- Israel

- /

- Specialty Stores

- /

- TASE:FOX

Uncovering Three Undiscovered Gems in the Middle East with Strong Potential

Reviewed by Simply Wall St

As Gulf markets experience gains amid positive global equity trends and ongoing U.S.-China trade talks, the Middle East presents a dynamic environment for investment opportunities. In this context, identifying stocks with strong fundamentals and growth potential becomes crucial for investors looking to capitalize on the region's evolving economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 23.11% | 5.81% | 10.57% | ★★★★★★ |

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| Alfa Solar Enerji Sanayi ve Ticaret | 38.29% | -32.50% | -4.61% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 6.88% | 51.77% | 67.59% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 43.01% | 40.80% | -34.83% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi (IBSE:BANVT)

Simply Wall St Value Rating: ★★★★★★

Overview: Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi is a food company based in Turkey with a market capitalization of TRY20.30 billion.

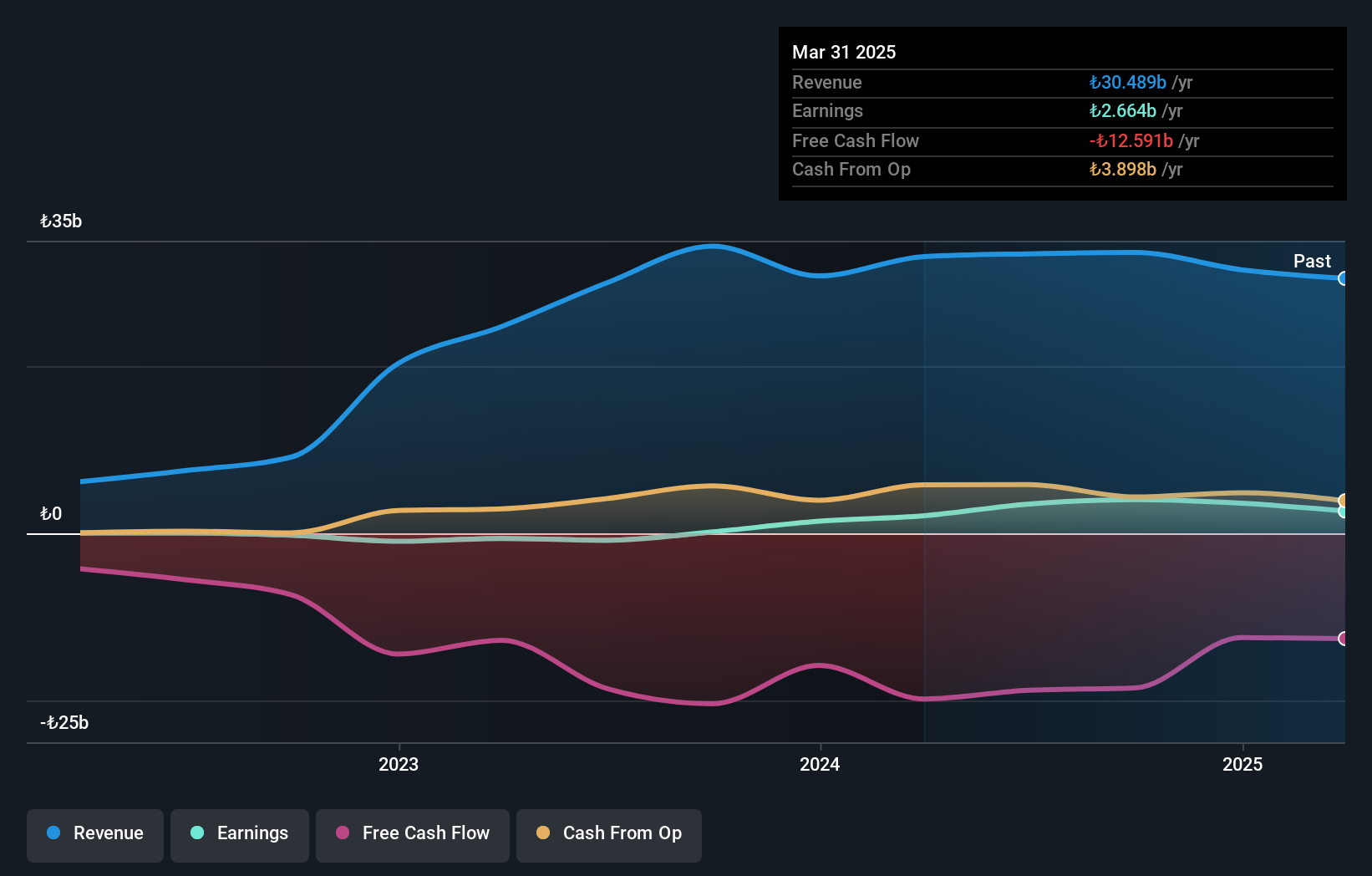

Operations: Banvit generates revenue primarily from its food processing segment, amounting to TRY30.49 billion. The company's financial performance is influenced by its gross profit margin trends, which are a key indicator of profitability within the industry.

Banvit, a small player in the food industry, has shown impressive earnings growth of 27.1% over the past year, outpacing the broader industry's -6.8%. The company's debt situation is favorable with more cash on hand than total debt, and interest payments are comfortably covered by EBIT at 10x coverage. Despite these strengths, Banvit recently reported a net loss of TRY 14.16 million for Q1 2025 against a previous net income of TRY 920.46 million from last year; this shift seems influenced by reduced sales from TRY 8.72 billion to TRY 7.67 billion during the same period.

MIA Teknoloji Anonim Sirketi (IBSE:MIATK)

Simply Wall St Value Rating: ★★★★★☆

Overview: MIA Teknoloji Anonim Sirketi offers software development services to public and private organizations in Turkey, with a market capitalization of TRY16.01 billion.

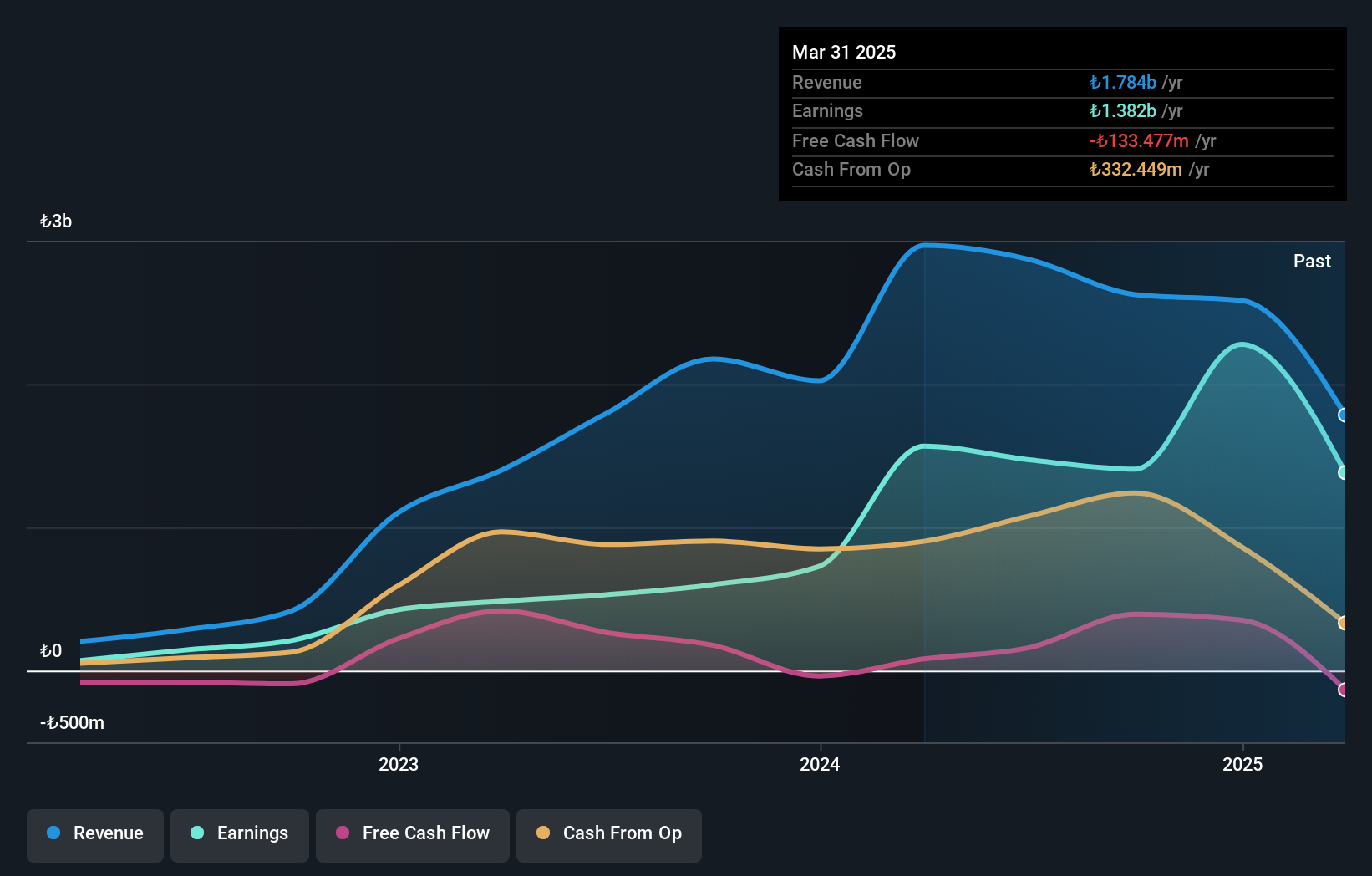

Operations: The company's primary revenue stream is derived from its software and programming segment, generating TRY1.78 billion.

MIA Teknoloji, a nimble player in the tech sector, showcases a satisfactory net debt to equity ratio of 2.4%, reinforcing its financial stability. Despite facing an earnings downturn of 11.8% last year, which contrasts with the software industry's growth average of 22%, it remains profitable with non-cash earnings contributing significantly to its bottom line. The company's price-to-earnings ratio stands at an attractive 11.6x compared to the TR market's 17.3x, suggesting potential undervaluation. While free cash flow isn't positive currently, MIATK's ability to cover interest payments comfortably indicates robust financial health moving forward.

Fox-Wizel (TASE:FOX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fox-Wizel Ltd. is engaged in the design, purchase, marketing, and distribution of clothing, fashion accessories, underwear, footwear, sports accessories, home fashion items, and baby and children's products with a market cap of ₪4.11 billion.

Operations: Revenue is primarily derived from the Sports segment, generating ₪2.49 billion, followed by Fashion and Home Fashion in Israel at ₪2.18 billion.

Fox-Wizel, a notable player in the retail sector, reported first-quarter sales of ILS 1.48 billion, up from ILS 1.3 billion last year. However, net income dropped to ILS 15.2 million from ILS 27.33 million due to increased expenses or market conditions impacting profitability. Despite this dip, their debt management appears robust with a satisfactory net debt to equity ratio of 7.1%. The company's price-to-earnings ratio stands at 14.7x, slightly below the industry average of 15.1x, indicating potential value for investors seeking opportunities in emerging markets like Israel's retail landscape.

- Unlock comprehensive insights into our analysis of Fox-Wizel stock in this health report.

Review our historical performance report to gain insights into Fox-Wizel's's past performance.

Key Takeaways

- Unlock more gems! Our Middle Eastern Undiscovered Gems With Strong Fundamentals screener has unearthed 220 more companies for you to explore.Click here to unveil our expertly curated list of 223 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FOX

Fox-Wizel

Designs, acquires, markets, and distributes clothing, fashion accessories, lingerie, footwear, fashion and sports accessories, home fashion, and baby and children's products in Israel, Canada, Europe, Asia, and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion