- Israel

- /

- Electronic Equipment and Components

- /

- TASE:TLSY

Investors Holding Back On Telsys Ltd. (TLV:TLSY)

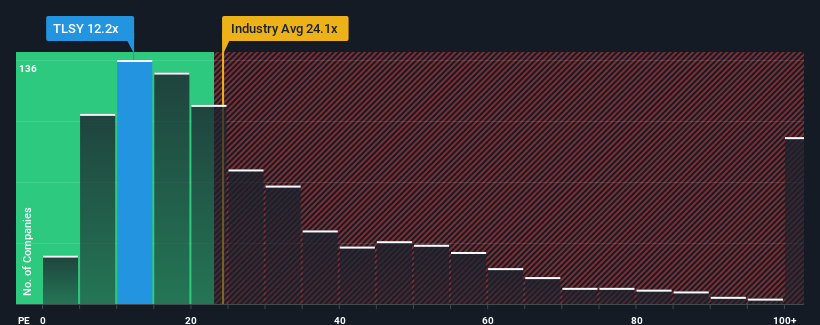

It's not a stretch to say that Telsys Ltd.'s (TLV:TLSY) price-to-earnings (or "P/E") ratio of 12.2x right now seems quite "middle-of-the-road" compared to the market in Israel, where the median P/E ratio is around 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's exceedingly strong of late, Telsys has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Telsys

Does Growth Match The P/E?

Telsys' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 38%. The latest three year period has also seen an excellent 133% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 12% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it interesting that Telsys is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Telsys' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Telsys currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Having said that, be aware Telsys is showing 3 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Telsys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:TLSY

Telsys

Telsys Ltd. markets and distributes electronic components and open tools in Israel.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026