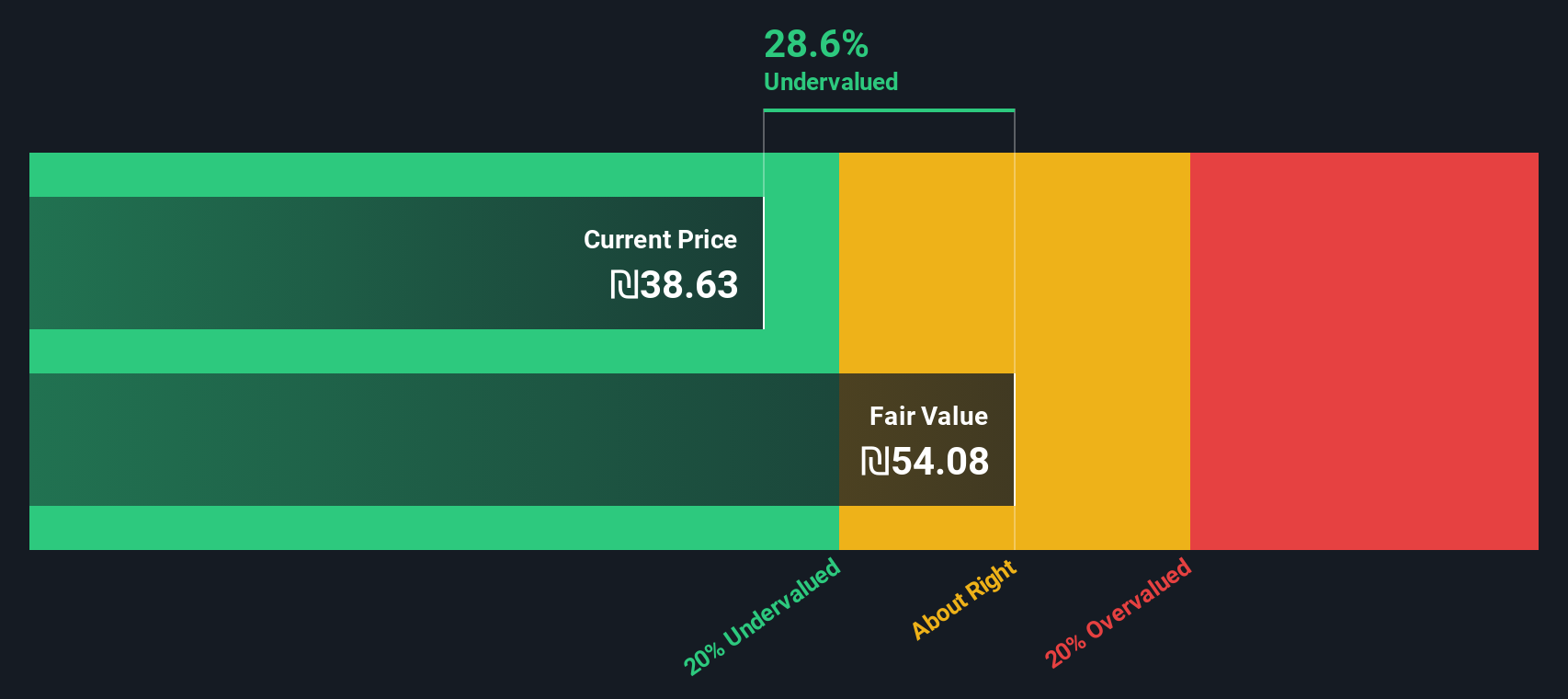

While the price to earnings ratio looks stretched, our DCF model paints a different picture. It suggests fair value around ₪54.08 per share, roughly 28.6 percent above today’s ₪38.63 price, implying the market might still be underestimating long term cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Partner Communications for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Partner Communications Narrative

If you see the numbers differently or simply want to dig into the data yourself, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Partner Communications.

Ready for your next investing move?

Act now and put your research momentum to work by scanning targeted stock ideas with the Simply Wall St Screener, so promising opportunities never slip past you.

- Capture potential bargains early by tracking these 920 undervalued stocks based on cash flows that the market may be overlooking despite strong underlying cash flows.

- Position your portfolio for innovation by focusing on these 25 AI penny stocks at the forefront of artificial intelligence driven disruption.

- Strengthen your income stream by zeroing in on these 14 dividend stocks with yields > 3% that could help support reliable long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PTNR

Partner Communications

Provides various communication services in Israel.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026