- Israel

- /

- Specialty Stores

- /

- TASE:FOX

Uncovering Undiscovered Gems On None In January 2025

Reviewed by Simply Wall St

As we step into 2025, global markets are reflecting a mixed sentiment. While major U.S. indices like the S&P 500 and Nasdaq Composite have closed out strong years, economic indicators such as the Chicago PMI and downward GDP revisions signal caution for investors, especially in small-cap sectors. In this environment, identifying promising stocks involves looking beyond short-term market fluctuations to uncover those with solid fundamentals and growth potential that remain underappreciated by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Castro Model (TASE:CAST)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Castro Model Ltd. operates in the retail sector, offering fashion products, home fashion, accessories, and cosmetics in Israel with a market capitalization of ₪950.95 million.

Operations: Castro Model Ltd. generates revenue primarily from apparel fashions and fashion accessories in Israel, with respective contributions of ₪1.36 billion and ₪505.50 million. The care and cosmetics segment adds another ₪75.03 million to the total revenue stream.

Castro Model has shown remarkable earnings growth of 2960% in the past year, far outpacing the Specialty Retail industry's -22% performance. The company reported third-quarter sales of ILS 507.6 million and net income of ILS 16.65 million, with basic earnings per share rising to ILS 2 from ILS 1.5 a year ago. Despite trading at a value that's significantly below its estimated fair value by around 79%, Castro's interest coverage ratio is only at 2.4x, which may be concerning for some investors as it's below the preferred threshold of three times interest repayments. However, its debt-to-equity ratio has impressively decreased from 54% to just under nine percent over five years, indicating improved financial health and stability in managing obligations effectively while maintaining high-quality earnings.

Equital (TASE:EQTL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Equital Ltd. operates in the real estate, oil and gas, and residential construction sectors both in Israel and internationally, with a market capitalization of ₪5.26 billion.

Operations: Equital Ltd.'s primary revenue streams include oil and gas operations in Israel (₪1.63 billion) and property rental and management in Israel (₪920.65 million). The company also generates revenue from oil and gas activities in the USA (₪540.58 million) and building construction for sale in Israel (₪99.42 million).

Equital's recent performance showcases its potential as a promising player in the oil and gas industry. The company reported ILS 268M in third-quarter sales, slightly up from ILS 265M last year, with revenue reaching ILS 947M compared to ILS 839M. Net income surged to ILS 131M from ILS 108M, reflecting high-quality earnings. Despite a high net debt to equity ratio of 46.9%, interest payments are well-covered by EBIT at six times coverage. Over the past year, Equital's earnings growth of nearly 39% outpaced the industry's average of about 13%, indicating robust operational strength and potential value for investors.

- Click here to discover the nuances of Equital with our detailed analytical health report.

Assess Equital's past performance with our detailed historical performance reports.

Fox-Wizel (TASE:FOX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fox-Wizel Ltd. is involved in the design, purchase, marketing, and distribution of clothing, fashion accessories, underwear, footwear, fashion and sports accessories, home fashion, and baby and children's products with a market cap of ₪4.27 billion.

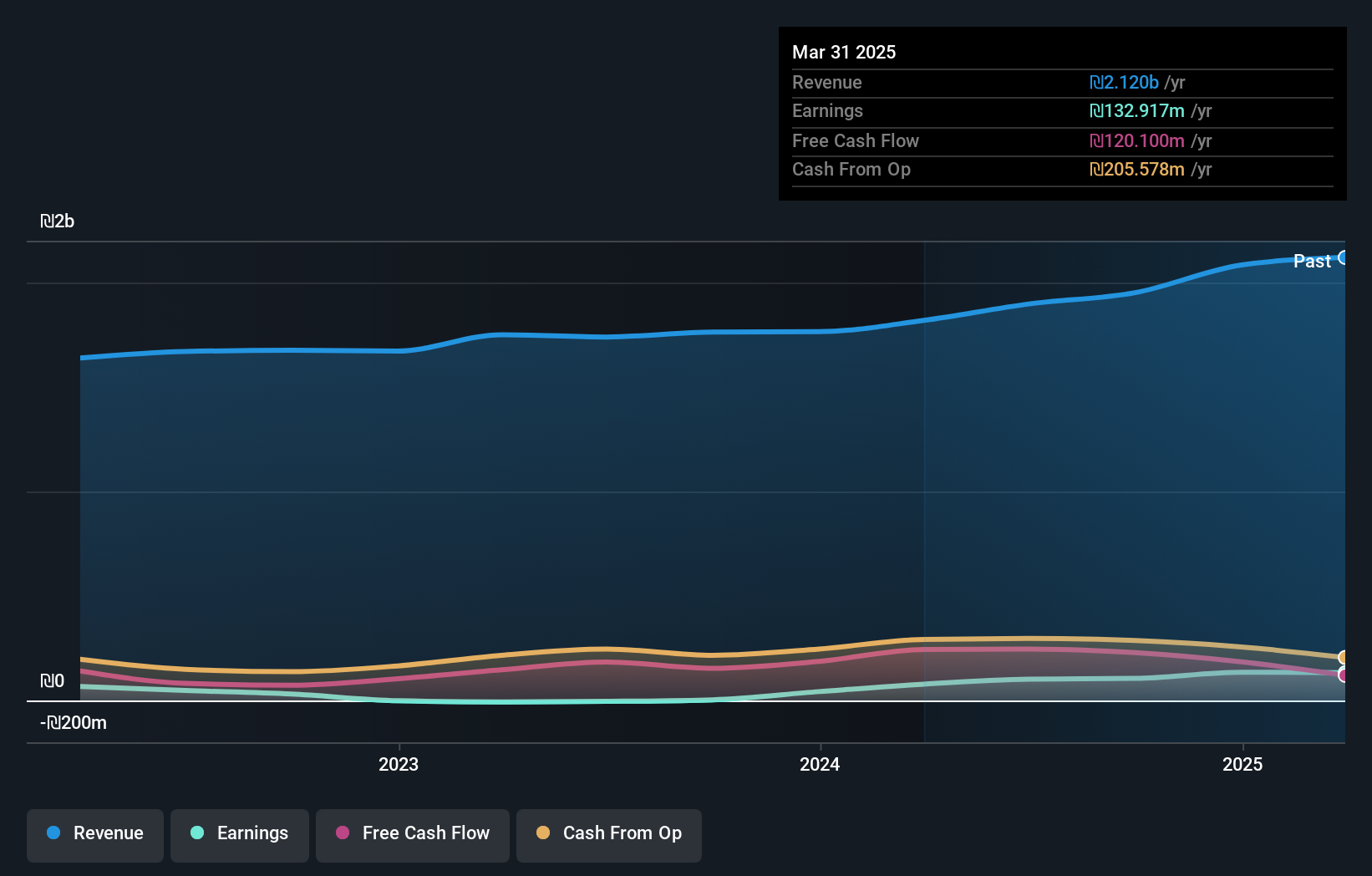

Operations: Fox-Wizel generates revenue primarily from its Sports segment, which includes brands like Nike and Foot Locker, contributing ₪2.23 billion, and the Fashion and Home Fashion segment in Israel, adding ₪2 billion. The company's net profit margin shows notable trends over time.

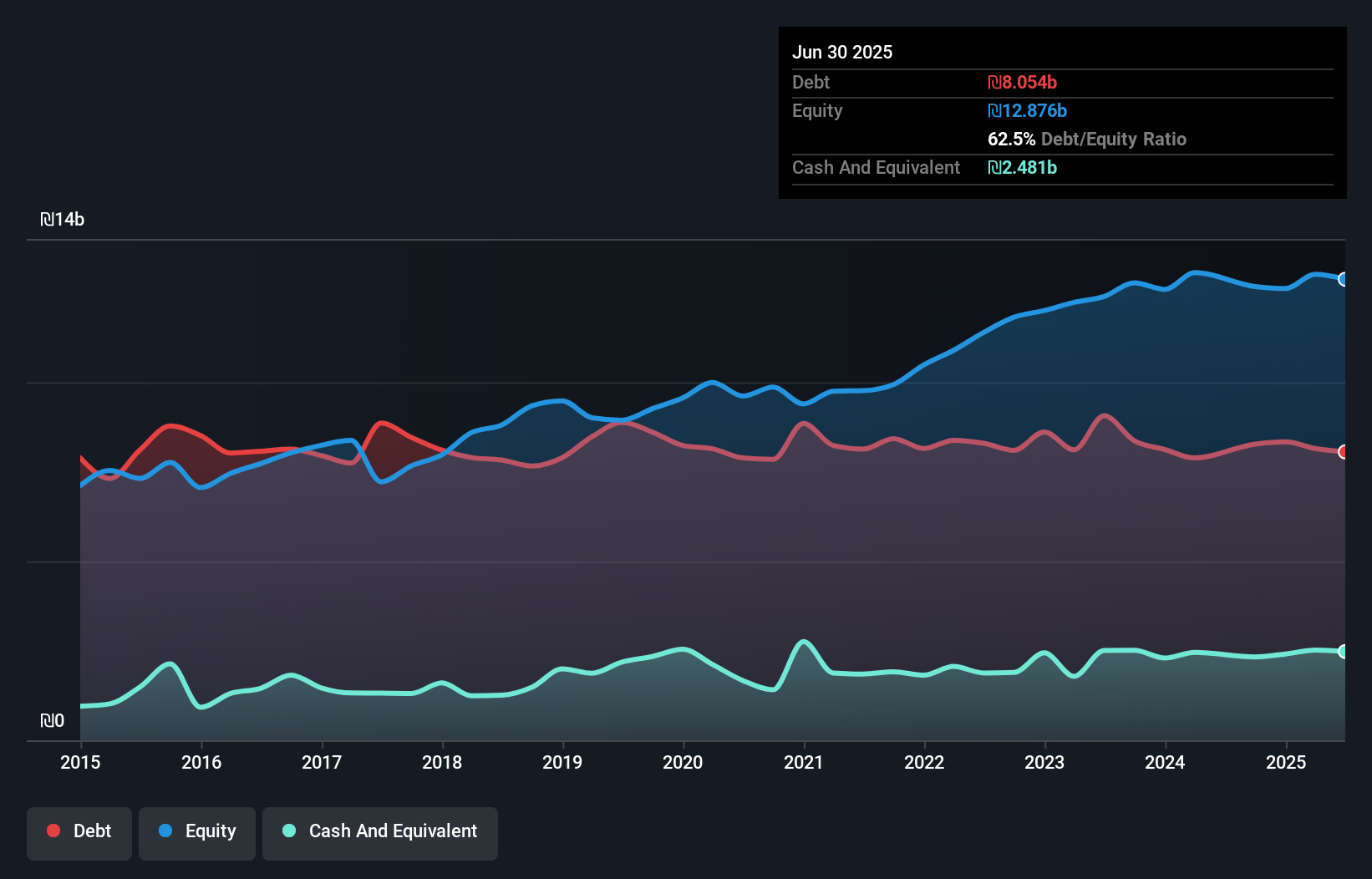

Fox-Wizel, a notable player in the retail sector, has shown promising financial resilience with earnings surging 62.9% over the past year, outpacing industry averages. The company has reduced its debt to equity ratio from 73% to 48.9% over five years and is trading at a significant discount of 87.5% below its estimated fair value. Recent results highlight robust growth; third-quarter sales reached ILS 1,631 million compared to ILS 1,399 million last year, while net income rose sharply from ILS 15.87 million to ILS 51.81 million this quarter alone, reflecting high-quality earnings amidst challenging market conditions.

- Unlock comprehensive insights into our analysis of Fox-Wizel stock in this health report.

Understand Fox-Wizel's track record by examining our Past report.

Taking Advantage

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4669 more companies for you to explore.Click here to unveil our expertly curated list of 4672 Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FOX

Fox-Wizel

Designs, purchases, markets, and distributes of clothing, fashion accessories, underwear, footwear, fashion and sports accessories, home fashion, and baby and children's products.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives