- Israel

- /

- Specialty Stores

- /

- TASE:URBC

Discovering Middle East's Hidden Stock Gems May 2025

Reviewed by Simply Wall St

As the Middle East's markets experience a mixed performance, with Gulf bourses generally gaining on renewed US-China trade talks and economic indicators showing varied results across the region, investors are increasingly looking for opportunities in underexplored areas. In this environment, identifying stocks that demonstrate resilience and potential for growth amidst global uncertainties can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Bulbuloglu Vinc Sanayi ve Ticaret Anonim Sirketi | 13.42% | 32.03% | 47.24% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 14.46% | 58.05% | 72.63% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi (IBSE:BANVT)

Simply Wall St Value Rating: ★★★★★★

Overview: Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi operates as a food company in Turkey and has a market capitalization of TRY21.74 billion.

Operations: Banvit generates revenue primarily from its operations in the food sector within Turkey. The company has a market capitalization of TRY21.74 billion.

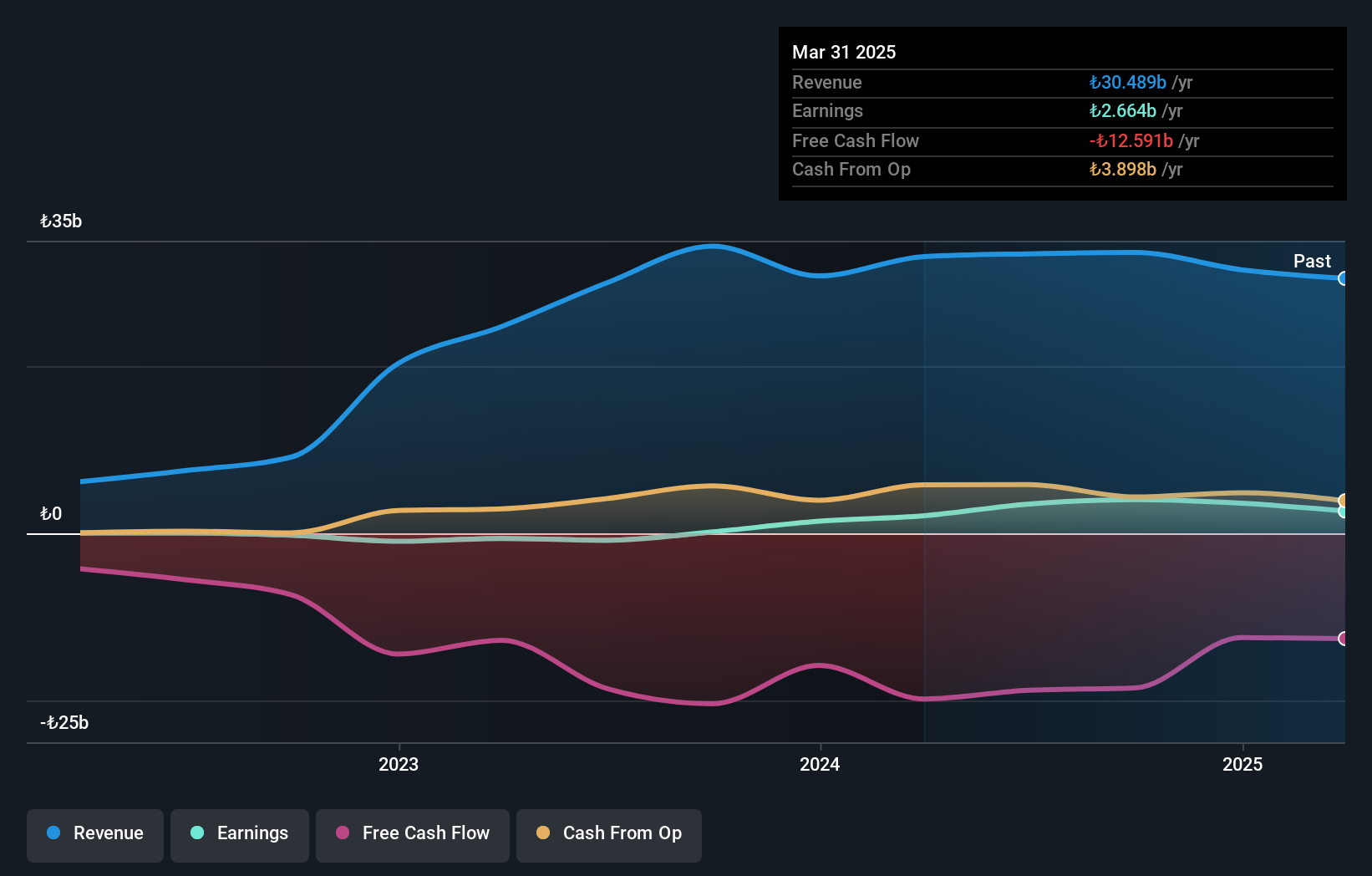

Banvit Bandirma has shown impressive earnings growth, with a 259% increase over the past year, outpacing the food industry's -10.3%. Despite reporting a first-quarter net loss of TRY 14.16 million in 2025 compared to a net income of TRY 920.46 million last year, its full-year results for 2024 reflected strong performance with sales reaching TRY 31.53 billion and net income at TRY 3.60 billion, up from TRY 1.37 billion previously. The company appears to be trading at an attractive valuation with a price-to-earnings ratio of just six times compared to the TR market's eighteen times, suggesting potential value for investors seeking opportunities in emerging markets like Turkey's food sector.

