- Saudi Arabia

- /

- Electrical

- /

- SASE:1303

3 Middle Eastern Dividend Stocks Yielding Up To 5.7%

Reviewed by Simply Wall St

Amidst the backdrop of lower oil prices impacting UAE markets, investors are keenly observing how these fluctuations influence regional equities, with particular attention on dividend stocks that offer potential income stability. In this environment, selecting dividend stocks with strong fundamentals and consistent payout histories can provide a measure of resilience against market volatility.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 4.28% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.72% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.63% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.72% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.91% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.67% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 5.74% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.63% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.96% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 8.73% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

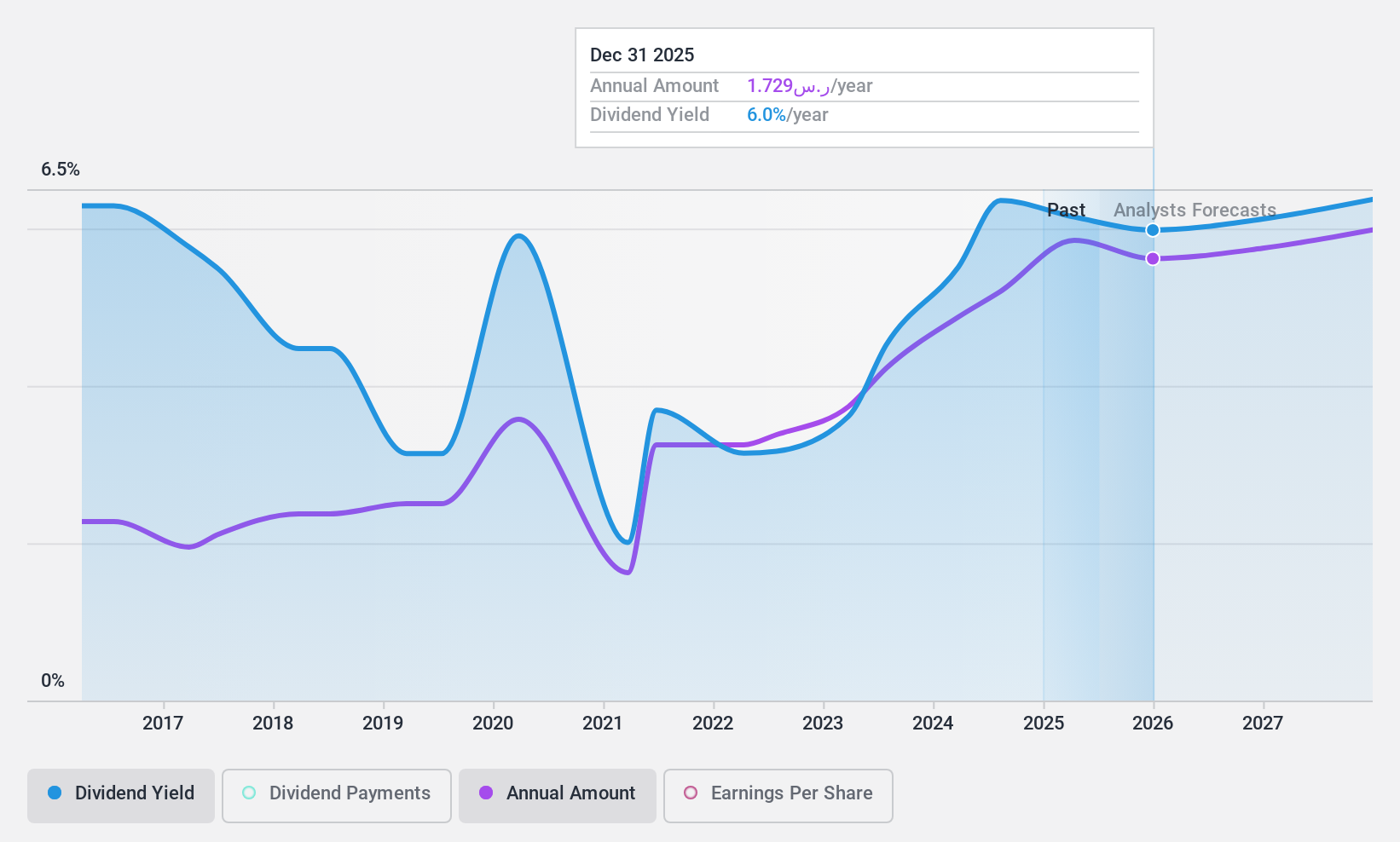

Riyad Bank (SASE:1010)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Riyad Bank offers banking and investment services in the Kingdom of Saudi Arabia, with a market capitalization of SAR93.74 billion.

Operations: Riyad Bank's revenue segments include Riyad Capital at SAR987.19 million, Retail Banking at SAR4.09 billion, Corporate Banking at SAR8.25 billion, and Treasury and Investment services at SAR2.33 billion.

Dividend Yield: 5.7%

Riyad Bank offers a competitive dividend yield of 5.74%, ranking in the top 25% of Saudi Arabian dividend payers. While its payout ratio is reasonable at 56.5%, ensuring dividends are covered by earnings, the bank's dividend history has been volatile over the past decade. Despite this, dividends have increased over ten years. Recent earnings showed net income growth to SAR 9.32 billion for 2024, indicating strong financial performance supporting future payouts amidst forecasted revenue growth of 9.93% per year.

- Navigate through the intricacies of Riyad Bank with our comprehensive dividend report here.

- Our expertly prepared valuation report Riyad Bank implies its share price may be too high.

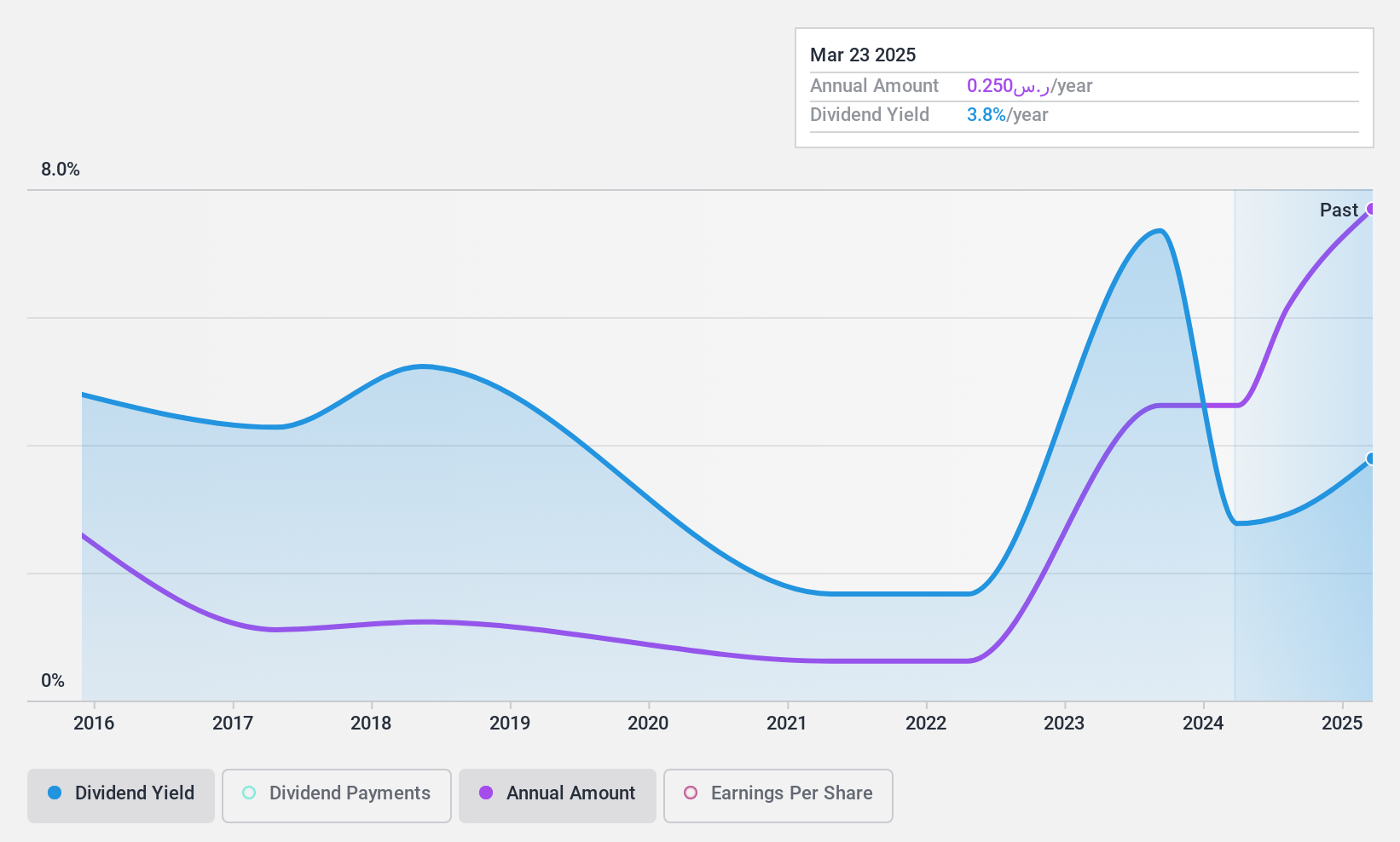

Electrical Industries (SASE:1303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Electrical Industries Company, with a market cap of SAR7.80 billion, operates through its subsidiaries to manufacture, assemble, supply, repair, and maintain various electrical equipment such as transformers and switch gears across Saudi Arabia and other international markets including the Gulf countries, Europe, and Asia.

Operations: Electrical Industries Company's revenue is primarily derived from its Manufacturing, Assembly and Supply segment, which generated SAR1.90 billion, and its Service segment, which contributed SAR88.80 million.

Dividend Yield: 3.4%

Electrical Industries' dividend yield of 3.42% is below the top tier in Saudi Arabia, but dividends are covered by earnings and cash flows with payout ratios of 62.3% and 43.2%, respectively. Despite a volatile dividend history, recent earnings growth to SAR 401.73 million suggests improved financial stability. However, the share price has been highly volatile recently, which may concern income-focused investors seeking reliability in dividend stocks within the Middle East market.

- Click here and access our complete dividend analysis report to understand the dynamics of Electrical Industries.

- Our expertly prepared valuation report Electrical Industries implies its share price may be lower than expected.

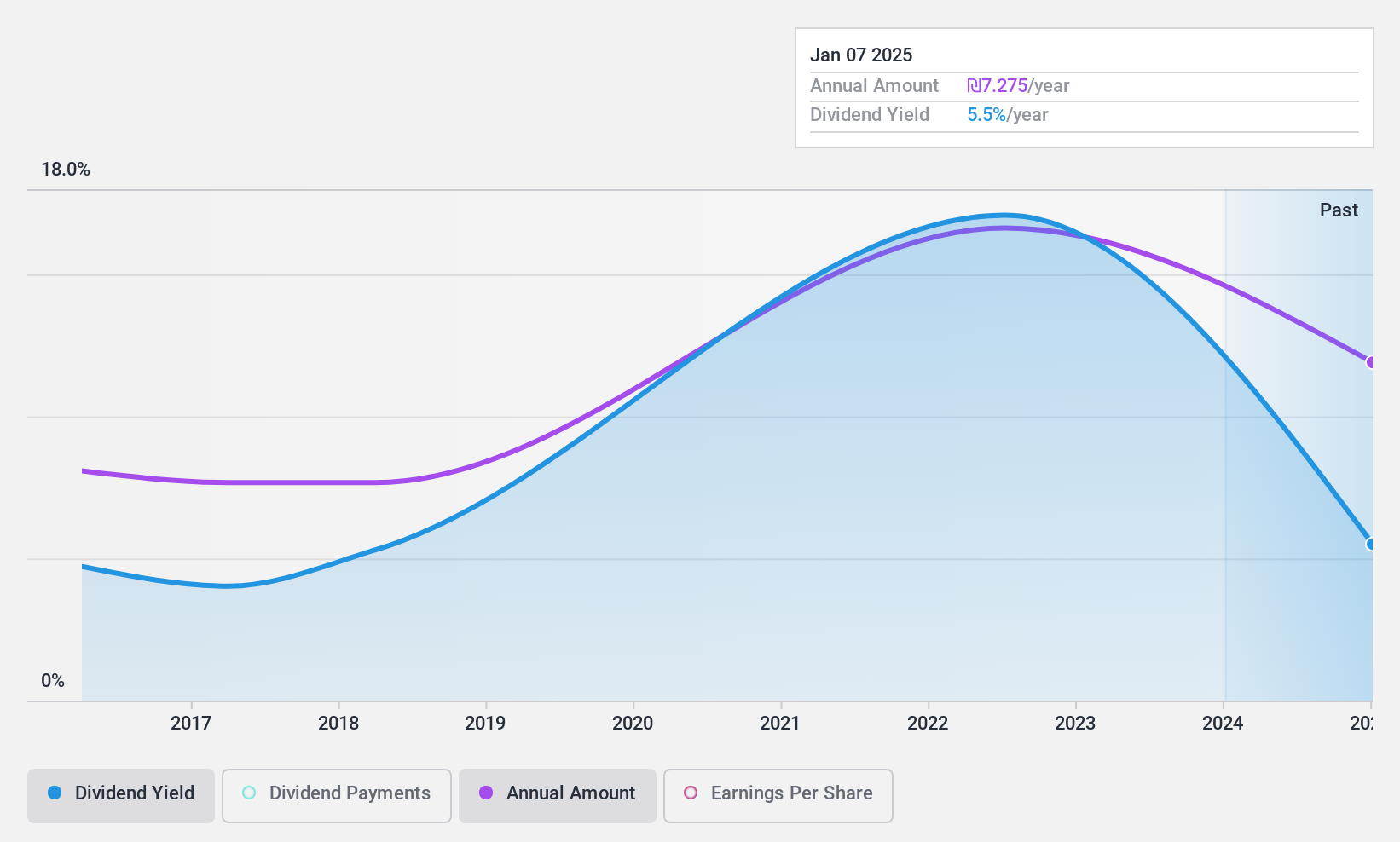

Castro Model (TASE:CAST)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Castro Model Ltd. operates in Israel, focusing on the retail sale of fashion products, home fashion, accessories, and cosmetics with a market cap of ₪1.32 billion.

Operations: Castro Model Ltd.'s revenue is primarily derived from apparel fashions at ₪1.45 billion, fashion accessories in Israel at ₪540.23 million, and care and cosmetics at ₪80.13 million.

Dividend Yield: 4.5%

Castro Model's dividends are well covered by earnings and cash flows, with payout ratios of 44.4% and 32.4%, respectively. Despite a history of volatility in dividend payments over the past decade, recent earnings growth to ILS 135.4 million from ILS 42.52 million last year indicates potential stability improvements. However, its dividend yield of 4.53% is lower than the top tier in the IL market, and share price volatility remains a concern for investors prioritizing steady income streams.

- Click here to discover the nuances of Castro Model with our detailed analytical dividend report.

- Our valuation report here indicates Castro Model may be undervalued.

Summing It All Up

- Explore the 67 names from our Top Middle Eastern Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electrical Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1303

Electrical Industries

Engages in the manufacture, assembly, supply, repair, and maintenance of transformers, compact substations and low voltage distribution panels, electrical distribution boards, cable trays, switch gears, and other electrical equipment.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives