- Israel

- /

- Telecom Services and Carriers

- /

- TASE:BEZQ

What Bezeq The Israel Telecommunication Corp. Ltd's (TLV:BEZQ) P/E Is Not Telling You

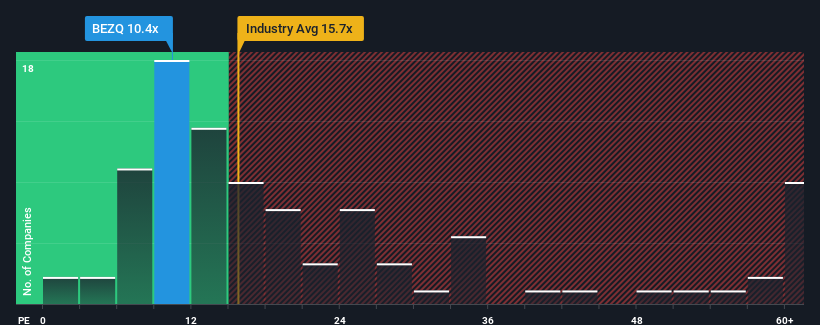

There wouldn't be many who think Bezeq The Israel Telecommunication Corp. Ltd's (TLV:BEZQ) price-to-earnings (or "P/E") ratio of 10.4x is worth a mention when the median P/E in Israel is similar at about 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Bezeq The Israel Telecommunication certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Bezeq The Israel Telecommunication

Is There Some Growth For Bezeq The Israel Telecommunication?

In order to justify its P/E ratio, Bezeq The Israel Telecommunication would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 19% gain to the company's bottom line. The latest three year period has also seen an excellent 49% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 3.9% per year during the coming three years according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to expand by 21% per year, which is noticeably more attractive.

In light of this, it's curious that Bezeq The Israel Telecommunication's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Bezeq The Israel Telecommunication currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about these 2 warning signs we've spotted with Bezeq The Israel Telecommunication.

If these risks are making you reconsider your opinion on Bezeq The Israel Telecommunication, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bezeq The Israel Telecommunication might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:BEZQ

Bezeq The Israel Telecommunication

Provides communications services to business and private customers in Israel.

Good value with adequate balance sheet.