- Israel

- /

- Real Estate

- /

- TASE:RANI

We're Not So Sure You Should Rely on Rani Zim Shopping Centers's (TLV:RANI) Statutory Earnings

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. In this article, we'll look at how useful this year's statutory profit is, when analysing Rani Zim Shopping Centers (TLV:RANI).

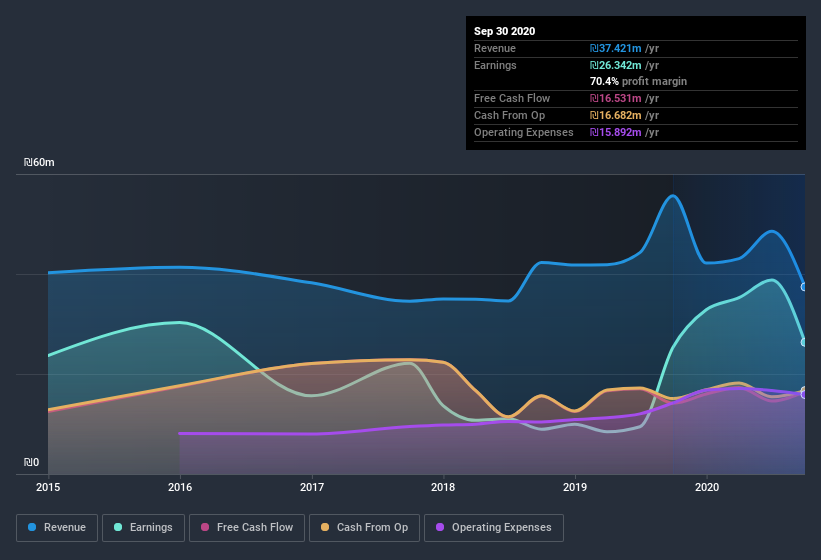

We like the fact that Rani Zim Shopping Centers made a profit of ₪26.3m on its revenue of ₪37.4m, in the last year. Happily, it has grown both its profit and revenue over the last three years (though we note its revenue is down over the last year).

See our latest analysis for Rani Zim Shopping Centers

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. In this article we'll look at how Rani Zim Shopping Centers is impacting shareholders by issuing new shares, as well as how unusual items have affected the income line. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Rani Zim Shopping Centers.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Rani Zim Shopping Centers issued 20% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Rani Zim Shopping Centers' EPS by clicking here.

How Is Dilution Impacting Rani Zim Shopping Centers' Earnings Per Share? (EPS)

Rani Zim Shopping Centers has improved its profit over the last three years, with an annualized gain of 19% in that time. But on the other hand, earnings per share actually fell by 22% per year. And over the last 12 months, the company grew its profit by 3.6%. But that's starkly different from the 8.8% drop in earnings per share. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if Rani Zim Shopping Centers' earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

The Impact Of Unusual Items On Profit

Finally, we should also consider the fact that unusual items boosted Rani Zim Shopping Centers' net profit by ₪32m over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. We can see that Rani Zim Shopping Centers' positive unusual items were quite significant relative to its profit in the year to September 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Rani Zim Shopping Centers' Profit Performance

In its last report Rani Zim Shopping Centers benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. Considering all this we'd argue Rani Zim Shopping Centers' profits probably give an overly generous impression of its sustainable level of profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example, we've found that Rani Zim Shopping Centers has 3 warning signs (1 is a bit concerning!) that deserve your attention before going any further with your analysis.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Rani Zim Shopping Centers, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TASE:RANI

Rani Zim Shopping Centers

Engages in the development, management, and lease or sale of commercial projects in Israel.

Proven track record with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.