- Israel

- /

- Telecom Services and Carriers

- /

- TASE:BEZQ

Unpleasant Surprises Could Be In Store For Bezeq The Israel Telecommunication Corp. Ltd's (TLV:BEZQ) Shares

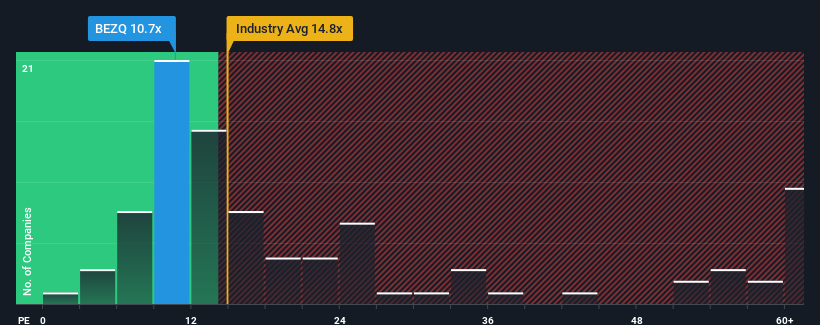

With a median price-to-earnings (or "P/E") ratio of close to 12x in Israel, you could be forgiven for feeling indifferent about Bezeq The Israel Telecommunication Corp. Ltd's (TLV:BEZQ) P/E ratio of 10.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent earnings growth for Bezeq The Israel Telecommunication has been in line with the market. The P/E is probably moderate because investors think this modest earnings performance will continue. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Check out our latest analysis for Bezeq The Israel Telecommunication

Is There Some Growth For Bezeq The Israel Telecommunication?

Bezeq The Israel Telecommunication's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a worthy increase of 2.5%. EPS has also lifted 26% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 6.6% per annum during the coming three years according to the three analysts following the company. Meanwhile, the rest of the market is forecast to expand by 14% per year, which is noticeably more attractive.

With this information, we find it interesting that Bezeq The Israel Telecommunication is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Bezeq The Israel Telecommunication's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Bezeq The Israel Telecommunication that you need to be mindful of.

If you're unsure about the strength of Bezeq The Israel Telecommunication's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Bezeq The Israel Telecommunication might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:BEZQ

Bezeq The Israel Telecommunication

Provides communications services to business and private customers in Israel.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives