- Israel

- /

- Real Estate

- /

- TASE:AFRE

What To Know Before Buying Africa Israel Residences Ltd (TLV:AFRE) For Its Dividend

Is Africa Israel Residences Ltd (TLV:AFRE) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

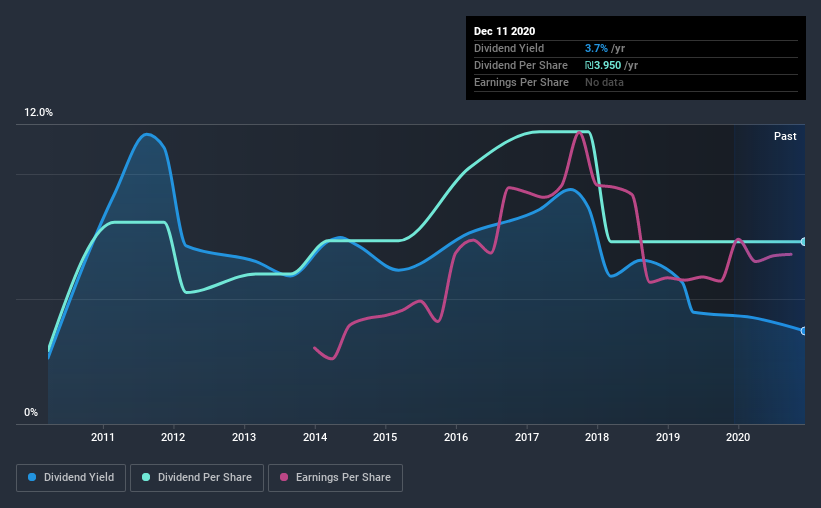

In this case, Africa Israel Residences likely looks attractive to investors, given its 3.7% dividend yield and a payment history of over ten years. It would not be a surprise to discover that many investors buy it for the dividends. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 50% of Africa Israel Residences' profits were paid out as dividends in the last 12 months. This is a middling range that strikes a nice balance between paying dividends to shareholders, and retaining enough earnings to invest in future growth. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Last year, Africa Israel Residences paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

Consider getting our latest analysis on Africa Israel Residences' financial position here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Africa Israel Residences' dividend payments. Its dividend payments have declined on at least one occasion over the past 10 years. During the past 10-year period, the first annual payment was ₪1.6 in 2010, compared to ₪4.0 last year. This works out to be a compound annual growth rate (CAGR) of approximately 9.5% a year over that time. The dividends haven't grown at precisely 9.5% every year, but this is a useful way to average out the historical rate of growth.

It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Africa Israel Residences might have put its house in order since then, but we remain cautious.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Africa Israel Residences has grown its earnings per share at 9.4% per annum over the past five years. It's good to see decent earnings growth and a low payout ratio. Companies with these characteristics often display the fastest dividend growth over the long term - assuming earnings can be maintained, of course.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, we like Africa Israel Residences' low dividend payout ratio, although we're a bit concerned that it paid out a substantially higher percentage of its free cash flow. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. In sum, we find it hard to get excited about Africa Israel Residences from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 3 warning signs for Africa Israel Residences (2 can't be ignored!) that you should be aware of before investing.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

When trading Africa Israel Residences or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TASE:AFRE

Africa Israel Residences

Engages in the development and sale of residential units under the Savyonim brand in Israel.

Acceptable track record with mediocre balance sheet.