- Israel

- /

- Telecom Services and Carriers

- /

- TASE:BEZQ

A Look At Bezeq The Israel Telecommunication's (TLV:BEZQ) Share Price Returns

The main aim of stock picking is to find the market-beating stocks. But even the best stock picker will only win with some selections. So we wouldn't blame long term Bezeq The Israel Telecommunication Corporation Limited (TLV:BEZQ) shareholders for doubting their decision to hold, with the stock down 54% over a half decade. The good news is that the stock is up 4.7% in the last week.

View our latest analysis for Bezeq The Israel Telecommunication

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Bezeq The Israel Telecommunication moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

The revenue decline of 2.5% isn't too bad. But if the market expected durable top line growth, then that could explain the share price weakness.

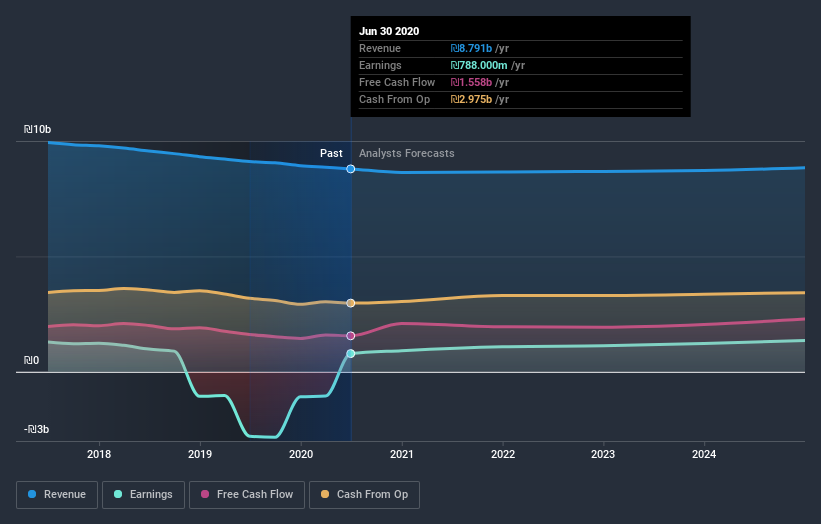

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Bezeq The Israel Telecommunication has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Bezeq The Israel Telecommunication

What about the Total Shareholder Return (TSR)?

We've already covered Bezeq The Israel Telecommunication's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Bezeq The Israel Telecommunication's TSR, which was a 43% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We're pleased to report that Bezeq The Israel Telecommunication shareholders have received a total shareholder return of 34% over one year. There's no doubt those recent returns are much better than the TSR loss of 7% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Bezeq The Israel Telecommunication has 2 warning signs we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

If you decide to trade Bezeq The Israel Telecommunication, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bezeq The Israel Telecommunication might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TASE:BEZQ

Bezeq The Israel Telecommunication

Provides communications services to business and private customers in Israel.

Good value with adequate balance sheet.