- Israel

- /

- Specialty Stores

- /

- TASE:FOX

Undiscovered Gems in Middle East Stocks July 2025

Reviewed by Simply Wall St

In recent months, most Gulf markets have shown resilience by closing higher despite global trade tensions, with the Abu Dhabi index marking its sixth consecutive session of gains and Dubai's main index reaching a 17-year high. This positive momentum in the Middle East market sets an intriguing backdrop for identifying undiscovered gems—stocks that possess strong fundamentals and potential growth opportunities amidst evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 10.29% | 36.24% | 62.32% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Riyadh Cement (SASE:3092)

Simply Wall St Value Rating: ★★★★★★

Overview: Riyadh Cement Company operates in the production and sale of cement across several Middle Eastern countries, including Saudi Arabia, Bahrain, Jordan, Kuwait, Qatar, and Oman with a market capitalization of SAR3.78 billion.

Operations: The primary revenue stream for Riyadh Cement comes from its cement manufacturing segment, which generated SAR825.73 million. The company's financial performance is influenced by various factors impacting its net profit margin, a key indicator of profitability.

Riyadh Cement, a noteworthy player in the Middle East's cement industry, is catching attention with its robust financial health and strategic moves. Recently, it reported Q1 2025 sales of SAR 225.23 million, up from SAR 188.89 million the previous year, alongside net income rising to SAR 75.68 million from SAR 70.1 million. The company boasts a debt-free status with earnings growth of 70% over the past year, outpacing the Basic Materials sector's average growth of nearly 50%. Additionally, it's trading at about 6% below its estimated fair value and maintains high-quality earnings without leverage concerns.

- Navigate through the intricacies of Riyadh Cement with our comprehensive health report here.

Assess Riyadh Cement's past performance with our detailed historical performance reports.

Africa Israel Residences (TASE:AFRE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Africa Israel Residences Ltd focuses on the development and sale of residential units in Israel under the Savyonim brand, with a market capitalization of ₪3.80 billion.

Operations: Africa Israel Residences generates revenue primarily from the promotion of projects, amounting to ₪1.15 billion, and initiation of rental housing at ₪22.29 million. The company has a market capitalization of approximately ₪3.80 billion.

Africa Israel Residences, a notable player in the real estate sector, has shown impressive growth with earnings surging 34.2% over the past year, outpacing its industry peers. Despite its high net debt to equity ratio of 67.1%, interest payments are well covered by EBIT at 3.9x coverage, indicating manageable financial obligations. The company experienced a significant one-off gain of ₪80 million in the last year, which might have skewed recent results but highlights potential for unexpected windfalls. Recent quarterly results showcased sales of ILS 246 million and net income rising to ILS 34 million from ILS 23 million previously.

Fox-Wizel (TASE:FOX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fox-Wizel Ltd. is involved in the design, purchasing, marketing, and distribution of a wide range of products including clothing, fashion accessories, underwear, footwear, home fashion items, and baby and children's products with a market cap of ₪4.99 billion.

Operations: Fox-Wizel generates revenue primarily from its segments in Sports and Fashion and Home Fashion within Israel, with the Sports segment contributing ₪2.49 billion and the Fashion and Home Fashion - Israel segment adding ₪2.18 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

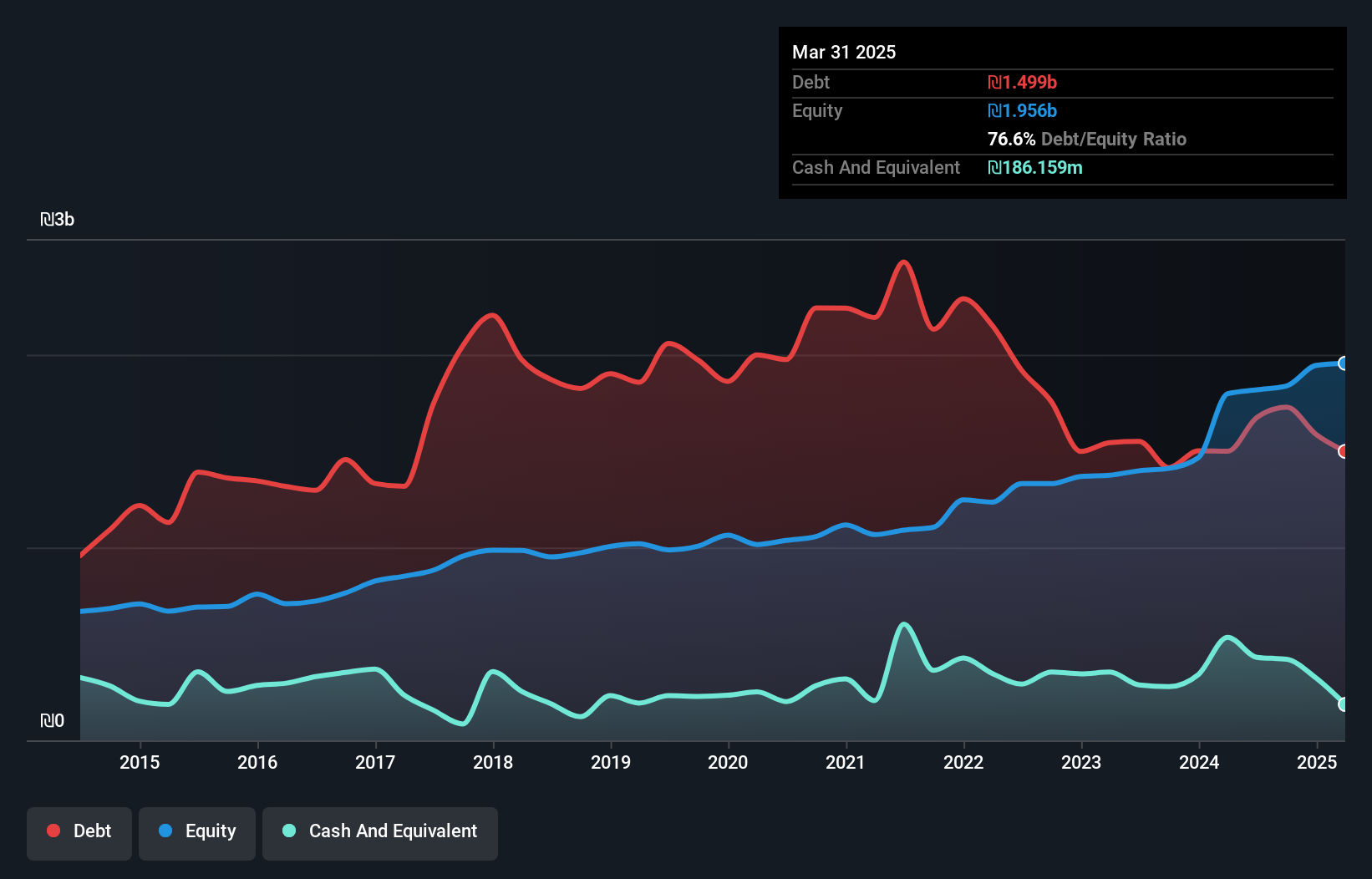

Fox-Wizel, a modest player in the retail sector, shows mixed financial signals. Recent reports highlight sales of ILS 1.48 billion for Q1 2025, up from ILS 1.3 billion the previous year, yet net income fell to ILS 15.2 million from ILS 27.33 million. Earnings per share also dipped to ILS 1.09 from last year's ILS 1.97 for diluted shares, reflecting challenges despite revenue growth. The company's debt situation seems stable with a reduction in its debt-to-equity ratio from 85% to a more manageable 63%. Additionally, its interest payments are well-covered by EBIT at a multiple of nearly four times.

- Click here to discover the nuances of Fox-Wizel with our detailed analytical health report.

Explore historical data to track Fox-Wizel's performance over time in our Past section.

Seize The Opportunity

- Dive into all 222 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FOX

Fox-Wizel

Designs, purchases, markets, and distributes of clothing, fashion accessories, underwear, footwear, fashion and sports accessories, home fashion, and baby and children's products.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives