Computer Direct Group Ltd. (TLV:CMDR) stock is about to trade ex-dividend in 2 days. Investors can purchase shares before the 9th of December in order to be eligible for this dividend, which will be paid on the 22nd of December.

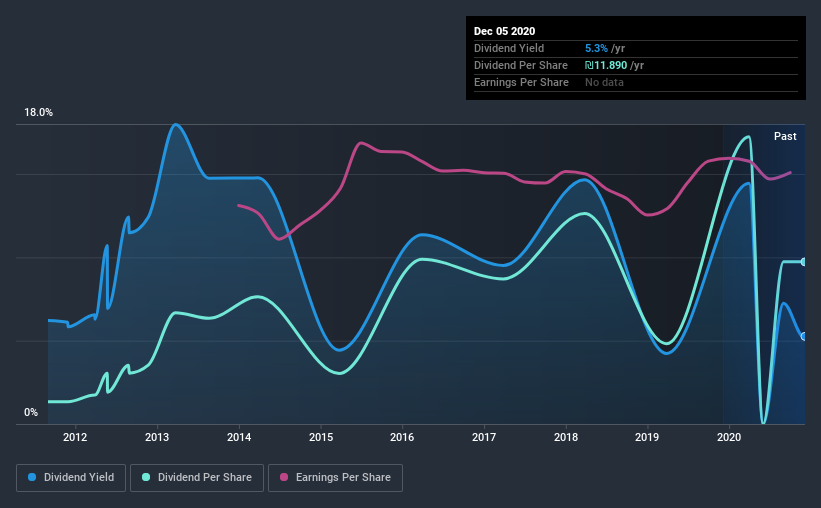

Computer Direct Group's next dividend payment will be ₪1.89 per share. Last year, in total, the company distributed ₪11.89 to shareholders. Based on the last year's worth of payments, Computer Direct Group stock has a trailing yield of around 5.3% on the current share price of ₪226.1. If you buy this business for its dividend, you should have an idea of whether Computer Direct Group's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Computer Direct Group

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Computer Direct Group distributed an unsustainably high 117% of its profit as dividends to shareholders last year. Without extenuating circumstances, we'd consider the dividend at risk of a cut. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. What's good is that dividends were well covered by free cash flow, with the company paying out 23% of its cash flow last year.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Computer Direct Group fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Click here to see how much of its profit Computer Direct Group paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're encouraged by the steady growth at Computer Direct Group, with earnings per share up 3.3% on average over the last five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Computer Direct Group has delivered 25% dividend growth per year on average over the past nine years. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

Final Takeaway

Is Computer Direct Group an attractive dividend stock, or better left on the shelf? Earnings per share have grown modestly, and last year Computer Direct Group paid out a low percentage of its cash flow. However, its dividend payments were not well covered by profits. In summary, while it has some positive characteristics, we're not inclined to race out and buy Computer Direct Group today.

With that being said, if dividends aren't your biggest concern with Computer Direct Group, you should know about the other risks facing this business. For example, we've found 4 warning signs for Computer Direct Group (1 is potentially serious!) that deserve your attention before investing in the shares.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Computer Direct Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TASE:CMDR

Computer Direct Group

Engages in the computing and software business in Israel.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)