- Israel

- /

- Retail Distributors

- /

- TASE:BRMG

Did You Participate In Any Of Brimag Digital Age's (TLV:BRMG) Fantastic 203% Return ?

Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. For example, long term Brimag Digital Age Ltd. (TLV:BRMG) shareholders have enjoyed a 86% share price rise over the last half decade, well in excess of the market return of around 56% (not including dividends).

View our latest analysis for Brimag Digital Age

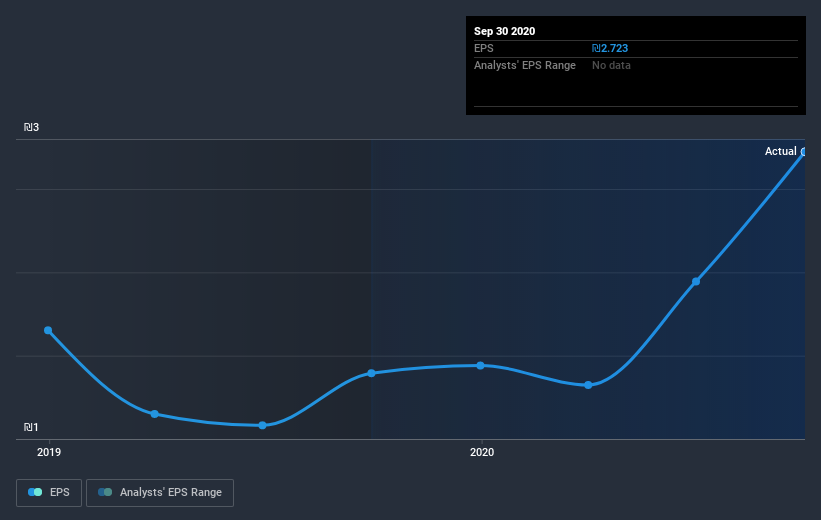

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Brimag Digital Age moved from a loss to profitability. That's generally thought to be a genuine positive, so we would expect to see an increasing share price. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. Indeed, the Brimag Digital Age share price has gained 25% in three years. In the same period, EPS is up 20% per year. This EPS growth is higher than the 8% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat. This unenthusiastic sentiment is reflected in the stock's reasonably modest P/E ratio of 8.53.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We've already covered Brimag Digital Age's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Brimag Digital Age shareholders, and that cash payout contributed to why its TSR of 203%, over the last 5 years, is better than the share price return.

A Different Perspective

It's nice to see that Brimag Digital Age shareholders have received a total shareholder return of 79% over the last year. That gain is better than the annual TSR over five years, which is 25%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Brimag Digital Age has 2 warning signs we think you should be aware of.

Of course Brimag Digital Age may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

If you decide to trade Brimag Digital Age, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Brimag Digital Age might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:BRMG

Brimag Digital Age

Imports, markets, and distributes home appliances and commercial air conditioning systems in Israel.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives