Adi Eyal is the CEO of Computer Direct Group Ltd. (TLV:CMDR), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also assess whether Computer Direct Group pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Computer Direct Group

Comparing Computer Direct Group Ltd.'s CEO Compensation With the industry

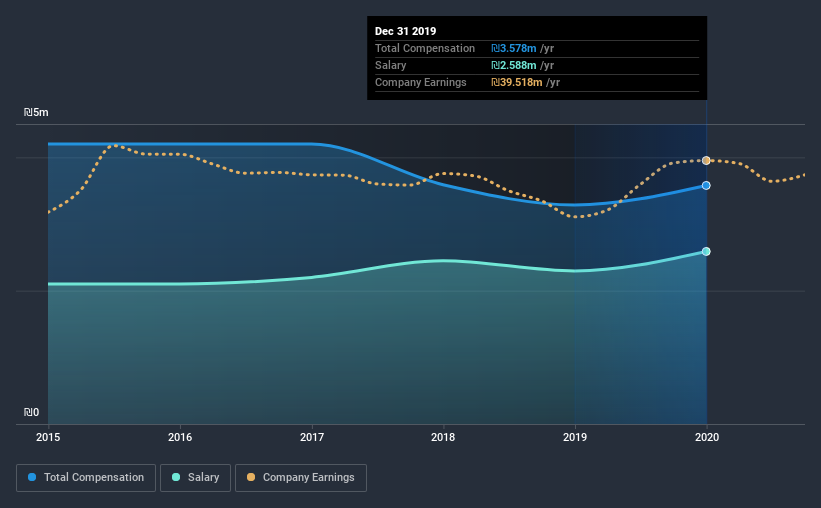

Our data indicates that Computer Direct Group Ltd. has a market capitalization of ₪781m, and total annual CEO compensation was reported as ₪3.6m for the year to December 2019. That's a notable increase of 8.9% on last year. Notably, the salary which is ₪2.59m, represents most of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between ₪325m and ₪1.3b, we discovered that the median CEO total compensation of that group was ₪997k. Hence, we can conclude that Adi Eyal is remunerated higher than the industry median. Furthermore, Adi Eyal directly owns ₪600m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | ₪2.6m | ₪2.3m | 72% |

| Other | ₪990k | ₪990k | 28% |

| Total Compensation | ₪3.6m | ₪3.3m | 100% |

On an industry level, roughly 76% of total compensation represents salary and 24% is other remuneration. There isn't a significant difference between Computer Direct Group and the broader market, in terms of salary allocation in the overall compensation package. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Computer Direct Group Ltd.'s Growth Numbers

Over the past three years, Computer Direct Group Ltd. has seen its earnings per share (EPS) grow by 1.4% per year. In the last year, its revenue is up 7.7%.

We're not particularly impressed by the revenue growth, but we're happy with the modest EPS growth. Considering these factors we'd say performance has been pretty decent, though not amazing. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Computer Direct Group Ltd. Been A Good Investment?

Most shareholders would probably be pleased with Computer Direct Group Ltd. for providing a total return of 203% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

As we touched on above, Computer Direct Group Ltd. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Still, shareholder returns for the company are very impressive for the last three years. That's why we were hoping EPS growth would match this growth, but sadly that is not the case. So, although we would've liked to see stronger EPS growth, positive investor returns lead us to believe CEO compensation is reasonable.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for Computer Direct Group (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Computer Direct Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TASE:CMDR

Computer Direct Group

Engages in the computing and software business in Israel.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion