- Israel

- /

- Electronic Equipment and Components

- /

- TASE:ININ

Investors Holding Back On Inter Industries Plus Ltd (TLV:ININ)

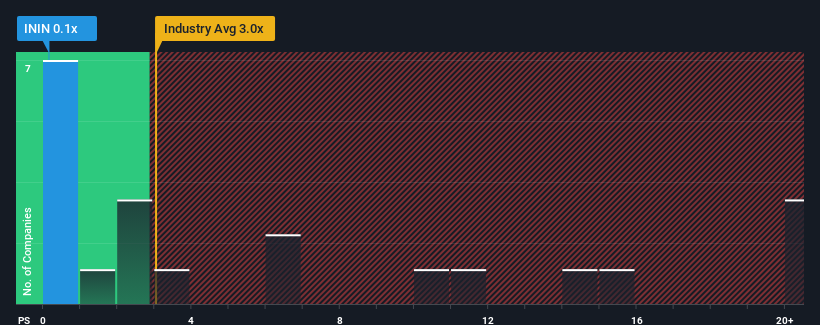

You may think that with a price-to-sales (or "P/S") ratio of 0.1x Inter Industries Plus Ltd (TLV:ININ) is definitely a stock worth checking out, seeing as almost half of all the Electronic companies in Israel have P/S ratios greater than 3x and even P/S above 12x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Inter Industries Plus

What Does Inter Industries Plus' P/S Mean For Shareholders?

For example, consider that Inter Industries Plus' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Inter Industries Plus' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Inter Industries Plus' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 4.1% decrease to the company's top line. Still, the latest three year period has seen an excellent 102% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 18%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that Inter Industries Plus' P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Inter Industries Plus currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Before you take the next step, you should know about the 3 warning signs for Inter Industries Plus (2 don't sit too well with us!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ININ

Inter Industries Plus

Engages in the energy and infrastructure businesses in Israel.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.