- Israel

- /

- Electronic Equipment and Components

- /

- TASE:NYAX

Nayax (TASE:NYAX) Valuation in Focus After Securing ChargeSmart EV Payments Partnership

Reviewed by Kshitija Bhandaru

Nayax (TASE:NYAX) just signed a long-term deal to become ChargeSmart EV’s preferred cashless payments provider. Its technology will be integrated into thousands of fast-growing U.S. electric vehicle charging sites.

See our latest analysis for Nayax.

This ChargeSmart partnership arrives as Nayax has been riding strong momentum, with a 1-year total shareholder return of 66.84% and an 11.4% 3-month share price return fueling investor confidence. Shares have climbed 47.61% year-to-date, reflecting growing optimism around both recurring deals and the company’s long-term growth potential.

If you’re interested in other tech-driven companies shaking up their markets, take the next step and discover the full list in our See the full list for free..

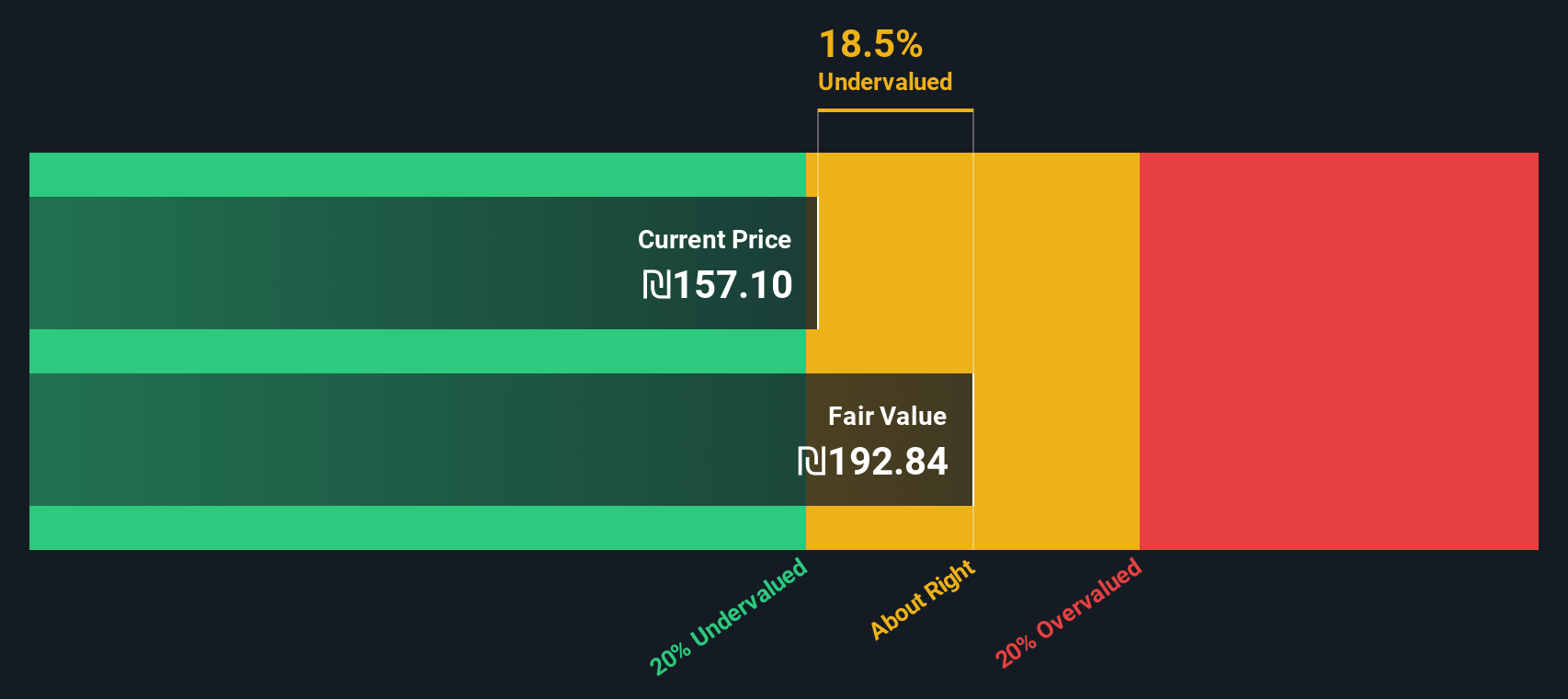

But with so much optimism already driving Nayax’s rapid share price gains, the key question now is whether the stock remains undervalued or if Wall Street is already pricing in the company’s next stage of growth. Is there a real buying opportunity, or has the rally captured all the upside?

Most Popular Narrative: 4.3% Overvalued

With Nayax closing at ₪160.3 and the most-followed narrative pointing to a fair value of ₪153.68, the recent rally has set expectations high. Here is what is driving this conviction and what might be fueling further debate.

Strategic M&A and international expansion, particularly the integration of recent acquisitions and entry into underpenetrated regions like Brazil and Benelux, are providing operational leverage, scale, and synergies that boost both revenue growth rates and profitability, evidenced by annualized gross margin improvements and operating margin gains.

Analysts are betting that Nayax’s future growth will not just be fueled by more customers, but by a transformation in how the company earns and scales profits. The driving force is a projection for much stronger margins and a profit multiple that signals belief in years of high-octane expansion. What bold financial and operational forecasts power this premium price target? The full narrative lays out the surprisingly aggressive assumptions that support the valuation and whether they are justified.

Result: Fair Value of ₪153.68 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition among payment providers and stricter global data regulations could limit Nayax’s future margin expansion and recurring revenue growth.

Find out about the key risks to this Nayax narrative.

Another View: SWS DCF Model Says Undervalued

Looking at the SWS DCF model, Nayax is valued quite differently. Our estimate of fair value is ₪191.59 per share, about 16% above the current price. This suggests a potential opportunity that stands in contrast to the consensus analyst view. Could the gap signal upside being missed?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nayax for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nayax Narrative

If you have your own perspective or want to dive deeper into the data, you can analyze the numbers directly and shape a personal view in under three minutes, then Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Nayax.

Looking for More Winning Investment Ideas?

Don’t let your next big opportunity slip away. Uncover high-potential stocks and fresh strategies using these powerful tools trusted by savvy investors worldwide:

- Boost your income and minimize risk by targeting reliable cash payouts in these 19 dividend stocks with yields > 3% with yields above 3%.

- Accelerate your portfolio’s growth by focusing on future-defining innovation through these 25 AI penny stocks that are positioned for AI breakthroughs.

- Get ahead of the crowd and spot strong businesses flying under the radar in these 887 undervalued stocks based on cash flows by evaluating their cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nayax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NYAX

Nayax

A fintech company, develops a complete solution for automated self-service retailers, commerce, and other merchants in the United States, Europe, the United Kingdom, Australia, Israel, and rest of the world.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives