As the Middle East markets experience a resurgence, driven by rising oil prices and positive economic indicators, UAE stocks have seen notable gains with Dubai's main market hitting a fresh 17-year peak. In this dynamic environment, identifying promising stocks involves looking for those that can capitalize on regional growth trends and sector-specific opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 50.97% | 56.63% | ★★★★★★ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.53% | 7.56% | 49.01% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.80% | 49.41% | 66.89% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 6.88% | 51.77% | 67.59% | ★★★★★☆ |

| Segmen Kardesler Gida Üretim ve Ambalaj Sanayi Anonim Sirketi | 2.02% | -10.23% | 74.54% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 12.49% | -23.32% | 41.51% | ★★★★☆☆ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 43.01% | 40.80% | -34.83% | ★★★★☆☆ |

| Dogan Burda Dergi Yayincilik Ve Pazarlama | 64.82% | 46.23% | -12.39% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sun Tekstil Sanayi ve Ticaret (IBSE:SUNTK)

Simply Wall St Value Rating: ★★★★★★

Overview: Sun Tekstil Sanayi ve Ticaret A.S. is engaged in designing, producing, and selling knit fabrics and ready-made womenswear garments both in Turkey and internationally, with a market cap of TRY19.37 billion.

Operations: Sun Tekstil generates revenue primarily from ready-made womenswear garments (TRY8.26 billion) and fabric production (TRY3.01 billion). The company has experienced eliminations amounting to TRY87.05 million in its financial reporting.

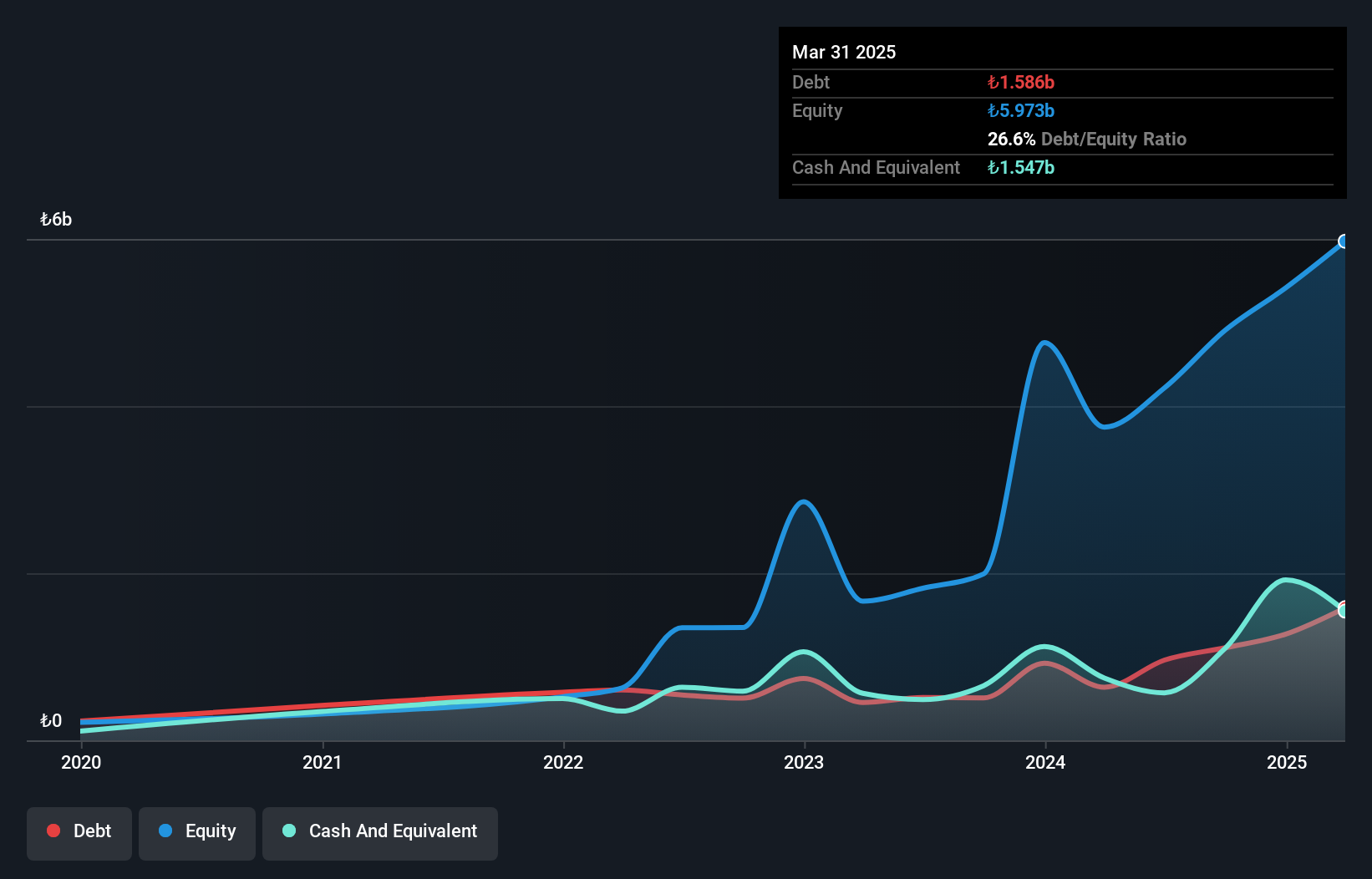

Sun Tekstil Sanayi ve Ticaret, a promising player in the Middle East textile sector, showcases impressive growth with earnings surging 142.1% over the past year, outpacing the industry average. The company's debt to equity ratio has significantly improved from 115.3% to a satisfactory 26.6% over five years, reflecting strong financial management. Despite volatile share prices recently, Sun Tekstil's net income for Q1 2025 stood at TRY 14.81 million compared to a loss last year of TRY 62.53 million, highlighting robust recovery efforts and potential for future stability amidst industry challenges.

- Click here to discover the nuances of Sun Tekstil Sanayi ve Ticaret with our detailed analytical health report.

Gain insights into Sun Tekstil Sanayi ve Ticaret's past trends and performance with our Past report.

Computer Direct Group (TASE:CMDR)

Simply Wall St Value Rating: ★★★★★★

Overview: Computer Direct Group Ltd. operates in the computing and software sector in Israel, with a market capitalization of ₪1.60 billion.

Operations: Computer Direct Group generates revenue primarily from Technological Solutions and Services, Management Consulting and Value-Added Services (₪2.57 billion), followed by Infrastructure and Computing (₪1.28 billion), and Outsourcing of Business Processes and Technology Support Centers (₪326.89 million).

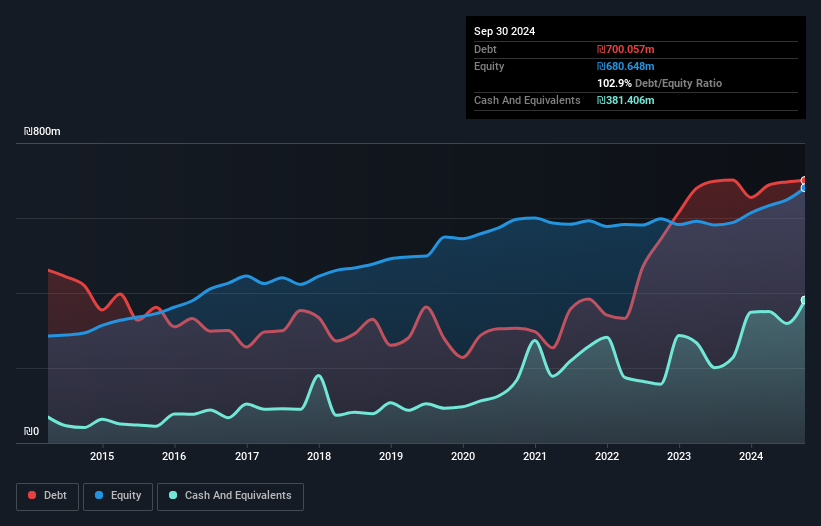

Computer Direct Group, a smaller player in the IT sector, showcases robust financial health with high-quality earnings and a significant reduction in its debt to equity ratio from 83.9% to 21.8% over five years. Its recent earnings report highlights sales of ILS 1.13 billion and net income of ILS 22.17 million for Q1 2025, reflecting steady growth compared to last year’s figures. The company has more cash than total debt, ensuring stability, while its interest payments are well-covered by EBIT at a ratio of 25.6x, indicating strong operational efficiency despite not outpacing industry growth rates recently at 22.9%.

- Click to explore a detailed breakdown of our findings in Computer Direct Group's health report.

Explore historical data to track Computer Direct Group's performance over time in our Past section.

Malam - Team (TASE:MLTM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Malam - Team Ltd is an Israeli company specializing in information technology services, with a market capitalization of ₪2.39 billion.

Operations: Malam - Team Ltd generates revenue primarily from three segments: Hardware and Cloud Infrastructure at ₪2.07 billion, Software, Projects, and Business Solutions at ₪1.44 billion, and Salary Service, Human Resources, and Long-Term Savings at ₪327.87 million. The company incurs consolidation adjustments of -₪44.81 million affecting its overall financials.

Malam - Team, a nimble player in the IT sector, has seen its earnings surge by 48.9% over the past year, outpacing the industry average of 25.1%. Recent first-quarter results show sales hitting ILS 1 billion and net income reaching ILS 30 million, both reflecting solid improvements from last year. However, with a debt-to-equity ratio climbing to 89.7% over five years and a net debt to equity ratio at 44.9%, concerns about leverage arise despite interest payments being well-covered by EBIT at a multiple of 4.1x. The company trades slightly below its estimated fair value by around 0.6%.

- Delve into the full analysis health report here for a deeper understanding of Malam - Team.

Understand Malam - Team's track record by examining our Past report.

Taking Advantage

- Dive into all 224 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:CMDR

Computer Direct Group

Engages in the computing and software business in Israel.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives