- Israel

- /

- Specialty Stores

- /

- TASE:CAST

3 Dividend Stocks Offering Yields Up To 6%

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and mixed economic signals, global markets experienced fluctuations, with U.S. stocks ending lower while European indices showed resilience. Amid these developments, investors are increasingly looking towards dividend stocks as a potential source of steady income in uncertain times. A good dividend stock typically offers a reliable yield and demonstrates the ability to maintain or grow payouts even when market conditions are volatile.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.79% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.99% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.11% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.25% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.45% | ★★★★★☆ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

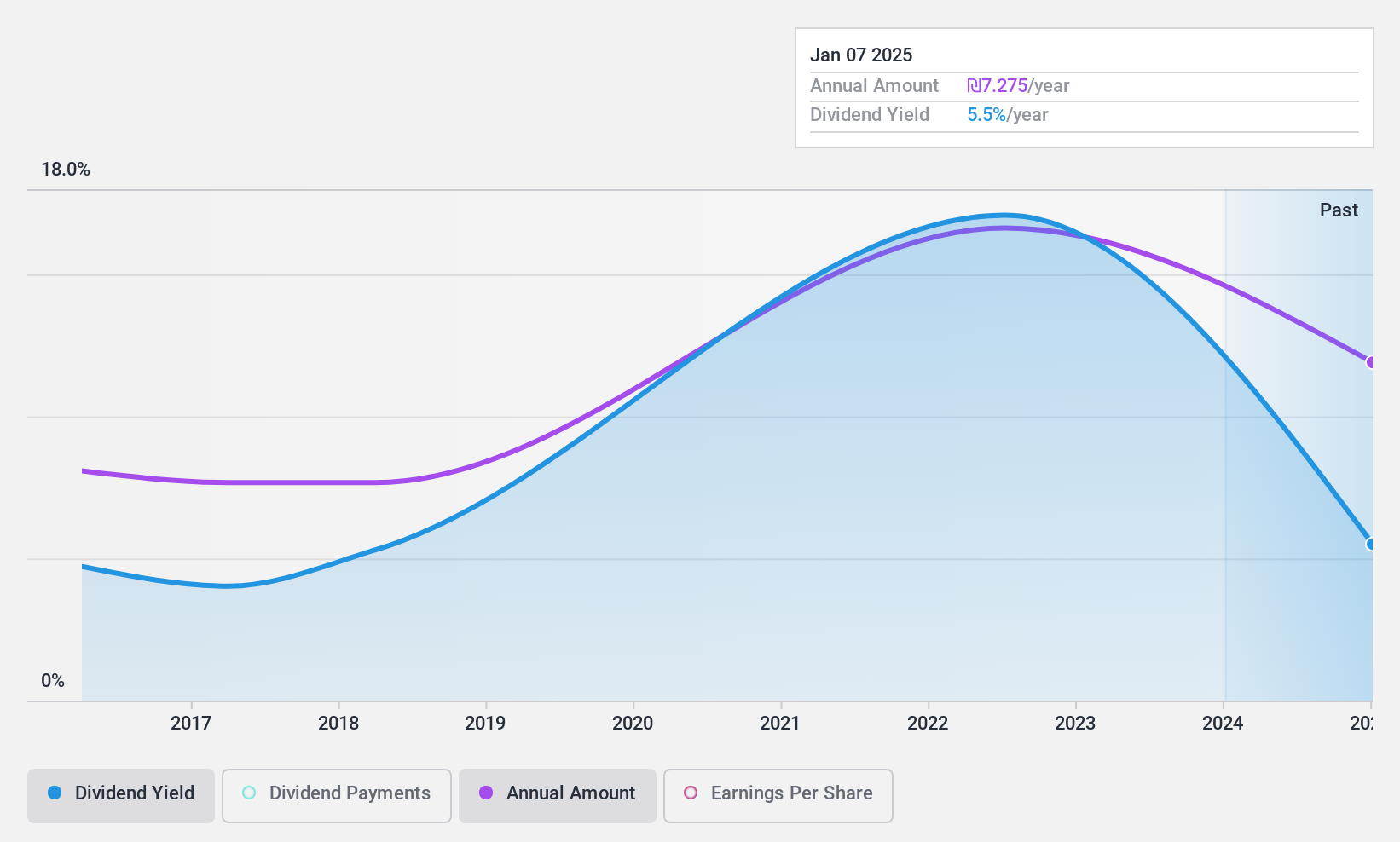

Emaar Properties PJSC (DFM:EMAAR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emaar Properties PJSC, along with its subsidiaries, is involved in property investment, development, and management both in the United Arab Emirates and internationally, with a market cap of AED125.51 billion.

Operations: Emaar Properties PJSC generates revenue through its segments, including Hospitality (AED1.96 billion), Real Estate (AED23.24 billion), and Leasing, Retail and Related Activities (AED6.98 billion).

Dividend Yield: 3.5%

Emaar Properties PJSC's dividend payments have been volatile over the past decade, with a low cash payout ratio of 21.7% indicating strong coverage by cash flows. The Price-To-Earnings ratio of 10.5x suggests good value compared to the AE market average. Despite a history of unreliable dividends, earnings have grown significantly at 25.3% per year over five years, supporting potential future payouts. However, its dividend yield of 3.52% is below top-tier levels in the AE market.

- Unlock comprehensive insights into our analysis of Emaar Properties PJSC stock in this dividend report.

- Our valuation report unveils the possibility Emaar Properties PJSC's shares may be trading at a premium.

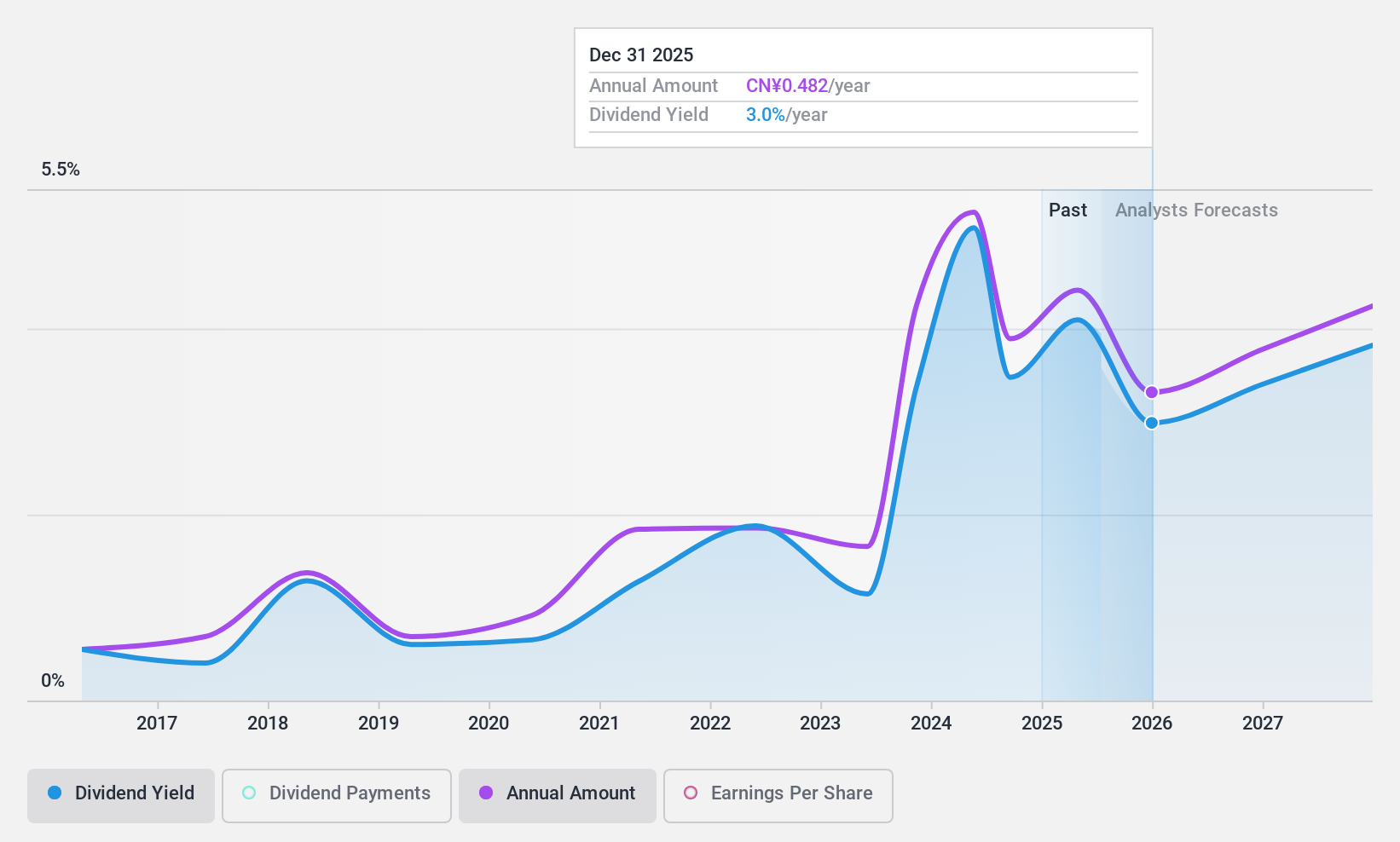

Zhejiang Dahua Technology (SZSE:002236)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Dahua Technology Co., Ltd. operates globally in the intelligent Internet of Things industry, with a market cap of CN¥54.95 billion.

Operations: Zhejiang Dahua Technology Co., Ltd. generates revenue of CN¥32.39 billion from the research, development, production, and sales of video IoT products.

Dividend Yield: 3.4%

Zhejiang Dahua Technology's dividend yield of 3.37% places it among the top 25% of CN market payers, yet its sustainability is questionable due to a high cash payout ratio of 93.6%, indicating inadequate coverage by cash flows. Although dividends have grown over the past decade, they remain volatile and unreliable. The stock trades at a significant discount to estimated fair value, suggesting good relative value despite potential earnings decline forecasts over the next three years.

- Navigate through the intricacies of Zhejiang Dahua Technology with our comprehensive dividend report here.

- The analysis detailed in our Zhejiang Dahua Technology valuation report hints at an deflated share price compared to its estimated value.

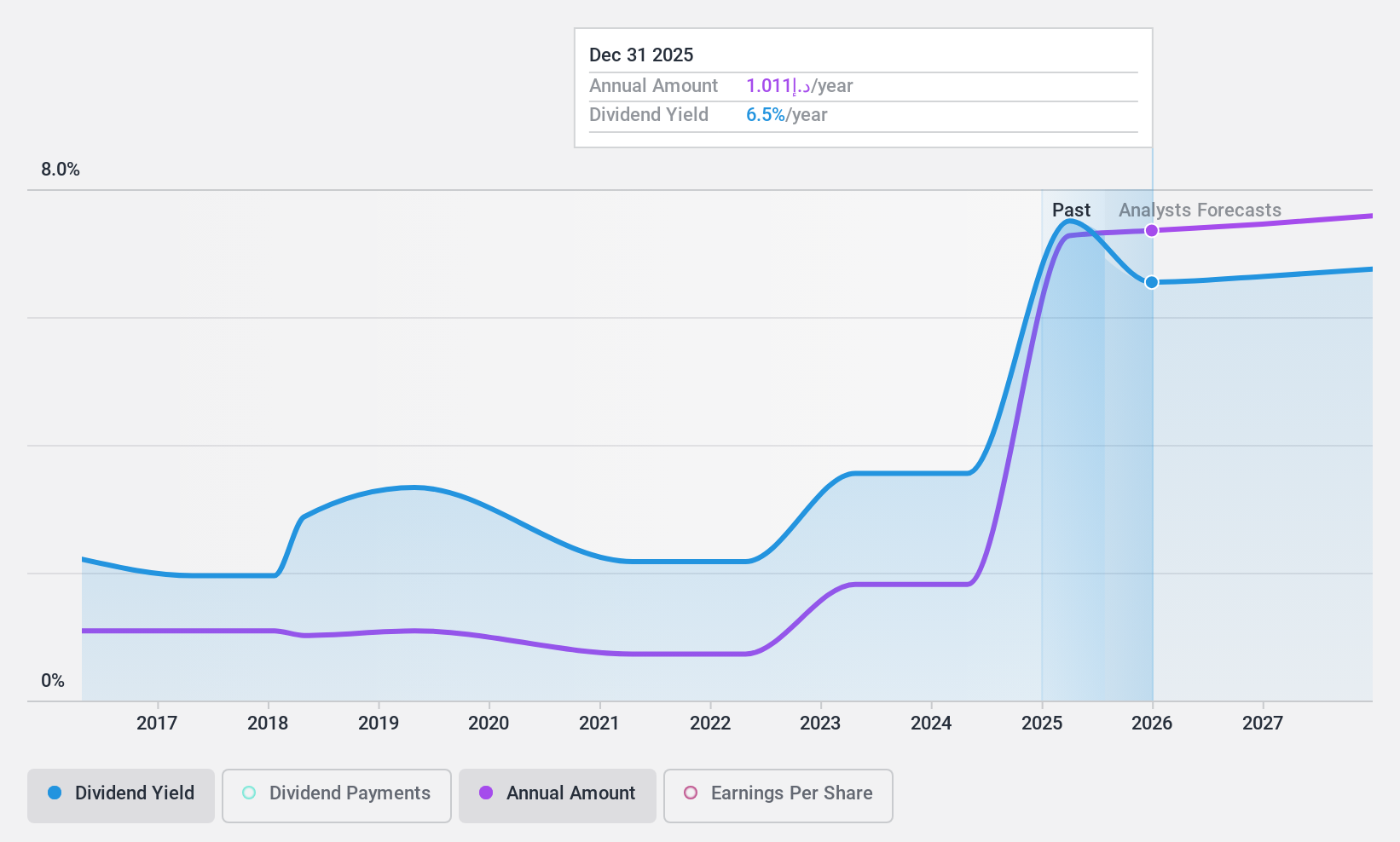

Castro Model (TASE:CAST)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Castro Model Ltd. operates in Israel, focusing on the retail sale of fashion products, home fashion, accessories, and cosmetics and care products, with a market cap of ₪993.01 million.

Operations: Castro Model Ltd.'s revenue segments include Apparel Fashions at ₪1.36 billion, Fashion Accessories in Israel at ₪505.50 million, and Care and Cosmetics at ₪75.03 million.

Dividend Yield: 6%

Castro Model offers a dividend yield of 6.04%, ranking it in the top 25% of IL market payers, with dividends well-covered by cash flows due to a low cash payout ratio. However, its dividend track record is unstable and unreliable over the past decade despite recent growth. The stock trades at a significant discount to estimated fair value, presenting potential for value investors amid fluctuating earnings and revenue improvements reported in recent quarters.

- Click to explore a detailed breakdown of our findings in Castro Model's dividend report.

- Our valuation report here indicates Castro Model may be undervalued.

Summing It All Up

- Click here to access our complete index of 1959 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:CAST

Castro Model

Engages in the retail sale of fashion products, home fashion, fashion accessories and cosmetics and care products in Israel.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives