Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that AFI Properties Ltd (TLV:AFPR) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for AFI Properties

How Much Debt Does AFI Properties Carry?

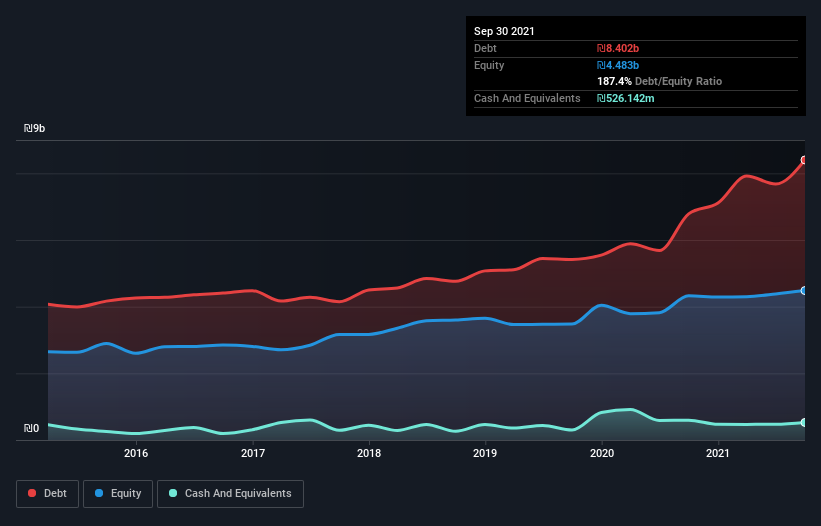

As you can see below, at the end of September 2021, AFI Properties had ₪8.40b of debt, up from ₪6.78b a year ago. Click the image for more detail. On the flip side, it has ₪526.1m in cash leading to net debt of about ₪7.88b.

How Strong Is AFI Properties' Balance Sheet?

The latest balance sheet data shows that AFI Properties had liabilities of ₪1.64b due within a year, and liabilities of ₪7.85b falling due after that. On the other hand, it had cash of ₪526.1m and ₪221.4m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₪8.75b.

When you consider that this deficiency exceeds the company's ₪7.35b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

AFI Properties has a rather high debt to EBITDA ratio of 19.0 which suggests a meaningful debt load. However, its interest coverage of 3.3 is reasonably strong, which is a good sign. Even more troubling is the fact that AFI Properties actually let its EBIT decrease by 9.4% over the last year. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. When analysing debt levels, the balance sheet is the obvious place to start. But it is AFI Properties's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, AFI Properties recorded free cash flow worth 76% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Mulling over AFI Properties's attempt at managing its debt, based on its EBITDA,, we're certainly not enthusiastic. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Looking at the bigger picture, it seems clear to us that AFI Properties's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example AFI Properties has 3 warning signs (and 2 which are potentially serious) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:AFPR

Proven track record and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026