Thob Al Aseel (SASE:4012)

Simply Wall St Value Rating: ★★★★★★

Overview: Thob Al Aseel Company engages in the development, import, export, wholesale, and retail of fabrics and readymade clothes with a market capitalization of SAR1.58 billion.

Operations: Thob Al Aseel generates revenue primarily from two segments: Thobs, contributing SAR398.77 million, and Fabrics, adding SAR123.70 million.

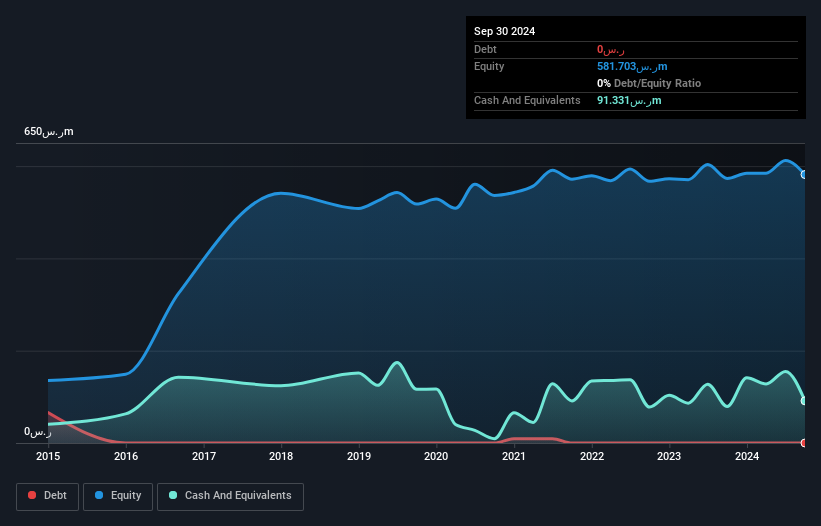

Thob Al Aseel, a promising player in the Middle Eastern market, is trading at 37.9% below its estimated fair value, suggesting potential for growth. Despite a slight dip in sales to SAR 522 million from SAR 532 million last year, net income rose to SAR 83.9 million from SAR 76.92 million, reflecting improved profitability with basic earnings per share increasing to SAR 0.21 from SAR 0.19. The company remains debt-free and boasts high-quality earnings over the past five years with consistent free cash flow generation; however, its recent annual growth of 9.1% slightly lags behind the luxury industry's pace of 10.7%.

- Unlock comprehensive insights into our analysis of Thob Al Aseel stock in this health report.

Gain insights into Thob Al Aseel's historical performance by reviewing our past performance report.

Urbanica (Palo) Retail (TASE:URBC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Urbanica (Palo) Retail Ltd focuses on designing, purchasing, marketing, and retailing clothing for women, men, and children in Israel with a market cap of ₪1.55 billion.

Operations: Urbanica generates revenue primarily from fashion clothing and accessories, with sales figures of ₪472.50 million and ₪131.24 million, respectively.

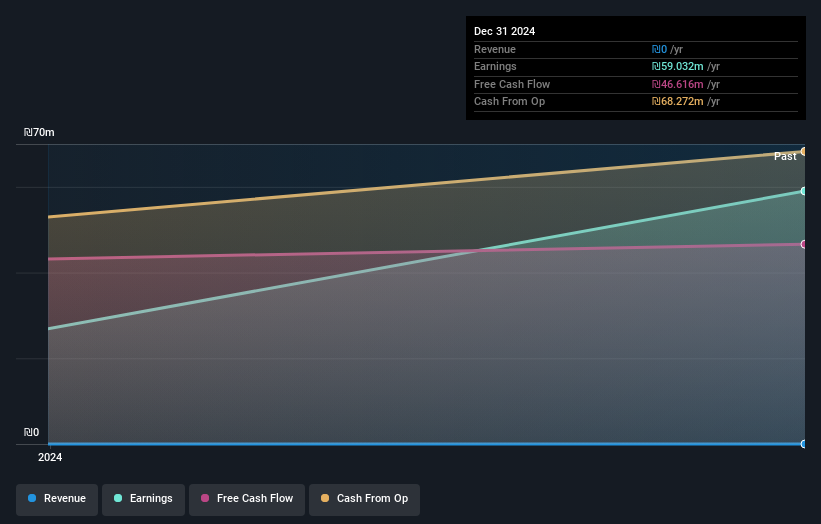

Urbanica Retail, a niche player in the Middle East retail sector, has shown impressive earnings growth of 119% over the past year, outpacing the Specialty Retail industry average of 66%. With no debt on its books, Urbanica's financial health is solid. Despite generating less than US$1 million in revenue (₪0), it boasts high-quality earnings and positive free cash flow, which reached ₪46.62 million recently. The company has filed for an IPO worth ILS 410 million to offer ordinary shares at ILS 10 each, signaling potential expansion plans. However, shares are highly illiquid and should be considered carefully by investors.

- Get an in-depth perspective on Urbanica (Palo) Retail's performance by reading our health report here.

Assess Urbanica (Palo) Retail's past performance with our detailed historical performance reports.

Seize The Opportunity

- Delve into our full catalog of 242 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:URBC

Urbanica (Palo) Retail

Engages in the designing, purchasing, marketing, and retail sale of clothing for women, men, and children in Israel.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives